Canara Robeco IPO Will Open On Oct 09, 2025 and Close On Oct 13, 2025.The ₹1,326.12 Cr. IPO Is A Book Build Issue, Consisting Entirely of offer for Sale. Canara Robeco IPO Price Band Is Set At ₹253 to ₹266 Per Share.

The Allotment will Be Finalized On Oct 14, 2025 and Listing date is Expected on The NSE BSE By Oct 16, 2025. Investor Quota like 50% QIB, 35% Retail, and 15% HNI Category.

Financial Year 2025 Company Posted a Total income 403.99 Cr. and A Net Profit of ₹190.70 Cr. Showing Strong Growth From The Previous Year. Based On Financial, The IPO Looks Promising For Long-term Investors.

Canara Robeco IPO Dates & Price Band Details

| Open Date | Oct 09, 2025 |

|---|---|

| Close Date | Oct 13, 2025 |

| Price Band | ₹253 to ₹ 266 per share |

| Face Value | ₹10 per equity share |

| Lot Size | 56 Shares |

| Type of Issue | Offer for Sale |

| Total Issue Size | 4,98,54,357 shares (aggregating up to ₹1,326.12 Cr) |

| Issue Type | Bookbuilding IPO |

| Listing Exchange | BSE & NSE |

| Retail Investor Quota | 35.00% |

| QIB Quota | 50.00% |

| NII (HNI) | 15.00% |

| DRHP (Draft Prospectus) | Click Here |

| RHP (Final Prospectus) | Click Here |

About Canara Robeco Asset Management Company Limited

Our Company was originally incorporated on March 2, 1993 as ‘Canara Robeco Asset Management Company Limited” We are India’s second oldest asset management company (“AMC”) Our primary activities include managing mutual funds and providing investment advice on Indian equities to Robeco Hong Kong Limited (“Robeco HK”), a member of our Promoter Group.

we managed 26 schemes comprising 12 equity schemes, 10 debt schemes and four (4) hybrid schemes with a quarterly average asset under management (“QAAUM”) of ₹ 1,110.52 billion as of June 30, 2025.

Our portfolio of equity-oriented schemes includes a large and mid-cap fund, a large cap fund, a flexi cap fund, a small cap fund, an aggressive hybrid fund, an equity-linked saving scheme (ELSS) tax saver fund, a multi-cap fund, a mid-cap fund, a focused fund, three sectoral funds (which includes consumer trends, infrastructure and manufacturing funds) a balanced advantage, a multi asset allocation fund and value fund.

Seven out of our 15 equity-oriented schemes have been managed for more than 10 years.

Canara Bank, as on June 30, 2025 Presence with a Network of 9,861 Branches and over 10,847 ATMs/recyclers and also operated 4 international branches located in New York (United States of America), London (United Kingdom), Dubai (UAE) and International Business Unit in Gujarat International Finance Tec-City.

We have a pan India geographical presence serving customers directly in more than 23 cities across 14 states and two (2) union territories with a network of 25 branches as of June 30, 2025.

Our branch presence across India is also supported by our third-party distribution partners. As of June 30, 2025, we had 52,343 empanelled distribution partners across India, including Canara Bank, 44 other banks, 548 national distributors (“ND”) and 51,750 mutual fund distributors (“MFDs”).

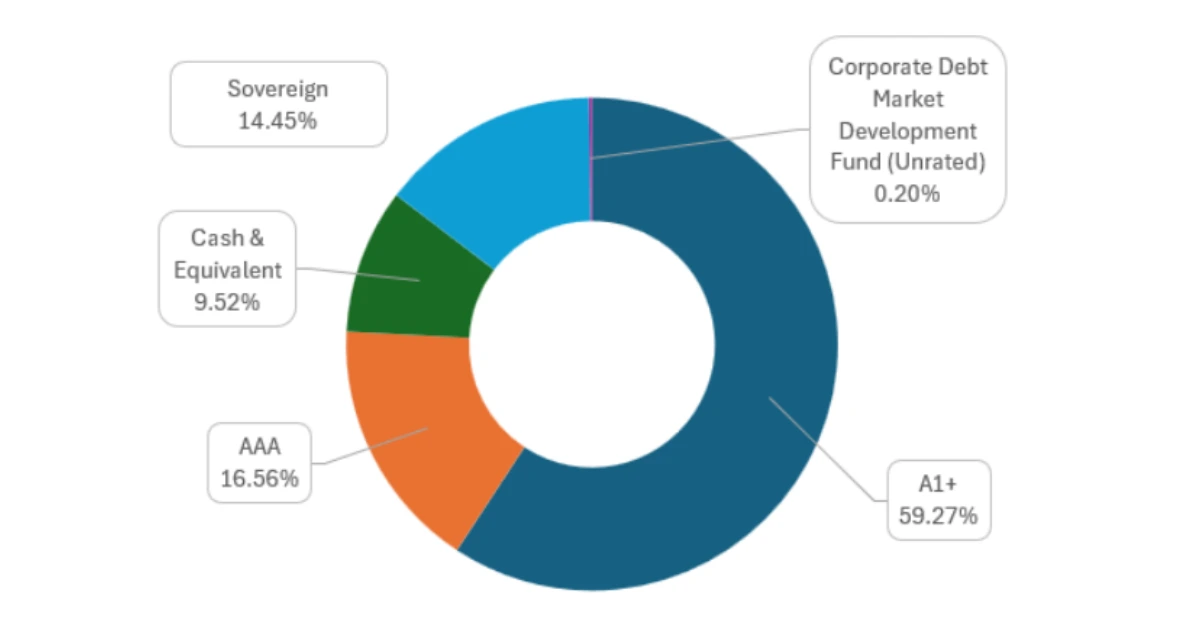

Our debt portfolio amongst others includes an overnight fund

Our Competitive Strengths

Recognized brand with legacy of operations and established parentage.

Operations led by professional management team and established corporate governance standards.

Well-diversified equity products mix backed by research-driven investment process.

Pan-India multi-channel sales and distribution network.

Expanding proportion of AUM contributed by individual investors and SIP contributions.

Integrated technology-led operations with a well-established digital eco-system.

Canara Robeco IPO Market Lot Size

The Minimum Lot Size For The Canara Robeco IPO is 56 Shares, Requiring An Application Amount of ₹14,896 For Retail Investors. Investors Must Apply in Multiples of The Lot Size.

| Application | Lot Size | Shares | Amount |

| Retail Minimum | 1 | 56 | ₹14,896 |

| Retail Maximum | 13 | 728 | ₹1,93,648 |

| S-HNI Minimum | 14 | 784 | ₹2,08,544 |

| S-HNI Maxmum | 67 | 3,752 | ₹9,98,032 |

| B-HNI Minimum | 68 | 3,808 | ₹10,12,928 |

Canara Robeco IPO Allotment & Listing Dates

Canara Robeco IPO Will Open on Oct 09, and Close on Oct 13, 2025. The allotment is Expected on Oct 14, With the Listing Scheduled on NSE BSE For Oct 16, 2025 (More information below table).

| Anchor Investor Bidding | Wed,Oct 8, 2025 |

|---|---|

| IPO Open | Thu, Oct 9, 2025 |

| IPO Close | Mon, Oct 13, 2025 |

| Allotment Finalisation | Tue, Oct 14, 2025 |

| Refunds / Unblocking | Wed, Oct 15, 2025 |

| Shares Credited to Demat | Wed, Oct 15, 2025 |

| Listing Date | Thu, Oct 16, 2025 |

Canara Robeco IPO Financial Report (FY 2024)

Canara Robeco Reported a Total Income of ₹403.99 Cr. in FY 2025, Slightly up From ₹318.78 Cr. in FY 2024. The Company Net Profit Also Rose to ₹190.70 Cr. From ₹151.00 Cr. in the Previous Year Showing Consistent Financial Growth Ahead of its IPO. (More information below table).

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|

| Assets | 674.03 | 516.81 | 377.97 |

| Total Income | 403.99 | 318.78 | 204.80 |

| Profit After Tax | 190.70 | 151.00 | 79.00 |

| Net Worth | 600.06 | 454.49 | 328.55 |

| Reserves and Surplus | 400.64 | 404.64 | 278.70 |

| Amount in ₹ Crore |

Canara Robeco IPO Valuation Report – FY 2025 (KPI)

Check Detailed Canara Robeco IPO Valuation Metrics for FY 2025, including EPS, P/E Ratio, RoNW, NAV, ROCE, and other key financial indicators. These Ratios help Investors Assess the Company financial Health & Valuation Before applying for The IPO. (More information below table).

| KPI | Value |

|---|---|

| Return on Equity (ROE) | -% |

| Return on Capital Employed (ROCE) | -% |

| EBITDA Margin | -% |

| PAT Margin | -% |

| Debt-to-Equity Ratio | - |

| Earnings Per Share (EPS) | 9.56 |

| Price to Earnings Ratio (P/E) | 27.82 |

| Return on Net Worth (RoNW) | 31.78% |

| Net Asset Value (NAV) | 30.09 |

Our Company Promoters

- Canara Bank And Orix Corporation Europe N.v

Canara Robeco Comparison With Industry Peers

| Name of the Companies | Face Value (₹) | Closing Price | EPS (Basic) (₹) | P/E | (“RoNW”) (%) | NAV per Equity Share (₹) | Revenue from Operations 2025 (₹ million) |

|---|---|---|---|---|---|---|---|

| Canara Robeco Asset Management Company Limited | 10 | N.A. | 9.56 | 27.82 | 31.78% | 30.09 | 4,036.95 |

| HDFC Asset Management Company Limited | 5 | 5,532.50 | 115.16 | 48.21 | 32.36% | 380.27 | 34,984.40 |

| Nippon Life India Asset Management Limited | 10 | 868.35 | 20.34 | 43.35 | 31.38% | 66.38 | 22,306.90 |

| Aditya Birla Sun Life AMC Limited | 5 | 791.50 | 32.26 | 24.60 | 26.99% | 129.19 | 16,847.80 |

| UTI Asset Management Company Limited | 10 | 1,304.10 | 57.35 | 22.83 | 16.04% | 403.22 | 18,510.90 |

Also Read: Canara Robeco IPO GMP Today, Grey Market Premium Live

Also Read: Canara HSBC Life IPO: Listing Price, GMP, Date, Review & Details

Canara Robeco Company Contact Details

Corporate Office: Construction House,

4th Floor, 5, Walchand Hirachand Marg,

Ballard Estate, Mumbai – 400 001,

Maharashtra, India

Tel: +91 22 6658 5000

E-mail: Secretarial@canararobeco.com

Website: https://www.canararobeco.com

Canara Robeco Lead Manager

SBI Capital Markets Limited

1501, 15th Floor, A & B Wing

Parinee Crescenzo building

G-Block Bandra Kurla Complex

Bandra (East) Mumbai 400 051

Maharashtra, India

Telephone: +91 22 4006 9807

E-mail: cramc.ipo@sbicaps.com

Website: www.sbicaps.com

Axis Capital Limited

Axis House, 1st Floor

Pandurang Budhkar Marg

Worli, Mumbai – 400 025

Maharashtra, India

Telephone: +91 22 4325 2183

E-mail: canararobecoamc.ipo@axiscap.in

Website: www.axiscapital.co.in

JM Financial Limited

7th Floor, Cnergy

Appasaheb Marathe Marg, Prabhadevi

Mumbai 400 025, Maharashtra, India

Telephone: +91 22 6630 3030

E-mail: canararobecoamc.ipo@jmfl.com

Website: www.jmfl.com

Canara Robeco IPO Registrar

MUFG Intime India Private Limited

C-101, 1st Floor, 247 Park

L.B.S. Marg, Vikhroli West

Mumbai 400 083 Maharashtra, India

Telephone: +91 810 811 4949

E-mail: canararobeco.ipo@in.mpms.mufg.com

Website: in.mpms.mufg.com

Canara Robeco IPO FAQs

Question 1: What is the Canara Robeco IPO?

Answer 1: Canara Robeco IPO is a Mainboard IPO of 49,854,357 equity shares of the face value of ₹10 approximately up to ₹1,326.12 Cr. The issue is price at ₹253 to ₹266 per share.

The Canara Robeco IPO opens on 09, Oct 2025 and closes on 13, Oct 2025.

MUFG Intime India Private Limited is the registrar for the IPO. The shares to be listed on NSE BSE.

Question 2: How to apply in Canara Robeco IPO through Groww?

Answer 2: Groww customers can apply online in Canara Robeco IPO using UPI as a payment gateway. Groww customers can apply in Canara Robeco IPO by login into Groww (back office) and submitting an IPO application form.

Steps to apply in Canara Robeco IPO through Groww –

Visit the Groww website and login to Groww.

Go to Main Page and click the Products & tools and click IPO tab.

New page Open and Show ‘ Canara Robeco IPO’ click the ‘Apply’ button.

Show IPO detail Shares lot Size and Bid Price & click here to Cutoff Price check Box and Continue.

Inter Your UPI id like . 95****299@kotak accept terms and condition click Box and Apply For IPO

groww share payment link Your UPI Mobile Number Pay Payment for IPO Bid to approve the e-mandate successfully submit application.

Question 3: When Canara Robeco IPO will open?

Answer 3: The Canara Robeco IPO opens on Oct 09, 2025 and closes on Oct 13, 2025.

Question 4: What is the lot size of Canara Robeco IPO?

Answer 4: Canara Robeco IPO lot size and the minimum order quantity is 56 Shares.

Question 5: How to apply for Canara Robeco IPO?

Answer 5: You can apply in Canara Robeco IPO online using either UPI or ASBA as a payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don’t offer banking services. Read more detail about applying IPO online through Groww, Zerodha, Upstox, 5Paisa, Phonepe Share Market, HDFC Bank, and Angel one.

Question 6: When is Canara Robeco IPO allotment date?

Answer 6: The Basis of Allotment for Canara Robeco IPO will be on Tue, Oct 14, 2025, and the allotted shares will be credited to your demat account by, Wed, Oct 15, 2025. For Check the Canara Robeco IPO allotment status.

Question 7: When is Canara Robeco IPO listing date?

Answer 7: The Canara Robeco IPO listing date is Oct 16, 2025. The date of Canara Robeco IPO listing on Thu, Oct 16, 2025.