bank nifty weightage: bank nifty weightage Bank Nifty is considered an important index of the banking sector of the stock market. It plays an important role in determining the fluctuations of the banking sector index. But have you ever wondered how the Bank Nifty Index is calculated? This index is an index of bank shares. Let us look at the concept of Bank Nifty weighting to know its importance and how it can impact your investments in detail.

Table of Contents

Toggle1. What is Bank Nifty weightage ?

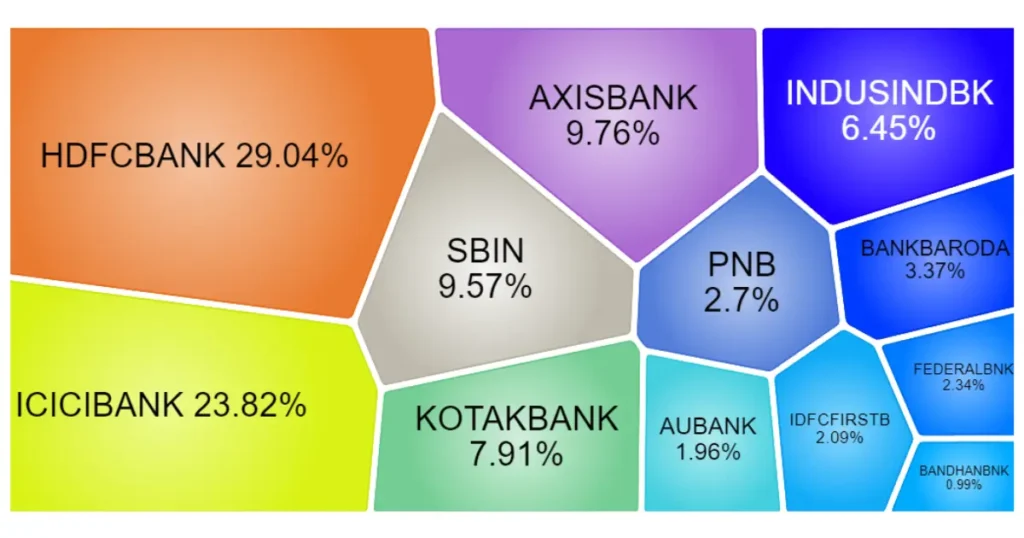

Bank Nifty weighting represents the contribution of all the stocks within the Bank Nifty index. In simple words, it shows how much impact each bank stock has on the movement of the Bank Nifty index.

2. How is Bank Nifty weightage calculated ?

The calculation of Bank Nifty weighting includes a variety of aspects, including how much market capitalization the bank has. Market capitalization is the total market value of a company’s outstanding shares. The higher the market capitalization of a bank, the higher will be its weight in the Bank Nifty index.

3.Understanding Market Capitalization ?

If the market capitalization of a bank is to be calculated then its value can be easily calculated by multiplying the current market price of that bank’s stock by its total outstanding shares. In this way investors can find out the size of that bank or company and its importance in the stock market.

4. Impact of market capitalization on weighting ?

The weighting of Bank Nifty is largely determined by the market capitalization of the bank, so banks with higher market capitalization have a greater impact on the movements of the index. For example, if a bank with a larger market capitalization experiences a significant price change, the Bank Nifty index is likely to see the largest impact compared to a smaller bank with a smaller market capitalization.

5 . Role of Free Float Market Capitalization ?

Apart from the total market capitalization of the bank, free float market capitalization also plays an important role in determining the weightage of Bank Nifty. Free float market capitalization excludes locked-in shares and shares held by insiders, giving a more accurate representation of the company’s market value.

6.Why is Bank Nifty Weightage important ?

It is very important for any investors to understand the Bank Nifty weighting as it helps them a lot in assessing the overall sentiment and direction of the banking sector. Higher weighting of a larger bank reflects its dominance in the index and indicates that its performance will have a greater impact on the movement of the Bank Nifty index.

7. Example of Bank Nifty Weighting ?

Suppose Bank A and Bank B are two components of Bank Nifty Index. If the market capitalization of Bank A is higher than that of Bank B, it will be weighted more in the index. Therefore, any significant price change in the stock of Bank A will have a greater impact on the Bank Nifty index than that of Bank B.

conclusion of bank nifty weightage ?

Bank Nifty Index weightage is an important factor for investors and influences their investment decisions in the banking sector. By understanding how the weighting is calculated and what effect it has on the movement of the index, investors can take a right decision and understand the ups and downs of the stock market more effectively. Are. So next time you track the Bank Nifty index, consider the importance of all its stocks so that you can understand how it can affect your investments.