Pine Labs IPO Will Open On Nov 07, 2025 and Close On Nov 11, 2025.The ₹3,899.91 Cr. IPO Is A Book Build Issue, Consisting Entirely of Fresh Issue and Offer for Sale. Pine Labs IPO Price Band Is Set At ₹210 to ₹221 Per Share.

The Allotment will Be Finalized On Nov 12, 2025 and Listing date is Expected on The NSE BSE By Nov 14, 2025. Investor Quota like 75% QIB, 10% Retail, and 15% HNI Category.

Financial Year 2025 Company Posted a Total income 2,327.09 Cr. and A Net Profit of ₹-145.49 Cr. Showing Strong Growth From The Previous Year. Based On Financial, The IPO Looks Promising For Long-term Investors.

Pine Labs IPO Dates & Price Band Details

| Open Date | Nov 07, 2025 |

|---|---|

| Close Date | Nov 11, 2025 |

| Face Value | ₹1 per equity share |

| Price Band | ₹210 to ₹221 per share |

| Lot Size | 67 Shares |

| Type of Issue | Fresh and OFS |

| Total Issue Size | 17,64,66,426 shares (Approx ₹3,899.91 Cr) |

| Fresh Issue | 9,41,17,647 shares (Approx ₹2,080.00 Cr) |

| Offer for Sale | 8,23,48,779 shares (Approx ₹ 1,819.91 Cr) |

| Employee Discount | ₹21.00 |

| Retail Investor Quota | 10% |

| QIB Quota | 75% |

| NII (HNI) Quota | 15% |

| Listing Exchange | NSE BSE |

| DRHP (Draft Prospectus) | Click Here |

| RHP | Click Here |

About Pine Labs India Limited

Our Company was originally incorporated on May 18, 1998 as‘Pine Labs Limited’ We are a technology company focused on digitizing commerce through digital payments and issuing solutions for merchants, consumer brands and enterprises, and financial institutions.

Our advanced technology infrastructure helps to accelerate their digitization journey in In dia and a growing number of international markets including Malaysia, UAE, Singapore, Australia, the U.S. and Africa.

Our “Digital Infrastructure and Transaction Platform” comprises in-store and online payment infrastructure, affordability, value added services (“VAS”) such as dynamic currency conversion and transaction processing, and financial technology (“FinTech”) infrastructure solutions and software applications.

we offer issuing and acquiring solutions to financial institutions enabling issuance of credit cards, debit cards, prepaid cards and forex cards to consumers, and enabling merchant acquiring solutions.

we processed payments of ₹11,424.97 billion in gross transaction value (“GTV”) and 5.68 billion transactions through our platforms. As of June 30, 2025, we had 988,304 merchants, 716 consumer brands and enterprises, and 177 financial institutions, who used our platforms to enable transactions quickly, securely and easily manage their business.

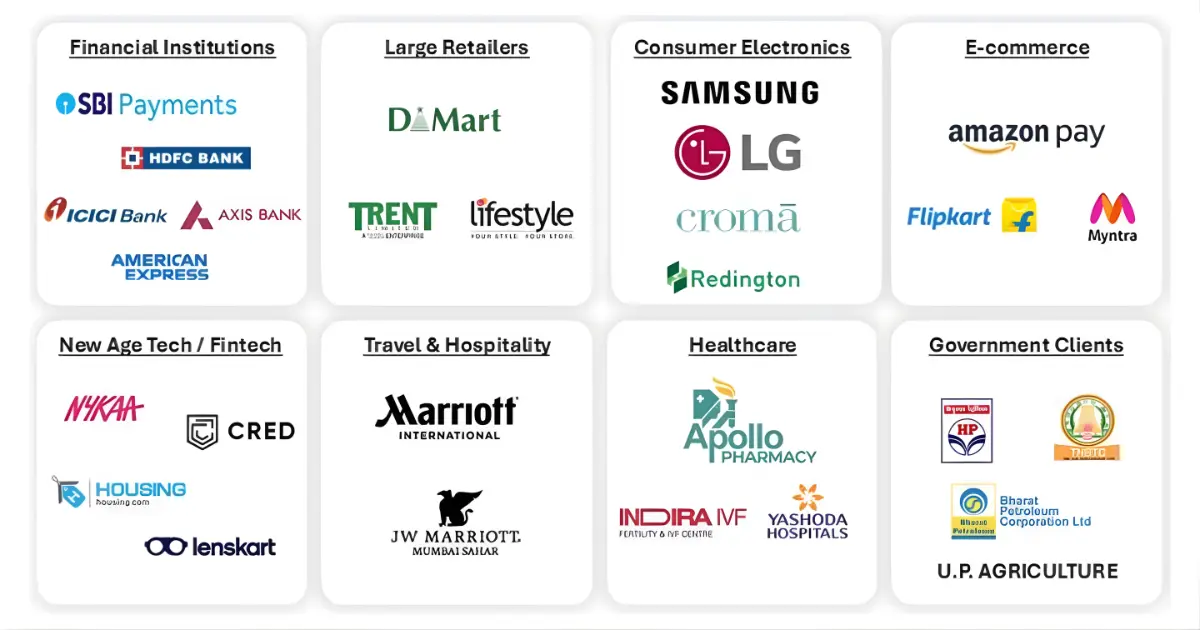

Our customer base spans industries such as department stores and retailers, supermarkets, e-commerce, restaurants, grocery, lifestyle, consumer electronics, healthcare, travel and hospitality, financial institutions and banks, FinTech companies, new-age technology companies as well as government organizations such as municipal corporations and state traffic police departments. We have integrated our solutions and partnered with large, marquee consumer brands and enterprises and financial institutions such as Croma, and HDFC Bank, among others.

Objects of Issue

Repayment / prepayment, in full or in part, of certain borrowings availed of by our Company.

Investment in certain of our Subsidiaries, namely Qwikcilver Singapore, Pine Payment Solutions, Malaysia & Pine Labs UAE for expanding outside India.

Investment in IT assets, expenditure towards cloud infrastructure, procurement of digital check-out points (“DCP”) and technology development initiatives.

General corporate purposes and unidentified inorganic acquisitions.

Pine Labs IPO Market Lot Size

The Minimum Lot Size For The Pine Labs IPO is 67 Shares, Requiring An Application Amount of ₹14,807 For Retail Investors. Investors Must Apply in Multiples of The Lot Size.

| Application | Lot Size | Shares | Amount |

|---|---|---|---|

| Retail Minimum | 1 | 67 | ₹14807 |

| Retail Maximum | 13 | 871 | ₹1,92,491 |

| S-HNI Minimum | 14 | 938 | ₹2,07,298 |

| S-HNI Maxmum | 67 | 4,489 | ₹9,92,069 |

| B-HNI Minimum | 68 | 4,556 | ₹10,06,876 |

Pine Labs IPO Allotment & Listing Dates

Pine Labs IPO Will Open on Nov 07, and Close on Nov 11, 2025. The allotment is Expected on Nov 12, With the Listing Scheduled on NSE BSE For Nov 14, 2025 (More information below table).

| Anchor Investor Bidding | Thu, Nov 06, 2025 |

|---|---|

| IPO Open | Fri, Nov 07, 2025 |

| IPO Close | Tue, Nov 11, 2025 |

| Allotment Finalisation | Wed, Nov 12, 2025 |

| Refunds / Unblocking | Thu, Nov 13, 2025 |

| Shares Credited to Demat | Thu, Nov 13, 2025 |

| Listing Date | Fri, Nov 14, 2025 |

Pine Labs IPO Financial Report (FY 2025)

Pine Labs Reported a Total Income of ₹2,327.09 Cr. in FY 2025, Slightly up From ₹1,824.16 Cr. in FY 2024. The Company Net Profit Also Rose to ₹-145.49 Cr. From ₹-341.90 Cr. in the Previous Year Showing Consistent Financial Growth Ahead of its IPO. (More information below table).

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|

| Assets | 10,904.32 | 10,715.74 | 9,648.56 | 9,363.21 |

| Total Income | 653.08 | 2,327.09 | 1,824.16 | 1,690.44 |

| Profit After Tax | 4.79 | -145.49 | -341.90 | -265.15 |

| EBITDA | 120.56 | 356.72 | 158.20 | 196.80 |

| NET Worth | 2,327.55 | -2,244.27 | -2,035.24 | -1,764.77 |

| Total Borrowing | 888.74 | 829.49 | 532.92 | 329.51 |

| Amount in ₹ Crore |

Pine Labs IPO Valuation Report – FY 2025 (KPI)

Check Detailed Pine Labs IPO Valuation Metrics for FY 2025, including EPS, P/E Ratio, RoNW, NAV, ROCE, and other key financial indicators. These Ratios help Investors Assess the Company financial Health & Valuation Before applying for The IPO. (More information below table).

| KPI | Value |

|---|---|

| EBITDA Margin | 15.38% |

| Earnings Per Share (EPS) | -1.45 |

| Price to Earnings Ratio (P/E) | [-] |

| Return on Net Worth (RoNW) | 37.57% |

Our Competitive Strengths

Ecosystem which brings together merchants, consumer brands and enterprises, and financial institutions enabling commerce transactions.

Full stack, cloud-based, scalable digital infrastructure and transaction platform.

Deep partnerships with large merchants, consumer brands and enterprises, and financial institutions.

Experienced, professional management team.

Pine Labs Comparison With Industry Peers

| Company | Face Value | P/E Ratio | EPS (₹) | RoNW (%) | NAV Per Equity Share (₹) | Revenue (₹ in Million) |

|---|---|---|---|---|---|---|

| Pine Labs Limited | 1 | [●] | (1.45) / (1.45) | (4.15) | (22.43) | 22,742.74 |

| One97 Communications Limited (Paytm) | 1 | (110.98) | (10.35) / (10.35) | (4.69) | 235.54 | 69,004.00 |

| Zaggle Prepaid Ocean Services Limited (Zaggle) | 1 | 48.87 | 6.99 / 6.96 | 9.64 | 99.25 | 13,037.57 |

| Global Listed Peers | ||||||

| Adyen N.V. (Adyen) | 1.03 | 46.23 | 3,058.07 / 3,047.77 | 25.06 | 13,987.40 | 229,236.90 |

| Shopify Inc. (Shopify) | N.A. | 96.50 | 133.45 / 131.75 | 19.58 | 761.60 | 754,800.00 |

| Block, Inc. (Block) | 0.00 | 16.10 | 399.50 / 387.60 | 14.51 | 2,925.70 | 2,050,289.51 |

| Marqeta, Inc. (Marqeta) | 0.01 | 101.20 | 4.25 / 4.25 | 2.34 | 180.20 | 43,094.58 |

Also Read: Pine Labs IPO GMP Today, Grey Market Premium Live

Also Read: Groww IPO Date, Price, GMP, Review, Details

Pine Labs Company Contact Details

Pine Labs Ltd.

Unit No. 408, 4th Floor, Time Tower,

MG Road, DLF QE Gurgaon, Haryana, 122002

Tel: +91 22 6986 3600

Email: cosecy@pinelabs.com

Website: http://www.pinelabs.com/

Pine Labs Lead Manager

Axis Capital Limited

1st Floor, Axis House

Pandurang Budhkar Marg, Worli

Mumbai 400 025, Maharashtra,India

Tel: +91 22 4325 2183

E-mail: lgindia.ipo@axiscap.in

Website: www.axiscapital.co.in

- Citigroup Global Markets India Pvt Ltd.

- Morgan Stanley India Company Pvt Ltd.

- J.P. Morgan India Private Ltd.

- jefferies India Private Limite.

Pine Labs IPO Registrar

KFin Technologies Limited

Selenium Tower B, Plot No.31-32

Gachibowli, Financial District

Nanakramguda, Serilingampally

Hyderabad 500 032 Telangana, India

Tel: +91 40 6716 2222/ 1800 309 4001

E-mail: lgelectronics.ipo@kfintech.com

Website: www.kfintech.com

Pine Labs IPO FAQs

Question 1: What is the Pine Labs IPO?

Answer 1: Pine Labs IPO is a Mainboard IPO of 17,64,66,426 equity shares of the face value of ₹10 approximately up to ₹3,899.91 Cr. The issue is price at ₹210 to ₹221 per share.

The Pine Labs IPO opens on 07, Nov 2025 and closes on 11, Nov 2025.

KFin Technologies Limited is the registrar for the IPO. The shares to be listed on NSE BSE.

Question 2: How to apply in Pine Labs IPO through Groww?

Answer 2: Groww customers can apply online in Pine Labs IPO using UPI as a payment gateway. Groww customers can apply in Pine Labs IPO by login into Groww (back office) and submitting an IPO application form.

Steps to apply in Pine Labs IPO through Groww –

Visit the Groww website and login to Groww.

Go to Main Page and click the Products & tools and click IPO tab.

New page Open and Show ‘ Pine Labs IPO’ click the ‘Apply’ button.

Show IPO detail Shares lot Size and Bid Price & click here to Cutoff Price check Box and Continue.

Inter Your UPI id like . 95****299@kotak accept terms and condition click Box and Apply For IPO

groww share payment link Your UPI Mobile Number Pay Payment for IPO Bid to approve the e-mandate successfully submit application.

Question 3: When Pine Labs IPO will open?

Answer 3: The Pine Labs IPO opens on 07, Nov 2025 and closes on 11, Nov 2025.

Question 4: What is the lot size of Pine Labs IPO?

Answer 4: Pine Labs IPO lot size and the minimum order quantity is 67 Shares.

Question 5: How to apply for Pine Labs IPO?

Answer 5: You can apply in Pine Labs IPO online using either UPI or ASBA as a payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don’t offer banking services. Read more detail about applying IPO online through Groww, Zerodha, Upstox, 5Paisa, Phonepe Share Market, HDFC Bank, and Angel one.

Question 6: When is Pine Labs IPO allotment date?

Answer 6: The Basis of Allotment for Pine Labs IPO will be on Wed, Oct 12, 2025, and the allotted shares will be credited to your demat account by, Thu, Oct 13, 2025. For Check the Pine Labs IPO allotment status.

Question 7: When is Pine Labs IPO listing date?

Answer 7: The Pine Labs IPO listing date is Nov 14, 2025. The date of Pine Labs IPO listing on Fri, Nov 14, 2025.