Rajputana Industries IPO details Today : Rajputana Industries IPO details Today is Open on 30 July 2024 and Close on 1 August 2024. Rajputana Industries IPO to Raise 6,285,000 shares (Approx ₹23.88 Cr) via IPO. The Fresh issue of 6,285,000 shares (Approx ₹23.88 Cr).

Our Company was originally incorporated June 13, 2011 Our Company is Primarily engaged in the business of manufacturing of diverse range of non-ferrous metal products from primarily Copper, Aluminium, Brass and various alloys from recycling of scrap metal.

We procure scrap metal from open markets and convert them into billets made of metals like aluminium, copper or brass etc. through recycling in our inhouse manufacturing unit situated at SP-3, SKS Industrial Area, Reengus Extension, Sikar, Rajasthan.

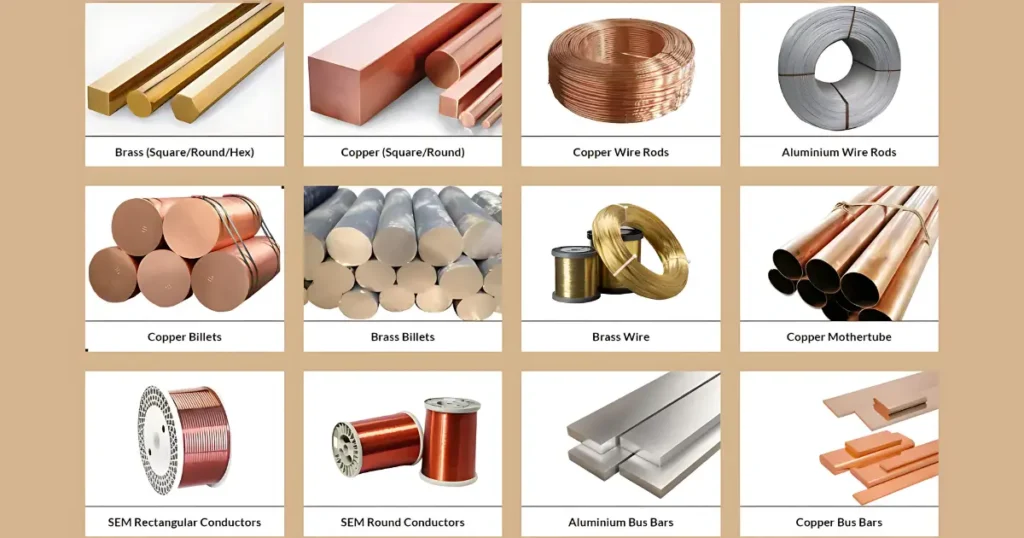

Once these billets are manufactured from recycled scrap metal, we either sell them to different manufacturing companies or we use them to produce products like Copper rods, Aluminium rods, Copper mother tube, brass wires, super enameled copper conductor and many more products. These wires, tubes, bars, billets and rods are manufactured in various shapes and sizes as per the requirement of the customers and / or demand in the market.

Over the past couple of years, our company has outgrown itself into a distinguished large-scale organization specializing in wires, tubes, bus, bars and rods of various shapes, sizes and in various nonferrous metals having plentiful applications.

This acquisition was strategically made to take the advantage of the forward integration as our company was involved in the process of manufacturing of billets of several metals like copper, aluminum, brass etc made out of scrap metals, which were used as a raw material in the operations of Shera Energy Limited in order to produce the winding wires and strips.

Key industries wherein our products are widely used for several purposes are as follows

Electrical and Electronics Industry :- Used for electrical connectors, terminals, circuitry, and components due to better electrical conductivity with strength and corrosion resistance.

Automotive Industry :- Utilized in manufacturing components like connectors, terminals, harnesses, sensors, and electrical terminations, leveraging the combination of strength, corrosion resistance, and thermal conductivity.

Plumbing and Sanitary Industry :- Commonly used for fittings, valves, faucets, pipe connectors, and other plumbing components, offering corrosion resistance, durability, and ease of fabrication.

Construction and Architecture Industry :- Applications include decorative trims, handrails, hardware, and fasteners, leveraging aesthetic appeal, strength, corrosion resistance, and ease of fabrication.

Industrial Equipment Manufacturing :- Used in components such as fasteners, bearings, gears, andconnectors, providing strength, corrosion resistance, and machinability in heavy-duty applications.

HVAC and Refrigeration Industry :- Widely applied in heating, ventilation, air conditioning (HVAC), and refrigeration for producing copper tubes and pipes in systems like air conditioning, heat exchangers, and refrigeration units, owing to copper’s excellent thermal conductivity and corrosion resistance.

Renewable Energy Industry :- Crucial in the solar power industry for applications like solar panels, photovoltaic systems, and solar power generation equipment, given copper’s essential role in efficient energy conversion with its high electrical conductivity.

Marine Industry :- Brass billets find applications in the marine industry due to their excellent corrosion resistance in saltwater environments. They are used in the production of marine fittings, valves, propellers, and other components that are exposed to seawater. Brass’s corrosion resistance and durability make it suitable for marine applications.

Furniture and Decorative Industry :- Brass billets are widely used in the furniture and decorative industry for their aesthetic appeal. They are utilized in the production of decorative hardware, handles, knobs, and architectural accents. Brass’s golden appearance, durability, and ease of shaping contribute to its popularity in the furniture and decorative sector.

Musical Instruments :- Brass billets find applications in the manufacturing of musical instruments, particularly brass instruments such as trumpets, trombones, and saxophones. Brass’s unique acoustic properties, including its resonance and malleability, make it a preferred material for instrument construction.

General Manufacturing Industry :- Brass billets are used in various general manufacturing applications where corrosion resistance, strength, and formability are required. They find use in industries such as aerospace, machinery, hardware, and precision engineering.

Aerospace and Aviation :- Super enameled aluminium conductors find applications in the aerospace and aviation industry. They are used in aircraft electrical systems, including motors, generators, and wiring harnesses. The lightweight nature of aluminium conductors helps reduce the overall weight of aircraft, contributing to fuel efficiency and improved performance.

Consumer Electronics :- Super enameled aluminium conductors are used in consumer electronic devices such as appliances, televisions, computers, and audio systems. They are employed in motors,transformers, and other electrical components in these devices.

Lighting Industry :- Super enameled aluminium conductors find applications in the lighting industry for fluorescent lamps, LED lighting, and other lighting fixtures. They are used in ballasts, transformers, and other electrical components.

Telecommunications :- Super enameled copper conductors find applications in telecommunications equipment and systems. They are used in communication cables, connectors, and other components that require reliable and efficient electrical connections

Rajputana Industries IPO Date & Price Band Details

| IPO Open Date | 30 July 2024 |

|---|---|

| IPO Close Date | 1 August 2024 |

| IPO Size | 6,285,000 shares (Approx ₹23.88 Cr) |

| Fresh Issue | 6,285,000 shares (Approx ₹23.88 Cr) |

| Lot Size | 3000 Shares |

| IPO Face Value | ₹10 Per Equity Share" |

| IPO Price Band | ₹36 to ₹38 Per Every Share |

| IPO Listing On | NSE SME |

| IPO Retail Quota | 35% |

| IPO QIB Quota | 50% |

| IPO NII Quota | 15% |

| DRHP Draft | Click Here |

| Anchor Investor | Click Here |

Rajputana Industries IPO Market Lot Details

| Application | Lot Size | Shares | Amount |

|---|---|---|---|

| Retail Minimum | 1 | 3000 | ₹114,000 |

| Retail Maximum | 1 | 3000 | ₹114,000 |

| S-HNI Minimum | 2 | 6000 | ₹228,000 |

Object of the Issue

- Funding the Working capital requirements of our Company.

- Purchase of Grid Solar Power Generating System.

- General corporate purposes.

Rajputana Industries IPO Allotment & Listings (Details)

| IPO Open Date | 30 July 2024 |

|---|---|

| IPO Close Date | 1 August 2024 |

| Basis of Allotment | 2 August 2024 |

| Refunds | 5 August 2024 |

| Credit to Demat Account | 5 August 2024 |

| IPO Listing Date | 6 August 2024 |

Rajputana Industries Financial Reports

| ₹ in Crores | |||

|---|---|---|---|

| Year | Revenue | Expense | PAT |

| 2024 | ₹327.01 | ₹320.14 | ₹5.13 |

| 2023 | ₹255.25 | ₹251.06 | ₹3.10 |

| 2022 | ₹244.51 | ₹240.98 | ₹2.64 |

Our Company Promoters

- Shivani Sheikh

- Sheikh Naseem

- Shera Energy Limited

Qualitative Factors

- Experienced senior management team and qualified workforce.

- Long standing relationships with existing clientele.

- Focus on Quality.

- Established Manufacturing facility.

- Innovative Ideas.

- Industry Knowledge and Expertise.

Rajputana Industries IPO Comparison Listed Industry Peers Group

| Company Name | Face Value | EPS | P/E Ratio | Ro NW (%) | NAV Per | Revenue (₹ in Lakhs) |

|---|---|---|---|---|---|---|

| Rajputana Industries Limited | 10.00 | 2.19 | [.] | 11.29% | 17.90 | 25,466.50 |

| Peer Group | ||||||

| Nupur Recyclers Limited | 10.00 | 2.04 | 59.04 | 13.35% | 15.30 | 9,884.76 |

| Baheti Recycling Limited | 10.00 | 6.81 | 29.66 | 15.35% | 33.21 | 35,996.29 |

Comparison of Accounting Ratios with Listed Peer Group Companies

- Rajputana Industries Limited

- Nupur Recyclers Limited

- Baheti Recycling Limited

Also Read: Bulkcorp International IPO Details, GMP Price, Date, Review

Rajputana Industries Company Contact Details

Rajputana Industries Limited

F-269-B, Road No. 13, VKIA, Jaipur Rajasthan 302013

Telephone: +91 – 9588841031

E-mail: cs@rajputanaindustries.com

Website: www.rajputanaindustries.com

Rajputana Industries Lead Manager

Holani Consultants Private Limited

401 – 405 & 416 -418, 4th Floor,

Soni Paris Point, Jai Singh Highway,

Bani Park, Jaipur -302016, Rajasthan

Telephone: +91 – 141 – 2203996

E-mail ID: ipo@holaniconsultants.co.in

Investor Grievance ID: complaints.redressal@holaniconsultants.co.in

Website: www.holaniconsultants.co.in

Contact Person: Mrs. Payal Jain

Rajputana Industries IPO Registrar

Bigshare services Private Limited

Office No, S-2, 6th Floor, Pinnacle Business Park

Mahakali Caves Road, Next to Ahura Centre,

Andheri (East), Mumbai – 400093

Tel: + 022-6263 8200

Website: www.bigshareonline.com

Email: ipo@bigshareonline.com

Investor Grievance ID- investor@bigshareonline.com

Contact Person: Mr. Jibu John

4 thoughts on “Rajputana Industries IPO Details, GMP Price, Date, Review”