Akiko Global Services IPO Details Today : Akiko Global Services IPO Details Today is Open on 25 June 2024 and Close on 27 June 2024. Akiko Global Services IPO to Raise 3,001,600 shares (Approx ₹23.11 Cr) via IPO. The Fresh issue of 3,001,600 shares (Approx ₹23.11 Cr).

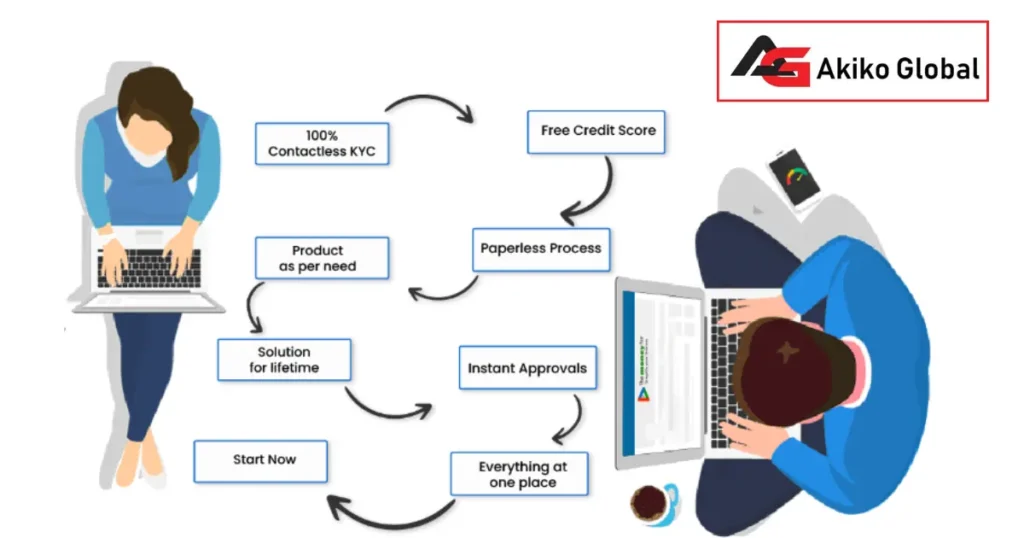

Our Company has commenced its operations in 2018 and is currently working as a Channel Partner (DSA) for major Banks / NBFCs. Our proficiency lies in the field of credit cards and loans, empowering us to offer extensive guidance and assistance to individuals and businesses as they navigate the expansive landscape of financial products.

Whether it’s finding the right credit card for maximizing rewards and benefits, or securing the most suitable loan for personal or business needs, our team is dedicated to delivering informed and tailored recommendations.

Our business is completely compliance driven as our Company is ISO Certified by QFS Management Systems LLP, Accredited by Standards Council of Canada and has inbuilt steps that are followed as per the guidelines issued by the respective banks.

we are a trusted channel partner for major banks and Non-Banking Financial Companies (NBFCs) in India, specializing in the distribution and sales of financial products such as credit cards and loans. With a focus on delivering high-quality financial solutions to customers.

We have carved a niche for ourself in the dynamic and competitive Indian financial services sector. Our expertise is enhanced by using a Customer Relationship Management (“CRM”) system in our day-to-day operations. All leads undergo injection and monitoring within our proprietary CRM, exclusively developed by our core IT team. What distinguishes us from the competition is our IT team’s capability to seamlessly integrate with external CRMs or APIs without the need for outsourcing any customer data.

Akiko Global Services IPO Date & Price Band Details

| IPO Open Date | 25 June 2024 |

|---|---|

| IPO Close Date | 27 June 2024 |

| IPO Size | 3,001,600 shares (Approx ₹23.11 Cr) |

| Fresh Issue | 3,001,600 shares (Approx ₹23.11 Cr) |

| Lot Size | 1600 Shares |

| IPO Face Value | ₹10 Per Equity Share" |

| IPO Price Band | ₹77 Per Every Share |

| IPO Listing On | NSE SME |

| IPO Retail Quota | 35% |

| IPO QIB Quota | 50% |

| IPO NII Quota | 15% |

| DRHP Draft | Click Here |

| Anchor Investor | Click Here |

Akiko Global Services IPO Market Lot Details

| Application | Lot Size | Shares | Amount |

|---|---|---|---|

| Retail Minimum | 1 | 1600 | ₹123,200 |

| Retail Maximum | 1 | 1600 | ₹123,200 |

| S-HNI Minimum | 2 | 3,200 | ₹246,400 |

Object of the Issue

- Implementation of ERP Solution and TeleCRM.

- Mobile Application for financial product solution.

- To meet working capital requirements.

- Enhancing visibility and awareness of our brands, including but not limited to “Akiko Global” or “Moneyfair”.

- General Corporate Purpose.

- Issue Expenses.

Akiko Global Services IPO Allotment & Listings (Details)

| IPO Open Date | 25 June 2024 |

|---|---|

| IPO Close Date | 27 June 2024 |

| Basis of Allotment | 1 July 2024 |

| Refunds | 1 July 2024 |

| Credit to Demat Account | 1 July 2024 |

| IPO Listing Date | 2 July 2024 |

Akiko Global Services Financial Reports

| ₹ in Crores | |||

|---|---|---|---|

| Year | Revenue | Net Worth | PAT |

| 2024 | ₹2,609.76 | ₹1,403.37 | ₹321.48 |

| 2023 | ₹3,958.97 | ₹578.40 | ₹453.26 |

| 2022 | ₹1,353.31 | ₹123.14 | ₹77.85 |

| 2021 | ₹610.78 | ₹45.29 | ₹22.98 |

Our Company Promoters

- Mr. Ankur Gaba

- Ms. Richa Arora

- Mr. Gurjeet Singh Walia

- Mr. Puneet Mehta

Qualitative Factors

- Experienced and Qualified Management and Employee base.

- Strong and Consistent Financial Performance.

- Growing customer base.

- Scalable and reliable business model.

- Experienced Promoters and Senior Management with extensive domain knowledge.

Akiko Global Services Company Contact Details

11th Floor, Off No. 8/4-D, Vishwadeep Building,

District Centre Janakpuri, New Delhi – 110058.

Tel. No.: 011 4010 4241

Email: accounting@akiko.co.in

Website: www.themoneyfair.com

Akiko Global Services IPO Registrar

Skyline Financial Services Pvt Ltd

Address: D-153A, 1st floor, Phase I, Okhla Industrial

Area, Delhi -110020

Tel No.: 011- 40450193-97

Fax No. +91-11-26812683

Email: ipo@skylinerta.com

Investor Grievance Email: ipo@skylinerta.com

Contact Person: Mr. Anuj Rana

Website: www.skylinerta.com

2 thoughts on “Akiko Global Services IPO details, Date, Price, GMP, Review”