If your a small stock trader looking for the Best App For MTF in India, this post will help you choose the right Margin Trading Facility (MTF) platform. Margin Trading Facility (MTF) allows you to buy stocks by paying only a portion of the total amount. Let understand this with an example. Suppose you have ₹1000 and want to buy a stock that is priced at ₹500 per share. If your broker offers MTF (Margin Trading Facility), you will only have to contribute 20%, i.e. ₹100, and your stock broker will Finance The Remaining 80%, i.e. ₹400. This Way, you can buy More shares for less Money.

In this article, we will Provide you with Detailed information about Margin Trading Facility (MTF) Trading apps in India, how MTF Works, its Advantages and Disadvantages, and help you Choose the Right MTF app by Comparing top MTF apps like Groww App, Dhan, Kotak Securities, and Angel One App in detail.

What is MTF (Margin Trading Facility)?

Margin Trading Facility (MTF) is a Service that allows traders and investors to increase their money by 4x to 5x, buy More shares, and groww their Profits with less Risk. In return, they have to pay interest to their stoc kbroker Every day.

Let Understand this with a Simple Example: If you want to buy shares Worth ₹100,000, You,ll need to invest ₹25,000, and Your stock broker Will Provide you with a ₹75,000 Credit line. You’ll have to pay Daily interest on that Money Until you sell your Holdings or Repay the Margin money. This interest is Deducted from your Stock Broker Wallet.

If we Understand in detail, (MTF) helps you to Take Delivery of a Larger Position for less Money, Even if the stock price falls, it has less Risk than intraday Trading, which can prove to be a good Opportunity For active Traders.

Note: Whenever you buy any stock in MTF, always keep one thing in mind that whenever the price of the stock goes down, you have to pay extra amount to your broker as per the value of the stock, so it is important for you to have extra money.

How MTF Works in Groww App

Let’s understand how the margin trading feature works step by step:

- Your stock broker lists stocks for MTF trading in its app.

- You choose a stock and select the MTF option when purchasing the stock.

- You invest only a portion of the stock price (margin), and your broker invests the remaining amount.

- You pay daily interest on the money you borrow from your broker.

- You can hold this position for a long time until you close it or a margin call is triggered.

- If the margin on your stock drops, the stock broker can sell your holdings.

How to Choose The Best MTF App in India

When choosing a good MTF stock broker app, you should consider the following factors:

- MTF interest rates – The stock broker’s interest rates should be at least as low as possible.

- High leverage offered – Most brokers offer up to 4x margin.

- Nifty 50 stocks – The more top stocks you have, the greater the flexibility and lower the risk.

- Broker app should be simple – A stock broker’s mobile app should have the simplest and easiest interface to use.

- Broker Transparency – The broker should have clear policies on interest rates, collateral, and liquidation.

- 24/7 support – MTF trading is a bit different, and investors and traders may have many questions about it.

TOP 10 Best MTF Brokers in India 2026

Here is a Comparison of the Best and Most Trusted MTF Trading apps in India to help you Decide which stocks to buy in MTF 2025.

| Broker Name | MTF Margin | Stocks - ETF | Interest (%) (Daily) | Pledge / Unpledge |

|---|---|---|---|---|

| Zerodha | 5X | 1300+ | 0.04% | 15 + 15 + GST |

| Upstox | 4X | 477+ | ( 40K / 20 per slab) | 20 + 20 + GST |

| Angel One | 4X | 1,040 | 0.041% per day | 20 + 20 + GST |

| Groww | 4X | 100+ | 0.041% per day | ₹20 per order + GST |

| M Stock | 4X | 1,000+ | 0.0411% per day | Total – 32 + GST |

| Fyers | 4X | 1,400 | 0.0424% per day | 12 + 12 + GST |

| Dhan App | 4X | 1,450+ | 0.0342% Per Day | 15 + 15 + GST |

| Kotak Securities | 5x | 1300+ | 9.69% p.a. | 20 + 20 + GST |

| Samco | 4X | 1200+ | 0.05% per day | Total – 30 + GST |

| Paytm Money | 4X | 1200+ | 7.99% p.a | ₹15 + 15 GST |

Note: Before activating MTF in any trading app, do compare its interest rate, stock list and margin 4x to 5X.

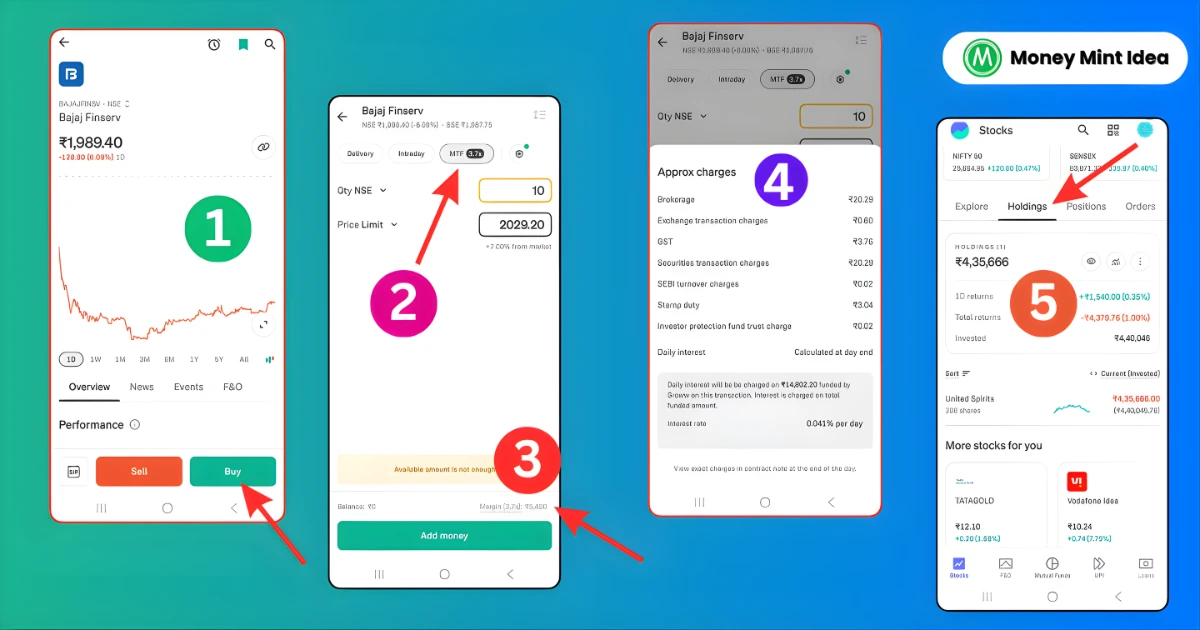

How to Use MTF in the Groww App Step-by-Step Guide

- Open your Groww app and log in by entering your PIN.

- Select the stock and click Buy.

- You must select “MTF” instead of delivery.

- Check the margin for the stock and check your wallet balance.

- Submit your order. Once the shares are purchased, the order will display all the details.

- Click on “Groww’s dashboard holdings.” Any profit or loss will be displayed here.

Note: When you sell your MTF holdings, the full settlement will be as if you were a delivery.

MTF Pro Risk Management Tips

- Always place a stop loss after every leveraged trade.

- Avoid holding stocks in MTFs for extended periods of time – interest accrues daily.

- Don’t use full leverage; start small and save some Money.

- Monitor your margin percentage regularly.

- Stay away from stocks that fluctuate widely, Nifty 50 is a safe bet.

- Read your broker MTF Policy thoroughly before using MTFs.

Also Raed: Enable F&O Trading on Groww Without Income Proof

Conclusion

The MTF margin trading facility can be a very good option, multiplying your trading profits, but only if you understand the risks involved. For experienced stock traders, investing in MTFs can be a smart way to multiply their profits. If you’re just learning to trade, trade wisely.

Among these, Groww App and Angel One App offer excellent services. They have emerged as the best apps for MTF trading in 2025, as they offer low interest rates, a simple interface, and most stocks are sourced from the Nifty50.