ONGC Ltd share price target 2025: Are you considering investing in ONGC Ltd share price target? Want to know its future Price target? This guide will discuss the ONGC Ltd share target for The Years 2025, 2026 and 2030. Along with this, we will do a complete Fundamental analysis to help you make the right decision.

About ONGC Ltd-

Maharatna ONGC is the largest crude oil and natural gas Company in India, contributing around 71 per cent to Indian domestic production. Crude oil is the raw material used by downstream companies like IOC, BPCL, HPCL and MRPL to produce petroleum products like Petrol, Diesel, Kerosene, Naphtha, and Cooking Gas LPG.

Oil and Natural Gas Corporation Limited (ONGC) is publishing its 3rd Integrated Annual Report in FY 2023-24.

The report provides comprehensive details regarding the financial and non-financial performance, risk and opportunity management and other material information related to ONGC’s value creation strategy, stakeholder engagement, governance and performance evaluation through both current capital and future strategies.

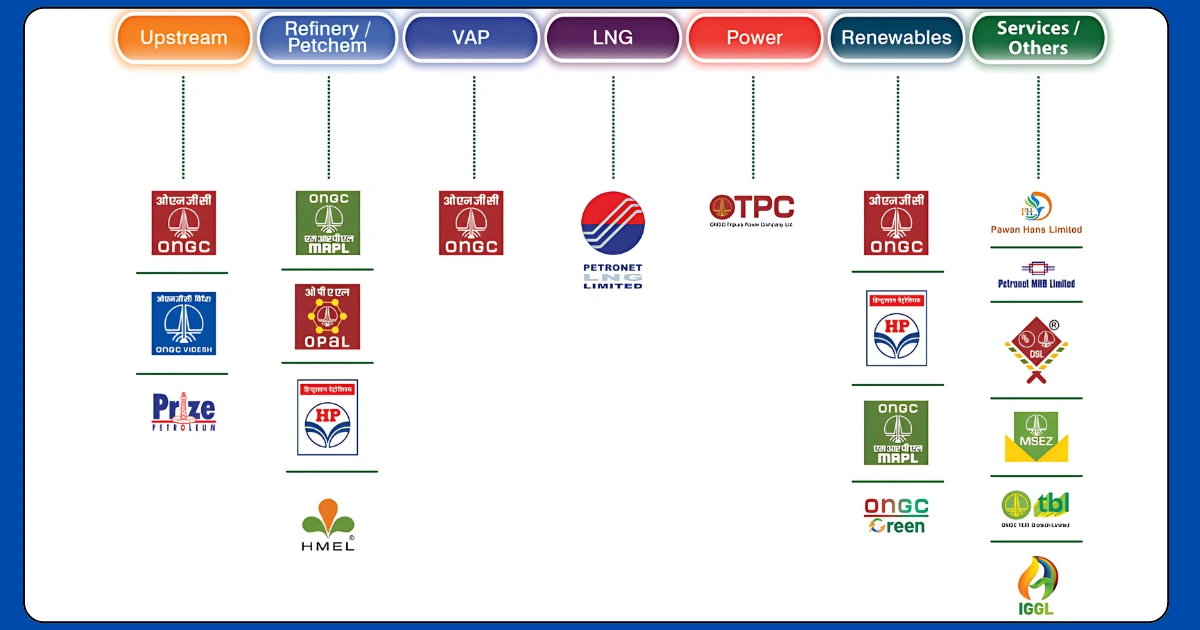

Our Subsidiaries Company

Financial Capital

- Equity: ₹3,650,905 million

- Debt: ₹1,197,554 million

Key Material Issues Aligned

- Product and Service Quality

- Asset Utilisation

- Raw Material Security

At ONGC, we understand that sustainable growth is the need of the hour. That’s the reason we are working towards the time-bound target of achieving Net zero carbon emissions by 2038.

We are taking steps to ensure that as we continue to source conventional energy for the nation’s energy security, we are also, at the same time, increasingly focusing on tapping into renewable energy sources so as to have a minimal impact on the environment. This transformation in the energy sector is our commitment to the nation.

ONGC Share Price Target Tomorrow

ONGC Share Price Target 2025

The share price of ONGC may go up & Down. According to our analysis levels, the minimum cost of ONGC shares in 2025 can be ₹240, and the maximum price can be ₹265.

| Month Wise (Year 2025) | Target Price |

|---|---|

| June | ₹250 |

| July | ₹254 |

| August | ₹258 |

| September | ₹262 |

| October | ₹265 |

| November | ₹267 |

| December | ₹270 |

Titagarh Ltd Share Price Target 2025 to 2030

ONGC Share Price Target 2026

The share price of ONGC may go up & Down. According to our analysis levels, the minimum cost of ONGC shares in 2026 can be ₹260, and the maximum price can be ₹320.

| Month Wise (Year 2026) | Target Price |

|---|---|

| January | ₹260 |

| December | ₹320 |

CDSL Ltd Share Price Target 2025 to 2030

ONGC Share Price Target 2027

The share price of ONGC may go up & Down. According to our analysis levels, the minimum cost of ONGC shares in 2027 can be ₹310, and the maximum price can be ₹370.

| Month Wise (Year 2027) | Target Price |

|---|---|

| January | ₹310 |

| December | ₹370 |

Cochin Shipyard Ltd Share Price Target 2025 to 2030

ONGC Share Price Target 2028

The share price of ONGC may go up & Down. According to our analysis levels, the minimum cost of ONGC shares in 2028 can be ₹360, and the maximum price can be ₹420.

| Month Wise (Year 2028) | Target Price |

|---|---|

| January | ₹360 |

| December | ₹420 |

DCM Shriram Industries Share Price Target 2025 to 2030

ONGC Share Price Target 2029

The share price of ONGC may go up & Down. According to our analysis levels, the minimum cost of ONGC shares in 2029 can be ₹470, and the maximum price can be ₹530.

| Month Wise (Year 2029) | Target Price |

|---|---|

| January | ₹470 |

| December | ₹530 |

Zen Technologies Ltd Share Price Target 2025 to 2030

ONGC Share Price Target 2030

The share price of ONGC may go up & Down. According to our analysis levels, the minimum cost of ONGC shares in 2030 can be ₹520, and the maximum price can be ₹570.

| Month Wise (Year 2030) | Target Price |

|---|---|

| January | ₹520 |

| December | ₹570 |

IRFC Ltd Share Price Target 2025 to 2030

ONGC Fundamentals

| Fundamentals | ONGC |

|---|---|

| Market Cap | ₹3,07,085 Cr |

| 52 Week High | 345.00 |

| 52 Week Low | 205.00 |

| NSE Symbol | ONGC |

| ROE | 10.55% |

| P/E Ratio | 8.48 |

| EPS | 28.80 |

| P/B Ratio | 0.89 |

| Dividend Yield | 5.02% |

| Industry P/E | 8.76 |

| Book Value | 273.00 |

| Debt to Equity | 0.55 |

| Stock Face Value | 5 |

ONGC Shareholding Pattern

| Promoters | 58.89% |

|---|---|

| Retail & Others | 14.05% |

| DII | 11.05% |

| FII | 7.12% |

| Mutual Funds | 8.89% |

The ONGC Financial Reports

| Sector | Year (2025) |

|---|---|

| Revenue | 37,057 Cr. |

| Expense | 28,289 Cr. |

| Profit Before Tax | 8,767 Cr. |

| Net Profit | 6,448 Cr. |

How To Buy ONGC Shares?

To buy ONGC shares, you can easily buy shares of ONGC by using the trading platform of many stock brokers.

- Groww App

- Phonepe. Share Market App

- Angel One App

- Dhan App

- Upstox App

- Zerodha App

People also ask F&Q

Question 1: What is ONGC share price target for 2025?

Answer 1: The ONGC estimated share price target for 2025 can range from ₹240 to ₹265.

Question 2: What is ONGC share price target for 2030?

Answer 2: The ONGC estimated share price target for 2030 can range from ₹520 to ₹570.

Question 3: What are the primary growth drivers for ONGC stock?

Answer 3: The most prominent growth drivers include a diversified portfolio, strategic market expansion, technological innovations, and strong brand loyalty.

Question 4: Is ONGC a good long-term investment?

Answer 4: ONGC has strong long-term potential due to its diversification and sustainability focus. Investors should watch the company’s Q4 results for market insights.

Question 5: Is ONGC listed in NSE?

Answer 5: ONGC were listed at ₹244.24 on NSE.

Question 6: Who is the CEO of ONGC?

Answer 6: Arun Kumar Singh is the CEO of ONGC.

Question 7 : What is the share price of ONGC in 2035?

Answer 7: The estimated share price target for 2035 can range from ₹900 to ₹1,050.

Question 8 :What is the target price of ONGC in 2040?

Answer 8: The estimated share price target for 2040 can range from ₹1,100 to ₹1,350.