The Allotment date for the Bluestone Jewellery Company IPO will be Finalized on Aug 14, 2025. You will get Time from Aug 11, 2025 to Aug 13, 2025 to Submit your Application in the IPO, During this time this IPO saw a huge Response from all investor Categories and the total subscription was 2.72 times, in which Applications Were Submitted for [ 4,46,19,603 ] shares Against the Reserved [ 1,63,89,889] shares.

‘BlueStone Jewellery and Lifestyle Limited’ We offer contemporary lifestyle diamond, gold, platinum and studded jewellery under our flagship brand,BlueStone. We are a digital first direct-to-consumer (“DTC”) brand focussed on ensuring a seamless omnichannel experience for customers and are the second largest digital-first omni-channel jewellery brand in India.

We are among the few Leading Jewellery Retailers with a pan-India presence with 275 stores across 117 cities in 26 States and Union Territories in India, as of March 31, 2025 servicing over 12,600 PIN codes across India.

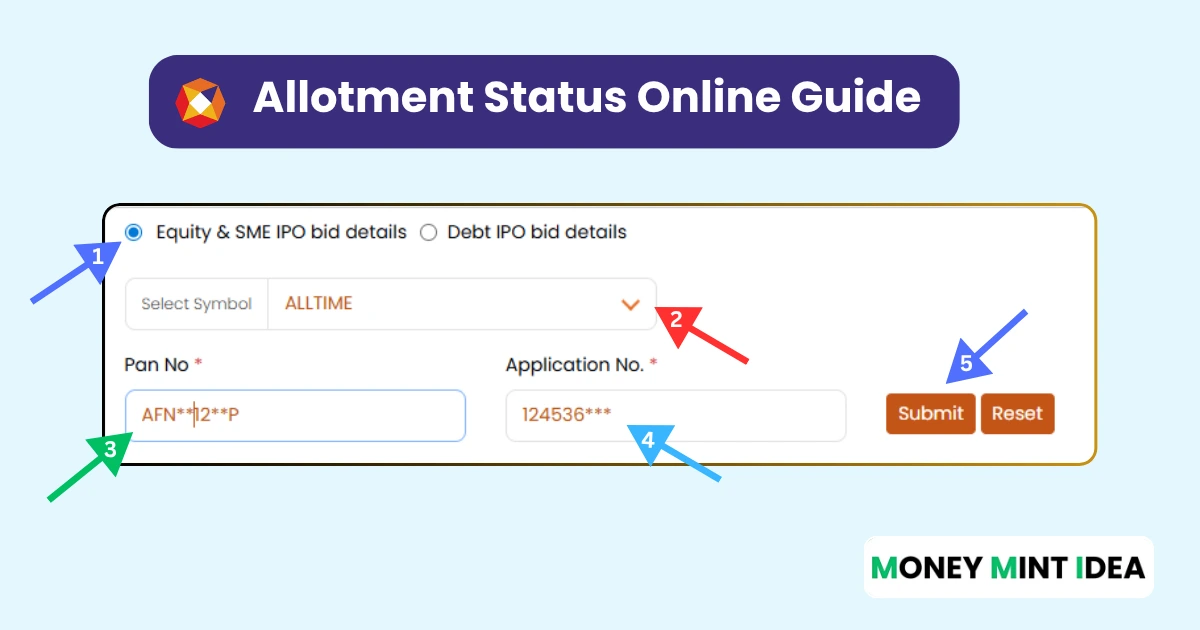

How to Check Bluestone Jewellery IPO Allotment Status Online on NSE – Step-by-Step Guide

1.Visit of NSE India IPO allotment Verification Status Page Click Here

2.Select (Equity & SME IPO bid details).

3.In Select IPO Symbol, select (Bluestone Jewellery Ltd).

4.Enter Your PAN Card Number and IPO Application No.

5.Click (Submit button).

How to Check Bluestone Jewellery IPO Allotment Status Online on BSE – Step-by-Step Guide

1.Click Here to Visit BSE The Application Status Page.

2.In Issue Type, (Select Equity).

3.In Issue Name, select ( Bluestone Jewellery Limited )

4.Enter your Application Number, or PAN Card No.

5. Click Box on (I’m not a robot )

6. Click (Submit button).

How to Check Bluestone Jewellery IPO on KFIN TECHNOLOGIES – Complete Guide :

1.Visit the KFIN TECHNOLOGIES official Website on IPO allotment status page (Click Here)

2. Open New Page In Company Selection, select (BLUESTONE JEWELLERY LIMITED)

3. Enter any of the following details:

– Application Number/CAF NO

– Beneficiary ID

– Pan Card Number

4. File Captcha Number Click Search and show your IPO Allotment Status

Bluestone Jewellery IPO 2025:

The ipo of Bluestone Jewellery Company is a Book-building Issue Size of ₹1,540.65 Cr, it has a Fresh Issue Size of ₹820.00 Cr, and OFS (Offer for Sale) of ₹720.65 Cr. Its Price Band in This IPO has Been Fixed Between ₹492 to ₹517 Per Share.

Pantomath Capital Advisors Pvt Ltd is The Book-Running Lead Manager of this IPO, and KFIN TECHNOLOGIES Pvt Ltd is going to be the Registrar of Bluestone Jewellery ipo.

By Clicking Here You Can see the Newly Listed IPO Information on BSE and NSE.

Bluestone Jewellery IPO Subscription Status – Latest Updates

| Day to day | (QIBs) Qualified Institutional Buyers | ( NII ) Non-Institutional Investors | (RIIs) Retail Individual Investors | Total Subscription Status |

|---|---|---|---|---|

| Day 1 | 0.57 | 0.04 | 0.39 | 0.39 |

| Day 2 | 0.84 | 0.23 | 0.75 | 0.66 |

| Day 3 | 4.25 | 0.57 | 1.38 | 2.72 |

Explore other Upcoming IPOs on BSE and NSE.

Where will the money from this IPO be used? :

The company will use the money raised from the new IPO for the following purposes such as:

- Funding our working capital requirements.

- General corporate purposes.

Bluestone Jewellery IPO GMP Price Details :

The GMP price of Bluestone Jewellery IPO on 14th August 2025 was ₹2, if we talk about the estimated listing price then it is ₹519, if we look at the estimated per share percentage of this stock then 0.39% listing gain can be obtained in this IPO.

Source: Investorgain Report dated 13 August 2025

Disclaimer: GMP (Grey Market Premium) price is just an unverified market news and does not have any concrete basis yet. The information given above is based on the news published in some media reports, it is for information purposes only. Investors should do their own study/research before taking their decision. We are not involved in the grey market in any way, nor do any trading or recommend doing grey market trading.

Disclaimer: This news is for stock market educational purposes only. The securities/investments mentioned here are not recommendatory.