LG Electronics IPO Will Open On Oct 07, 2025 and Close On Oct 09, 2025.The ₹11,607 Cr. IPO Is A Book Build Issue, Consisting Entirely of offer for Sale. LG Electronics IPO Price Band Is Set At ₹1,080 to ₹1,140 Per Share.

The Allotment will Be Finalized On Oct 10, 2025 and Listing date is Expected on The NSE BSE By Oct 14, 2025. Investor Quota like 50% QIB, 35% Retail, and 15% HNI Category.

Financial Year 2025 Company Posted a Total income 24,630.63 Cr. and A Net Profit of ₹2,203.35 Cr. Showing Strong Growth From The Previous Year. Based On Financial, The IPO Looks Promising For Long-term Investors.

LG Electronics IPO Dates & Price Band Details

| Open Date | Oct 07, 2025 |

|---|---|

| Close Date | Oct 09, 2025 |

| Price Band | ₹1,080 to ₹1,140 per share |

| Face Value | ₹10 per equity share |

| Lot Size | 13 Shares |

| Type of Issue | Offer for Sale |

| Total Issue Size | 101,815,859 shares (Approx ₹ 11,607 Cr) |

| Employee Discount | ₹108 per Equity Share |

| Issue Type | Bookbuilding IPO |

| Listing Exchange | BSE & NSE |

| Retail Investor Quota | 35.00% |

| QIB Quota | 50.00% |

| NII (HNI) Quota | 15.00% |

| Anchor Investor List | Click Here |

| DRHP (Draft Prospectus) | Click Here |

| RHP (Final Prospectus) | Click Here |

About LG Electronics India Limited

Our Company was originally incorporated on January 20, 1997 as “LG Electronics India Limited” home appliances and consumer electronics (excluding mobile phones) in India.

We are also market leaders in India across multiple product categories including washing machines, refrigerators, panel televisions, inverter air conditioners, and microwaves, based on the market share.

We sell products to B2C and B2B consumers in India and outside India, We also offer installation services, and repairs and maintenance services for all our products.

Our distribution network spans across urban and rural India through 35,640 B2C touch points for the three months ended June 30, 2025.

We provide installation and repairs/maintenance services through 1,006 service centers across urban and rural India, supported by 13,368 engineers and four call

centers, as of June 30, 2025, We also offer same-day installations.

We serviced consumers through a dedicated team 463 B2B trade partners as of June 30, 2025.

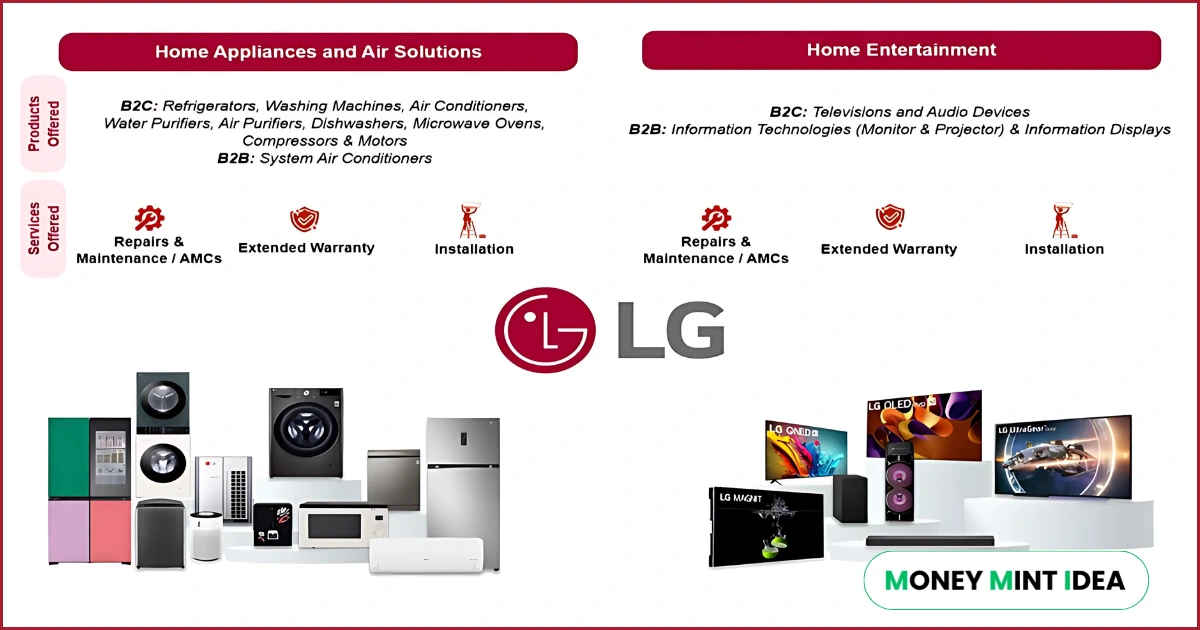

We operate our business across two segments as (i) Home Appliances and Air Solution (ii) Home Entertainment below:

we have a pan-India supply chain network of 25 product warehouses, comprising two central distribution centers (“CDCs”) and 23 regional distribution centers (“RDCs”) as of June 30, 2025.

LG Electronics IPO Market Lot Size

The Minimum Lot Size For The LG Electronics IPO is 13 Shares, Requiring An Application Amount of ₹14,820 For Retail Investors. Investors Must Apply in Multiples of The Lot Size.

| Application | Lot Size | Shares | Amount |

|---|---|---|---|

| Retail Minimum | 1 | 13 | ₹14,820 |

| Retail Maximum | 13 | 169 | ₹1,92,660 |

| S-HNI Minimum | 14 | 182 | ₹2,07,480 |

| S-HNI Maxmum | 66 | 858 | ₹9,78,120 |

| B-HNI Minimum | 67 | 871 | ₹9,92,940 |

LG Electronics IPO Allotment & Listing Dates

LG Electronics IPO Will Open on Oct 07, and Close on Oct 09, 2025. The allotment is Expected on Oct 10, With the Listing Scheduled on NSE BSE For Oct 14, 2025 (More information below table).

| Anchor Investor Bidding | Mon, Oct 6, 2025 |

|---|---|

| IPO Open | Tue, Oct 7, 2025 |

| IPO Close | Thur, Oct 9, 2025 |

| Allotment Finalisation | Fri, Oct 10, 2025 |

| Refunds / Unblocking | Mon,Oct 13, 2025 |

| Shares Credited to Demat | Mon,Oct 13, 2025 |

| Listing Date | Mon,Oct 14, 2025 |

LG Electronics IPO Financial Report (FY 2025)

LG Electronics Reported a Total Income of ₹24,630.63 Cr. in FY 2025, Slightly up From ₹21,557.12 Cr. in FY 2024. The Company Net Profit Also Rose to ₹2,203.35 Cr. From ₹1,511.07 Cr. in the Previous Year Showing Consistent Financial Growth Ahead of its IPO. (More information below table).

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|

| Assets | 11,516.44 | 11,517.15 | 8,498.44 | 8,992.12 |

| Total Income | 6,337.36 | 24,630.63 | 21,557.12 | 20,108.58 |

| Profit After Tax | 513.26 | 2,203.35 | 1,511.07 | 1,344.93 |

| EBITDA | 716.27 | 3,110.12 | 2,224.87 | 1,895.12 |

| NET Worth | 6,447.85 | 5,933.75 | 3,735.82 | 4,319.82 |

| Reserves and Surplus | 5,805.50 | 5,291.40 | 3,659.12 | 4,243.12 |

| Total Borrowing | 0.00 | 0.00 | 0.00 | 0.00 |

| Amount in ₹ Crore |

LG Electronics IPO Valuation Report – FY 2025 (KPI)

Check Detailed LG Electronics IPO Valuation Metrics for FY 2025, including EPS, P/E Ratio, RoNW, NAV, ROCE, and other key financial indicators. These Ratios help Investors Assess the Company financial Health & Valuation Before applying for The IPO. (More information below table).

| KPI | Value |

|---|---|

| Return on Equity (ROE) | -% |

| Return on Capital Employed (ROCE) | 42.91% |

| EBITDA Margin | 12.76% |

| PAT Margin | 8.95% |

| Debt-to-Equity Ratio | - |

| Earnings Per Share (EPS) | 32.46 |

| Price to Earnings Ratio (P/E) | 35.12 |

| Return on Net Worth (RoNW) | 37.13% |

| Net Asset Value (NAV) | 87.42 |

Our Competitive Strengths

Leading market share in the home appliances and consumer electronics industry in India.

Introducing innovative technologies tailored to the needs of the Indian consumers.

Shaping consumer experience with pan-India distribution and after-sales service network.

Operational efficiency through strong manufacturing capabilities and localized supply chain.

Capital efficient business with high growth and profitability.

Our Company Promoters

- LG Electronics Inc

LG Electronics Comparison With Industry Peers

| Company | Face value | CMP Price | EPS | NAV | P/E ratio | RONW (%) | Revenue FY25 (₹ mn) |

|---|---|---|---|---|---|---|---|

| LG Electronics India | 10 | - | 32.46 | 87.42 | 35.12 | 37.13 | 243,666.38 |

| Havells | 1 | 1,506.60 | 23.49 | 133.05 | 64.14 | 17.63 | 217,780.60 |

| Voltas | 1 | 1,339.70 | 25.43 | 197.66 | 52.68 | 12.76 | 154,127.90 |

| Whirlpool | 10 | 1,232.00 | 28.30 | 314.52 | 43.53 | 9.09 | 79,139.70 |

| Blue Star | 2 | 1,886.35 | 28.76 | 149.19 | 65.59 | 19.27 | 119,676.50 |

Also Read: LG Electronics IPO GMP Today, Grey Market Premium Live

LG Electronics Company Contact Details

Corporate Office: 16th – 20th Floor,

C-001, Tower D, KP Tower, Sector 16B,

Noida 201 301, Uttar Pradesh, India

Tel: +91 120 651 6700

E-mail: cs.india@lge.com

Website: www.lg.com/in

LG Electronics Lead Manager

Axis Capital Limited

1st Floor, Axis House

Pandurang Budhkar Marg, Worli

Mumbai 400 025, Maharashtra,India

Tel: +91 22 4325 2183

E-mail: lgindia.ipo@axiscap.in

Website: www.axiscapital.co.in

- Citigroup Global Markets India Pvt Ltd.

- Morgan Stanley India Company Pvt Ltd.

- J.P. Morgan India Private Ltd.

- BofA Securities India Ltd.

LG Electronics IPO Registrar

KFin Technologies Limited

Selenium Tower B, Plot No.31-32

Gachibowli, Financial District

Nanakramguda, Serilingampally

Hyderabad 500 032 Telangana, India

Tel: +91 40 6716 2222/ 1800 309 4001

E-mail: lgelectronics.ipo@kfintech.com

Website: www.kfintech.com

LG Electronics IPO FAQs

Question 1: What is the LG Electronics IPO?

Answer 1: LG Electronics IPO is a Mainboard IPO of 101,815,859 equity shares of the face value of ₹10 approximately up to ₹11,607 Cr. The issue is price at ₹1,080 to ₹1,140 per share.

The LG Electronics IPO opens on 25, Sep 2025 and closes on 29, Sep2025.

KFin Technologies Limited is the registrar for the IPO. The shares to be listed on NSE BSE.

Question 2: How to apply in LG Electronics IPO through Groww?

Answer 2: Groww customers can apply online in LG Electronics IPO using UPI as a payment gateway. Groww customers can apply in LG Electronics IPO by login into Groww (back office) and submitting an IPO application form.

Steps to apply in LG Electronics IPO through Groww –

Visit the Groww website and login to Groww.

Go to Main Page and click the Products & tools and click IPO tab.

New page Open and Show ‘LG Electronics IPO’ click the ‘Apply’ button.

Show IPO detail Shares lot Size and Bid Price & click here to Cutoff Price check Box and Continue.

Inter Your UPI id like . 95****299@kotak accept terms and condition click Box and Apply For IPO

groww share payment link Your UPI Mobile Number Pay Payment for IPO Bid to approve the e-mandate successfully submit application .

Question 3: When LG Electronics IPO will open?

Answer 3: The LG Electronics IPO opens on Oct 07, 2025 and closes on Oct 09, 2025.

Question 4: What is the lot size of LG Electronics IPO?

Answer 4: LG Electronics IPO lot size and the minimum order quantity is 13 Shares.

Question 5: How to apply for LG Electronics IPO?

Answer 5: You can apply in LG Electronics IPO online using either UPI or ASBA as a payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don’t offer banking services. Read more detail about applying IPO online through Groww, Zerodha, Upstox, 5Paisa, Phonepe Share Market, HDFC Bank, and Angel one.

Question 6: When is LG Electronics IPO allotment date?

Answer 6: The Basis of Allotment for LG Electronics IPO will be on Tue, Oct 10, 2025, and the allotted shares will be credited to your demat account by, Mon, Oct 13, 2025. For Check the LG Electronics IPO allotment status.

Question 7: When is LG Electronics IPO listing date?

Answer 7: The LG Electronics IPO listing date is Oct 14, 2025. The date of LG Electronics IPO listing on Tue, Oct 14, 2025.