Pine Labs IPO GMP Today ₹7 Get the Latest Updates on Pine Labs ipo Grey market premium (GMP), Kostak rate, and Subject to Sauda Price along with Expected Listing Gains. Track daily GMP trends and IPO details before investing.

Latest Pine Labs IPO GMP (Grey Market Premium)

Pine Labs IPO GMP Today is – ₹7 Per Share

Kostak Rate – Not Available

Subject to Sauda – ₹150

Expected Listing Gain – 3.16%

Pine Labs IPO GMP Price to Down a high to low of ₹6 Rupay on Nov 08 and a High Price of ₹35 on Nov 03, 2025 Showing Strong Market demand.

Pine Labs IPO GMP Live – Day-wise Trend ( Table)

| GMP Date | IPO Price | GMP | Estimated Listing Price | Estimated Profit |

|---|---|---|---|---|

| 13-11-2025 | 221.00 | ₹7 | ₹228 (3.16%) | ₹469 |

| 12-11-2025 | 221.00 | ₹6 | ₹227 (2.71%) | ₹402 |

| 11-11-2025 | 221.00 | ₹11 | ₹232 (4.97%) | ₹737 |

| 10-11-2025 | 221.00 | ₹6 | ₹227 (2.71%) | ₹402 |

| 09-11-2025 | 221.00 | ₹6 | ₹227 (2.71%) | ₹402 |

| 08-11-2025 | 221.00 | ₹6 | ₹227 (2.71%) | ₹402 |

| 07-11-2025 | 221.00 | ₹13 | ₹234 (5.88%) | ₹871 |

| 06-11-2025 | 221.00 | ₹11 | ₹232 (4.97%) | ₹737 |

| 05-11-2025 | 221.00 | ₹17 | ₹238 (7.69%) | ₹1139 |

| 04-11-2025 | 221.00 | ₹22 | ₹243 (9.95%) | ₹1474 |

| 03-11-2025 | 221.00 | ₹35 | ₹256 (15.84%) | ₹2345 |

| 01-11-2025 | 0 | ₹60 | ₹60 (0.00%) | 0 |

Pine Labs IPO Details

| Open Date | Nov 07, 2025 |

|---|---|

| Close Date | Nov 11, 2025 |

| Face Value | ₹1 per equity share |

| Price Band | ₹210 to ₹221 per share |

| Lot Size | 67 Shares |

| Type of Issue | Fresh and OFS |

| Total Issue Size | 17,64,66,426 shares (Approx ₹3,899.91 Cr) |

| Fresh Issue | 9,41,17,647 shares (Approx ₹2,080.00 Cr) |

| Offer for Sale | 8,23,48,779 shares (Approx ₹ 1,819.91 Cr) |

| Employee Discount | ₹21.00 |

| Retail Investor Quota | 10% |

| QIB Quota | 75% |

| NII (HNI) Quota | 15% |

| Listing Exchange | NSE BSE |

| DRHP (Draft Prospectus) | Click Here |

| RHP | Click Here |

About Pine Labs India Limited

Our Company was originally incorporated on May 18, 1998 as‘Pine Labs Limited’ We are a technology company focused on digitizing commerce through digital payments and issuing solutions for merchants, consumer brands and enterprises, and financial institutions.

Our advanced technology infrastructure helps to accelerate their digitization journey in In dia and a growing number of international markets including Malaysia, UAE, Singapore, Australia, the U.S. and Africa.

Our “Digital Infrastructure and Transaction Platform” comprises in-store and online payment infrastructure, affordability, value added services (“VAS”) such as dynamic currency conversion and transaction processing, and financial technology (“FinTech”) infrastructure solutions and software applications.

we offer issuing and acquiring solutions to financial institutions enabling issuance of credit cards, debit cards, prepaid cards and forex cards to consumers, and enabling merchant acquiring solutions.

we processed payments of ₹11,424.97 billion in gross transaction value (“GTV”) and 5.68 billion transactions through our platforms. As of June 30, 2025, we had 988,304 merchants, 716 consumer brands and enterprises, and 177 financial institutions, who used our platforms to enable transactions quickly, securely and easily manage their business.

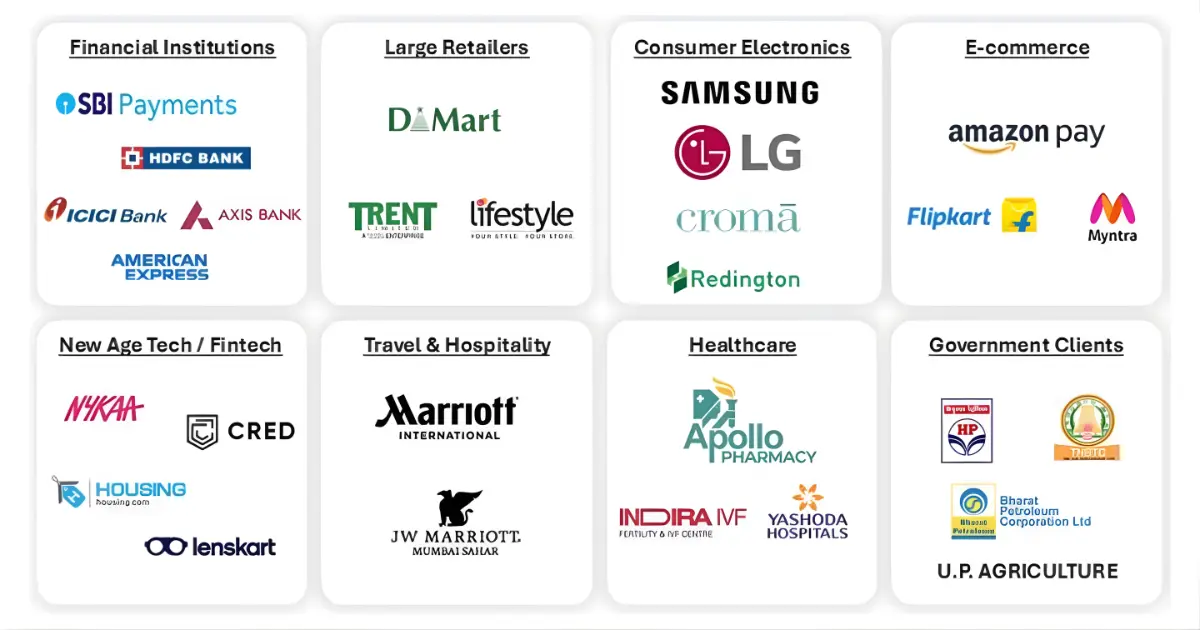

Our customer base spans industries such as department stores and retailers, supermarkets, e-commerce, restaurants, grocery, lifestyle, consumer electronics, healthcare, travel and hospitality, financial institutions and banks, FinTech companies, new-age technology companies as well as government organizations such as municipal corporations and state traffic police departments. We have integrated our solutions and partnered with large, marquee consumer brands and enterprises and financial institutions such as Croma, and HDFC Bank, among others.

Also Read: Pine Labs IPO Date, Price, GMP, Review, Details

Also Read: Emmvee Photovoltaic IPO GMP ₹21, Grey Market Premium Today

FAQs ON Pine Labs IPO GMP Today

Q1: What is Pine Labs IPO GMP today?

Pine Labs IPO GMP Price is ₹7 Per Share

Q2: What is the Kostak Rate today?

Pine Labs IPO Kostak Rate is ₹- as of today Not available.

Q3: Pine Labs ipo gmp investorgain?

Pine Labs ipo gmp Price investorgain is ₹6.5 rupay Righ Now

Q4: Pine Labs ipo gmp ipowatch?

Pine Labs ipo gmp ipowatch Price is ₹6 rupay Righ Now

Q5: What is the Subject to Sauda rate?

Pine Labs IPO Subject to Sauda is ₹150 as of today.

Q6: What are the expected listing gains?

Pine Labs IPO Estimated 3.16% returns based on current GMP

Disclaimer:

- IPO GMP (Grey Market Premium), Kostak and Subject to Sauda Rates are Unofficial and Can Change Quickly.

- We do Not BUY or SELL IPO Forms.

- Do Not apply For IPOs Based only on GMP Price.

- Always Review the company’s fundamentals before investing.