LG Electronics IPO GMP Today ₹371 Get the Latest Updates on LG Electronics ipo Grey market premium (GMP), Kostak rate, and Subject to Sauda Price along with Expected Listing Gains. Track daily GMP trends and IPO details before investing.

Latest LG Electronics IPO GMP (Grey Market Premium)

LG Electronics IPO GMP Today is – ₹371 Per Share

Kostak Rate – Not Available

Subject to Sauda – ₹3,800

Expected Listing Gain – 32.54%

LG Electronics IPO GMP Price to Down a high to low of ₹130 Rupay on Oct 01 and a High Price of ₹406 on Oct 10, 2025 Showing Strong Market demand.

LG Electronics IPO GMP Live – Day-wise Trend Table

| GMP Date | IPO Price | GMP | Estimated Listing Price | Estimated Profit |

|---|---|---|---|---|

| 13-10-2025 | 1140.00 | ₹371 | ₹1511 (32.54%) | ₹4823 |

| 12-10-2025 | 1140.00 | ₹380 | ₹1520 (33.33%) | ₹4940 |

| 11-10-2025 | 1140.00 | ₹380 | ₹1520 (33.33%) | ₹4940 |

| 10-10-2025 | 1140.00 | ₹395 | ₹1,535(34.64%) | ₹5,135 |

| 09-10-2025 | 1140.00 | ₹380 | ₹1520 (33.33%) | ₹4940 |

| 08-10-2025 | 1140.00 | ₹300 | ₹1440 (26.32%) | ₹3900 |

| 07-10-2025 | 1140.00 | ₹298 | ₹1438 (26.14%) | ₹3874 |

| 06-10-2025 | 1140.00 | ₹318 | ₹1458 (27.89%) | ₹4134 |

| 05-10-2025 | 1140.00 | ₹250 | ₹1390 (21.93%) | ₹3250 |

| 04-10-2025 | 1140.00 | ₹228 | ₹1368 (20.00%) | ₹2964 |

| 03-10-2025 | 1140.00 | ₹175 | ₹1315 (15.35%) | ₹2275 |

| 02-10-2025 | 1140.00 | ₹146 | ₹1286 (12.81%) | ₹1898 |

| 01-10-2025 | 1140.00 | ₹145 | ₹1285 (12.72%) | ₹1885 |

LG Electronics IPO Details

| Open Date | Oct 07, 2025 |

|---|---|

| Close Date | Oct 09, 2025 |

| Price Band | ₹1,080 to ₹1,140 per share |

| Face Value | ₹10 per equity share |

| Lot Size | 13 Shares |

| Type of Issue | Offer for Sale |

| Total Issue Size | 101,815,859 shares (Approx ₹ 11,607 Cr) |

| Employee Discount | ₹108 per Equity Share |

| Issue Type | Bookbuilding IPO |

| Listing Exchange | BSE & NSE |

| Retail Investor Quota | 35.00% |

| QIB Quota | 50.00% |

| NII (HNI) Quota | 15.00% |

| Anchor Investor List | Click Here |

| DRHP (Draft Prospectus) | Click Here |

| RHP (Final Prospectus) | Click Here |

About LG Electronics India Limited

Our Company was originally incorporated on January 20, 1997 as “LG Electronics India Limited” home appliances and consumer electronics (excluding mobile phones) in India.

We are also market leaders in India across multiple product categories including washing machines, refrigerators, panel televisions, inverter air conditioners, and microwaves, based on the market share.

We sell products to B2C and B2B consumers in India and outside India, We also offer installation services, and repairs and maintenance services for all our products.

Our distribution network spans across urban and rural India through 35,640 B2C touch points for the three months ended June 30, 2025.

We provide installation and repairs/maintenance services through 1,006 service centers across urban and rural India, supported by 13,368 engineers and four call

centers, as of June 30, 2025, We also offer same-day installations.

We serviced consumers through a dedicated team 463 B2B trade partners as of June 30, 2025.

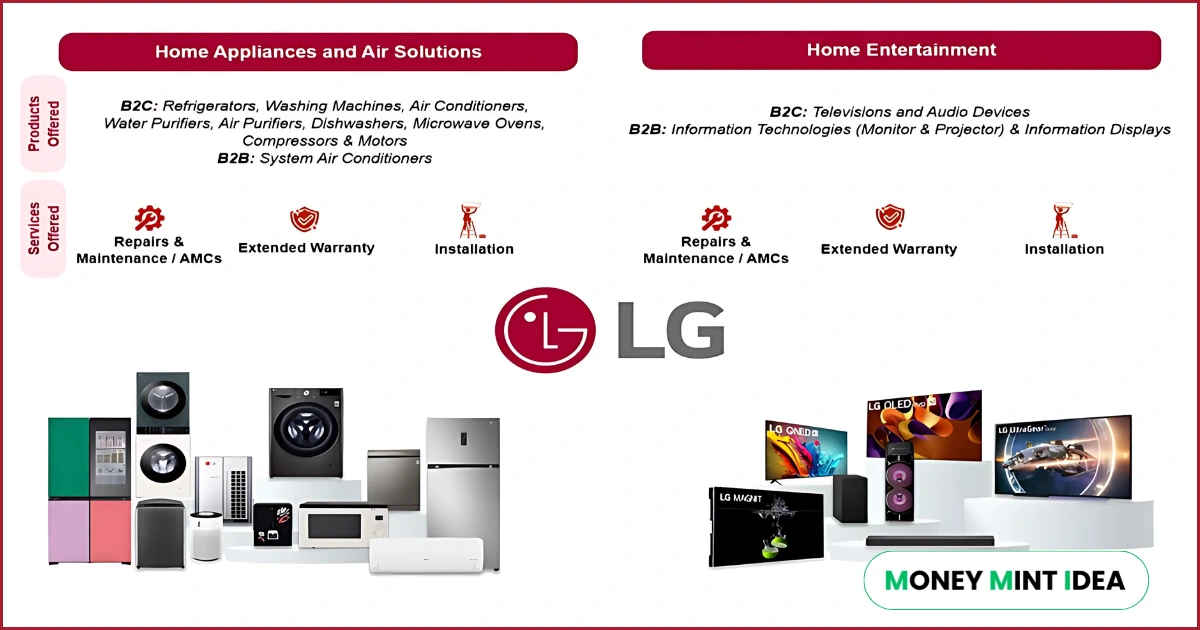

We operate our business across two segments as (i) Home Appliances and Air Solution (ii) Home Entertainment below:

we have a pan-India supply chain network of 25 product warehouses, comprising two central distribution centers (“CDCs”) and 23 regional distribution centers (“RDCs”) as of June 30, 2025.

Also Read: LG Electronics IPO Date, Price, GMP, Review, Details

Also Read: Canara HSBC Life IPO GMP Price Today

Also Read: Canara Robeco IPO GMP Price Today

FAQs ON LG Electronics IPO GMP Today

Q1: What is LG Electronics IPO GMP today?

LG Electronics IPO GMP Price is ₹371 Per Share

Q2: What is the Kostak Rate today?

LG Electronics IPO Kostak Rate is ₹- as of today Not available.

Q3: LG Electronics ipo gmp investorgain?

LG Electronics ipo gmp Price investorgain is ₹370 rupay Righ Now

Q4: LG Electronics ipo gmp ipowatch?

LG Electronics ipo gmp ipowatch Price is ₹371 rupay Righ Now

Q5: What is the Subject to Sauda rate?

LG Electronics IPO Subject to Sauda is ₹3,800 as of today.

Q6: What are the expected listing gains?

LG Electronics IPO Estimated 32.54% returns based on current GMP

Q7: How many times has LG IPO subscribed?

LG Electronics India IPO is 54.02+ times the shares on offer, by 9th Oct 17:05 p.m. Thursday.

Q8: Which IPO is better, Tata or LG?

Anchor investor demand for both IPOs is strong, although LG’s gray market premium (GMP) is higher than Tata’s at ₹371. Accordingly, LG’s IPO is more suitable.

Q9: What is the LG IPO GMP?

The LG Electronics IPO Grey Market Premium (GMP) is ₹371 today, according to the investorgain website.

Q9: Lg electronics ipo gmp grey market

Q10: LG Electronics IPO Grey Market GMP

As of today, the LG Electronics IPO Grey Market Premium (GMP) is ₹371, according to the Chittorgarh website.

Disclaimer:

IPO GMP (Grey Market Premium), Kostak and Subject to Sauda Rates are Unofficial and Can Change Quickly.

We do Not BUY or SELL IPO Forms.

Do Not apply For IPOs Based only on GMP Price.

Always Review the company’s fundamentals before investing.