hdb Unlisted share Price: Are you thinking of investing in hdb Unlisted share Price? Want to know its future Price target? In this guide, we will discuss the HDB Unlisted share Price for the year 2025. Along with this, we will do a complete Fundamental Analysis to help you make the right Decision for the HDB unlisted share Price.

About HDB Financial Services LTD

HDB Financial Services (‘HDBFS’ or ‘Company’) is a prominent Non-Banking Financial Company (NBFC) in India. Established in 2007, HDBFS has emerged as a leading entity in the non-banking financial sector.

Commitment to Inclusive Financial Solutions

- 1,682 branches across 31 states/ UTs to cater to underbanked and unbanked populations across the Country.

- Goes beyond traditional lending practices to enhance customer experience.

- Leverages data and analytics for personalised loan offerings. Values diversity, creating an inclusive work environment for employee growth.

- Emphasis on transparency and ethics as the core values solidifying HDB’s reputation as a trusted player in the financial sector.

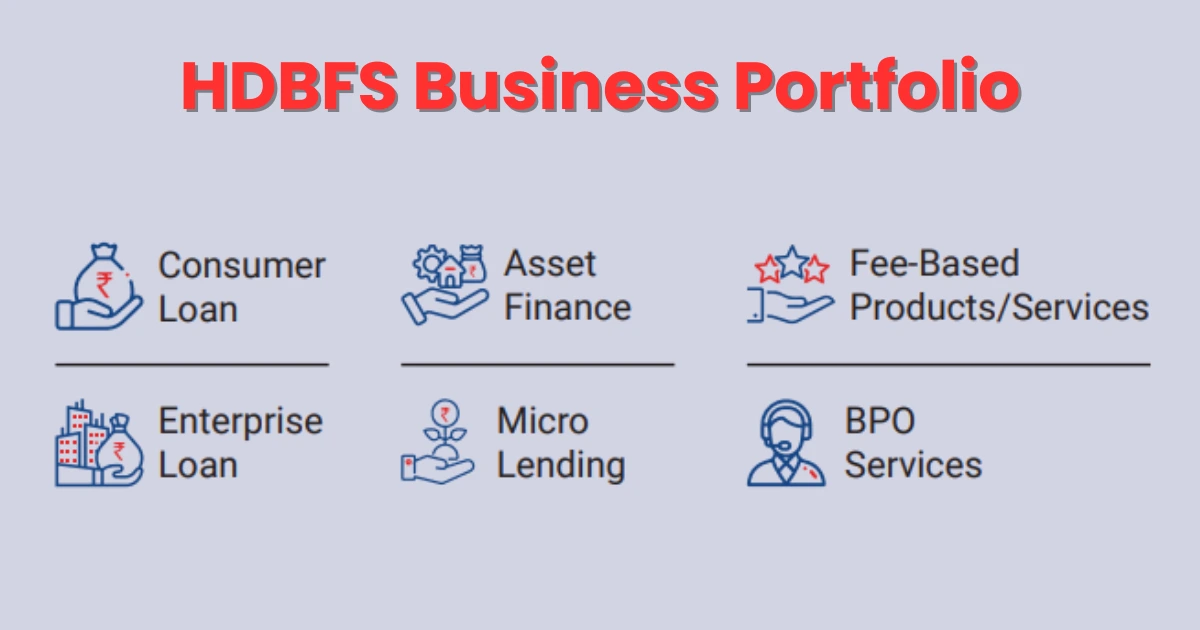

HDBFS’s Business Portfolio

Consumer Loans :

- Consumer Durable Loan

- Digital Product Loan

- Lifestyle Product Loan

- Personal Loan

- Auto Loan

- Two Wheeler Loan

- Gold Loan

Asset Finance :

- Commercial Vehicle Loan

- Construction Equipment Loan

- Tractor Loan

Enterprise Loans :

- Unsecured Business Loan

- Enterprise Business Loan

- Loan Against Property

- Loan Against Lease Rental

- Loan Against Securities

BPO Services :

- Collection Services

- Back Office and Sales Support

Micro Lending :

- Insurance Services

hdb Unlisted Share Price Details

Name

hdb Unlisted Share Price Details

Face Value

INR 10 per share

ISIN Code

INE756I01012

Lot Size

50 shares

Demat Status

NSDL, CDSL

hdb Share Price

INR ₹1125 per share

Market Cap

INR 89223 crores

Total number of shares

793100000 Shares

Financial Data hdb Unlisted Share Price

Particulars

FY 2022

FY 2023

FY 2024

Revenue

--

--

--

Revenue Growth (%)

--

--

--

Expenses

--

--

--

Net income

--

--

--

Margin (%)

--

--

--

hdb Share Price Target 2025

The share price of HDB may go up & Down. According to our analysis levels, the minimum price of the HDB share in 2025 can be ₹1120, and the maximum price can be ₹1400.

Month Wise (Year 2025)

Target Price

January

₹1120

December

₹1400

Opportunities in Aspirational India

As per the 2011 census, India’s population was approximately 12,500 Lakh, comprising nearly 2,450 Lakh households. CRISIL MI&A projects a 1.1% CAGR increase between CY 2011 and CY 2021, reaching 14,000 Lakhs and 15,200 Lakhs by CY 2031.

The number of households is expected to reach approximately 3,760 Lakhs over the same period. In 2022, India had one of the largest young populations globally, with a median age of 28 years.

CRISIL MI&A estimates that about 90% of Indians were below 60 years old in 2021, with 63% aged between 15 and 59 years. In comparison, in CYIn 2020, the United States (US), China and Brazil had 77%, 83%, and 86%, respectively, of their populations below 60 years old.

2 thoughts on “hdb Unlisted Share Price 2025”