Afcom holdings IPO details Today : Afcom holdings IPO details Today is Open on 2 August 2024 and Close on 6 August 2024. Afcom holdings IPO to Raise 3,54,000 shares (Approx ₹52.66 Cr) via IPO. The Fresh issue of 3,54,000 shares (Approx ₹52.66 Cr).

Our company was originally incorporated 2013 Our Company is engaged in carriage of cargo on airport-to-airport basis. We have been operating Cargo Flights to the ASEAN countries, particularly to Singapore. We are led by a management team that has extensive industry experience.

GENERAL CARGO – variety of products such as Machinery, Spare parts, Electronics, Garments, Leather goods, Chemicals (Non-DG) and IT products.

FLYING FRESH – such as fruits, flowers, and vegetables, Dairy products,Confectionery,Food items,Frozen fish,

FLYING PHARMA – We carry the following pharmaceutical categories, Tablets,Vaccines, Injection materials, Gel packed.

FLYING PRIORITY – Highest speed & priority,Minimal handling and transportation time,Express freight loaded near the cargo door – last in first out,Guarantee capacity and immediate ,space confirmation,Access to high demand flights guaranteed uplift, Higher handling priority and essentials. Our priority solution can be applied to general cargo and shipment requiring special handling.

DANGEROUS CARGO – Flammable materials, Gases, Magnetized materials, Hazmat or Hazchem, toxic products.

HIGH VALUE CARGO – like Gold, Silver , Diamonds, Gems and Jewellery, Precious art and artifacts, Currency.

PROJECT CARGO – heavy, our load experts are on hand to advice on the best solutions for your unique requirements.

FLYING EXPRESS – Valuable cargo, Dangerous goods unless as specified IATA DGR manual, Live Animals, Human Remains, Perishables.

People- centricity: Our network, routes and the solution we offer for the last mile connectivity helps the industry to solve the supply chain problem that are faced by the customers.

Our Core Values are :-

- Customer first

- Service Excellence

- Act with Integrity

- Build on trust

- Innovation

- Reliable

Growth through partnership:- We believe that systemic change requires cooperation and collaboration. Our infrastructure and technology capabilities are designed to be accessible to our partners in India and around the world.

Efficiency, always :- Saving money for our customers through our approach arising out of our above core values not only allows them to do more but also helps the customers to improve their efficiency amongst the competition .

We have appointed General Sales and Service Agents (“GSSAs”) in India, Hong Kong, Singapore, Thailand, Japan, South Korea, China, Taiwan.

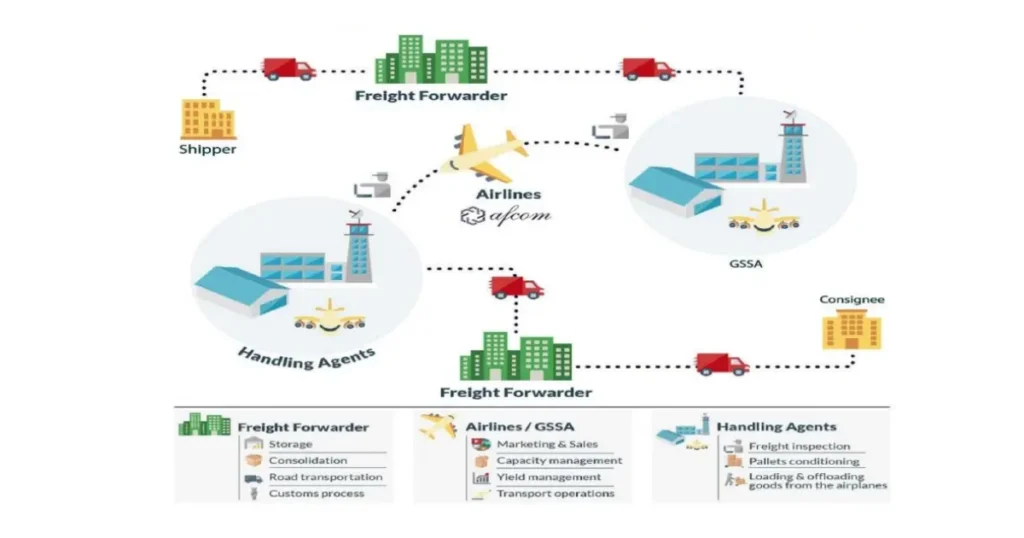

GSSA Role in the Supply Chain :-

The General Sales & Service Agent – GSSAs represent the Airline and market its cargo space amongst various Freight Forwarders in the market. They are the channel partner function as the extended arm of the Airline in terms of booking the cargo from the Freight forwarders and coordinate with their Custom Clearing Agent to clear the customs and ensure a smooth handover of the custom cleared cargo to the Airline, along with the required documents for shipment. We have entered into agreements with the GSSAs, pursuant to which the GSSAs must provide a minimum of 50% of the volume of cargo to us.

We pay the GSSAs commission and incentive based on the cargo they provide to us. Apart from GSSA, we also have business relations with freight forwarders and cargo

sales agents (“CSA”), who blocks space on our aircraft and hand over the cargo to us.

We have entered into an agreement dated 24th September, 2021 with the Air Logistics group (a part of World Freight Company), which is a global leader in the cargo sales and service business. The Air Logistics group represents our Company as its GSSA in far-eastern countries.

We have also entered into an agreement dated 13th October, 2022 with Taylor Logistics Private Limited, which is a part of the TTK Group as our GSSA in India.

Our mission is to enable customers to operate flexible, reliable and resilient supply chains at a better value proposition.

We provided supply chain solutions to a diverse base of customers. Active Customers such as e-commerce marketplaces, direct-to-consumer e-tailers and enterprises and SMEs across several verticals such as FMCG, consumer durables, consumer electronics, lifestyle, retail, automotive and manufacturing, through various Freight Forwarders for the period ended February 29, 2024.

This is achieved through high-quality logistics infrastructure and network engineering, a vast network of domestic and global partners and together, these create intersecting flywheels that drive network synergies within and across our services and enhance our value proposition to customers.

Our Business Operations Shipping by air is a fast and efficient means of transporting goods. Air Cargo handling equipment takes centre stage when it comes to swiftly moving goods across the globe. As the backbone of the Air Cargo Industry, these tools are used for loading, unloading, sorting, and transporting cargo.

Let’s delve into Air Cargo handling equipment, exploring its types, functions, and significance in logistics. Cargo handling equipment ensures the efficient flow of goods worldwide. These tools facilitate cargo movement within airports and aircraft. Efficient Air Cargo handling equipment is a building block of the global logistics network. Moreover, with the growth of e-commerce and international trade, the demand for advanced and automated handling equipment has surged.

A schematic representation of our operations is given below :-

The operational details of the business is explained below, in a step by step process Firstly, let’s understand about the various types of Air Cargo Handling Equipment:

- Cargo Dollies :- These types of equipment transport cargo between terminals and aircraft. They come in various sizes and designs to accommodate different types of cargo, from small packages to larger containers.

- Pallet Loaders : – Pallet loaders are designed to move Unit Load Devices (ULDs) on and off aircraft. They ensure smooth cargo transfers between the airport terminal and the aircraft’s cargo hold.

- Container Loaders and Unloaders :- Containers are machines that efficiently load and unload containers from aircraft. They are crucial for handling larger shipments.

- Forklifts :- They are essential for moving cargo within airport storage areas. Forklifts are used for lifting heavy and oversized items.

- Conveyor Belt Systems :- These systems streamline cargo movement within terminals by transporting baggage, packages, and other items to different processing areas.

- ULD Handling Systems :- Standardised containers and pallets known as Unit Load Devices (ULDs) are managed by ULD handling systems. These systems include equipment like ULD dollies, transporters, and storage units, ensuring efficient management of cargo containers.

Some functions of the Air Cargo handling equipment :-

- Loading and unloading- The primary function of Air Cargo handling equipment is to load and unload cargo. The entire process demands precision, speed, and careful handling

- Sorting and Segregation – Handling equipment assists in sorting and segregating different types of cargo to ensure efficient processing and distribution.

- Storage and Stacking – Efficient use of storage space is crucial. Handling equipment manages cargo storage and stacking within designated areas to optimise workflow.

Once the cargo is packed and the freight is booked, GSSA through its freight forwarder arranges for the shipment.

For booking the shipment the following documents is required :

- Commercial invoice- one the most important documents in shipping. The commercial invoice outlines the items being purchased and from whom, and the terms and conditions between buyer and seller.

- Packing list- shows the details of the cargo, including how it is packed.

- Certificate of origin- If import is from a free trade country, this certificate will need to be prepared to avoid paying unnecessary duty charges Import permits or Manufacturers Declarations- as required for the product type.

- Dangerous goods forms- if a supplier is shipping dangerous goods classified by the International Air Transport Association (IATA) or the International Maritime Organisation (IMO), they will be required to fill out and include relevant dangerous goods forms.

Afcom holdings IPO Date & Price Band Details

IPO Open Date

2 August 2024

IPO Close Date

6 August 2024

IPO Size

3,54,000 shares (Approx ₹52.66 Cr)

Fresh Issue

3,54,000 shares (Approx ₹52.66 Cr)

Lot Size

1200 Shares

IPO Face Value

₹10 Per Equity Share"

IPO Price Band

₹102 to ₹108 Per Every Share

IPO Listing On

BSE SME

IPO Retail Quota

35%

IPO QIB Quota

50%

IPO NII Quota

15%

DRHP Draft

Click Here

Anchor Investor

Click Here

Afcom holdings IPO Market Lot Details

Application

Lot Size

Shares

Amount

Retail Minimum

1

1200

1,29,600

Retail Maximum

1

1200

1,29,600

S-HNI Minimum

2

2400

2,59,200

Object of the Issue

- Funding Capital Expenditure towards taking of two new aircraft on Lease basis.

- Prepayment or repayment of all or a portion of certain outstanding borrowings availed by our company.

- Funding of working capital requirement.

- General Corporate Purposes.

- To meet out the Issue Expenses.

Afcom Holdings IPO Allotment & Listings (Details)

IPO Open Date

2 August 2024

IPO Close Date

6 August 2024

Basis of Allotment

7 August 2024

Refunds

8 August 2024

Credit to Demat Account

8 August 2024

IPO Listing Date

9 August 2024

Afcom Holdings Financial Reports

₹ in Crores

Year

Revenue

Expense

PAT

2024

₹133.70

₹103.04

₹23.10

2023

₹84.14

₹66.75

₹13.59

2022

₹48.27

₹40.29

₹5.15

2021

₹13.89

₹19.97

₹4.20

Our Company Promoters

- Capt. Deepak Parasuraman

- Mr. Kannan Ramakrishnan

- Wg. Cdr Jagan Mohan Manthena

- Mrs. Manjula Annamalai

Qualitative Factors

- Workforce Expertise.

- Leadership Excellence.

- Advanced Inspection Systems.

- Delivery Commitment.

- Specialized Talent Retention.

Also Read: Picturepost Studios IPO

Afcom holdings Company Contact Details

2, LIC Colony Dr. Radhakrishnan Nagar,

Thiruvanmiyur, Chennai,

Tamil Nadu, India, 600041

Telephone: +91-9841019204

E-mail: corporate@afcomcargo.com

Investor grievance id: investcare@afcomcargo.com

Website: www.afcomcargo.com

Afcom holdings Lead Manager

GYR Capital Advisors Private Limited

428, Gala Empire, Near JB Tower,

Drive in Road, Thaltej,

Ahemdabad-380 054,

Gujarat, India.Telephone: +91 +91 877756 4648

Email ID: info@gyrcapitaladvisors.com

Website: www.gyrcapitaladvisors.com

Investor Grievance ID: investors@gyrcapitaladvisors.com

Contact Person: Mr. Mohit Baid

Afcom holdings IPO Registrar

Link Intime India Private Limited

C-101, 1st Floor, 247 Park, Lal Bahadur Shashtri Marg,

Vikhroli (West), Mumbai – 400 083, Maharashtra, India

Telephone: +91-022-810 811 4949

E-mail: afcomholdings.ipo@linkintime.co.in

Website: www.linkintime.co.in

Investor Grievance ID: afcomholdings.ipo@linkintime.co.in

Contact Person: Shanti Gopalkrishnan

3 thoughts on “Afcom holdings IPO Details Today, Date, Price, GMP, Review”