Canara Robeco IPO GMP Today ₹14 Get the Latest Updates on Canara Robeco ipo Grey market premium (GMP), Kostak rate, and Subject to Sauda Price along with Expected Listing Gains. Track daily GMP trends and IPO details before investing.

Latest Canara Robeco IPO GMP (Grey Market Premium)

Canara Robeco IPO GMP Today is – ₹14 Per Share

Kostak Rate – Not Available

Subject to Sauda – ₹600

Expected Listing Gain – 5.26%

Canara Robeco IPO GMP Price to Down a high to low of ₹09 Rupay on Oct 10 and a High Price of ₹30 on Oct 07, 2025 Showing Strong Market demand.

Canara Robeco IPO GMP Live – Day-wise Trend ( Table)

| GMP Date | IPO Price | GMP | Estimated Listing Price | Estimated Profit |

|---|---|---|---|---|

| 14-10-2025 | 266.00 | ₹14 | ₹280 (5.26%) | ₹784 |

| 13-10-2025 | 266.00 | ₹09 | ₹275 (3.38%) | ₹504 |

| 12-10-2025 | 266.00 | ₹09 | ₹275 (3.38%) | ₹504 |

| 11-10-2025 | 266.00 | ₹09 | ₹275 (3.38%) | ₹504 |

| 10-10-2025 | 266.00 | ₹09 | ₹275 (3.38%) | ₹504 |

| 09-10-2025 | 266.00 | ₹30 | ₹296 (11.27%) | ₹1,680 |

| 08-10-2025 | 266.00 | ₹30 | ₹296 (11.27%) | ₹1,680 |

| 07-10-2025 | 266.00 | ₹30 | ₹296 (11.27%) | ₹1,680 |

Canara Robeco IPO Details

| Open Date | Oct 09, 2025 |

|---|---|

| Close Date | Oct 13, 2025 |

| Price Band | ₹253 to ₹ 266 per share |

| Face Value | ₹10 per equity share |

| Lot Size | 56 Shares |

| Type of Issue | Offer for Sale |

| Total Issue Size | 4,98,54,357 shares (aggregating up to ₹1,326.12 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing Exchange | BSE & NSE |

| Retail Investor Quota | 35.00% |

| QIB Quota | 50.00% |

| NII (HNI) | 15.00% |

| DRHP (Draft Prospectus) | Click Here |

| RHP (Final Prospectus) | Click Here |

About Canara Robeco Asset Management Company Limited

Our Company was originally incorporated on March 2, 1993 as ‘Canara Robeco Asset Management Company Limited” We are India’s second oldest asset management company (“AMC”) Our primary activities include managing mutual funds and providing investment advice on Indian equities to Robeco Hong Kong Limited (“Robeco HK”), a member of our Promoter Group.

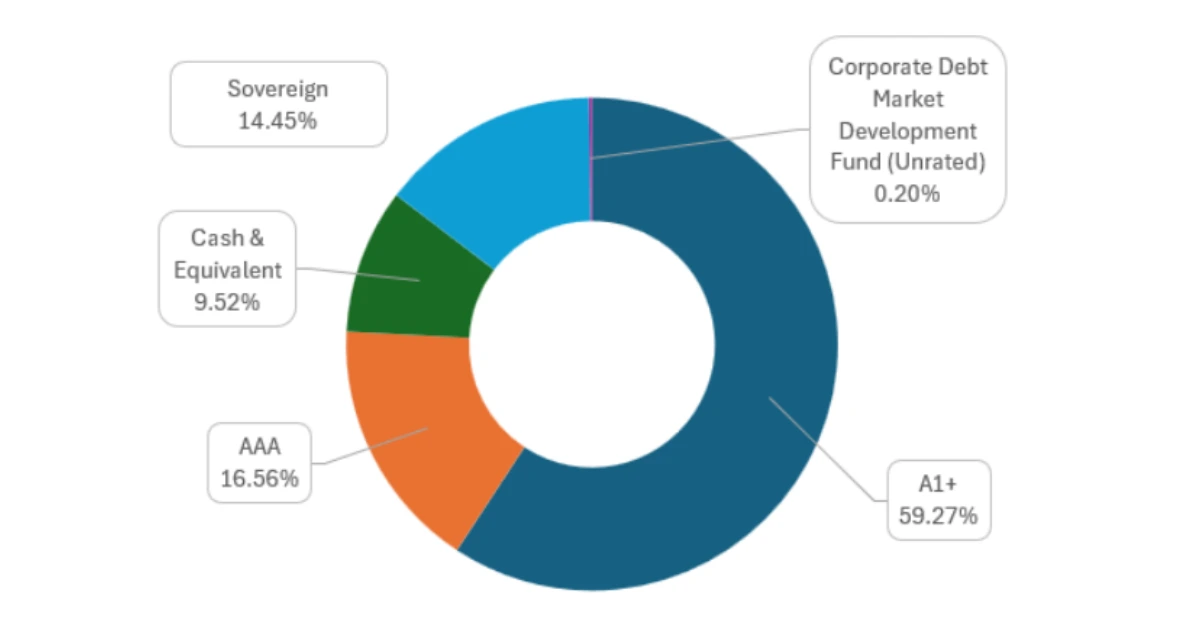

we managed 26 schemes comprising 12 equity schemes, 10 debt schemes and four (4) hybrid schemes with a quarterly average asset under management (“QAAUM”) of ₹ 1,110.52 billion as of June 30, 2025.

Our portfolio of equity-oriented schemes includes a large and mid-cap fund, a large cap fund, a flexi cap fund, a small cap fund, an aggressive hybrid fund, an equity-linked saving scheme (ELSS) tax saver fund, a multi-cap fund, a mid-cap fund, a focused fund, three sectoral funds (which includes consumer trends, infrastructure and manufacturing funds) a balanced advantage, a multi asset allocation fund and value fund.

Seven out of our 15 equity-oriented schemes have been managed for more than 10 years.

Canara Bank, as on June 30, 2025 Presence with a Network of 9,861 Branches and over 10,847 ATMs/recyclers and also operated 4 international branches located in New York (United States of America), London (United Kingdom), Dubai (UAE) and International Business Unit in Gujarat International Finance Tec-City.

We have a pan India geographical presence serving customers directly in more than 23 cities across 14 states and two (2) union territories with a network of 25 branches as of June 30, 2025.

Our branch presence across India is also supported by our third-party distribution partners. As of June 30, 2025, we had 52,343 empanelled distribution partners across India, including Canara Bank, 44 other banks, 548 national distributors (“ND”) and 51,750 mutual fund distributors (“MFDs”).

Our debt portfolio amongst others includes an overnight fund

Also Read: Canara Robeco IPO Date, Price, GMP, Review, Details

FAQs ON Canara Robeco IPO GMP Today

Q1: What is Canara Robeco IPO GMP today?

Canara Robeco IPO GMP Price is ₹14 Per Share

Q2: What is the Kostak Rate today?

Canara Robeco IPO Kostak Rate is ₹- as of today Not available.

Q3: Canara Robeco ipo gmp investorgain?

Canara Robeco ipo gmp Price investorgain is ₹13 rupay Righ Now

Q4: Canara Robeco ipo gmp ipowatch?

Canara Robeco ipo gmp ipowatch Price is ₹11 rupay Righ Now

Q5: What is the Subject to Sauda rate?

Canara Robeco IPO Subject to Sauda is ₹600 as of today.

Q6: What are the expected listing gains?

Canara Robeco IPO Estimated 5.26% returns based on current GMP

Disclaimer:

IPO GMP (Grey Market Premium), Kostak and Subject to Sauda Rates are Unofficial and Can Change Quickly.

We do Not BUY or SELL IPO Forms.

Do Not apply For IPOs Based only on GMP Price.

Always Review the company’s fundamentals before investing.