Arisinfra Solutions IPO Will Open On June 18, 2025 And Close On June 20, 2025. The ₹499.60 Cr. IPO Is A Book Build Issue, Consisting Entirely Of A Fresh Issue. Arisinfra Solutions IPO Price Band Is Set At ₹210 To ₹222 Per Share.

The Allotment Will Be Finalized On June 23, 2025 and Listing date is Expected on The NSE BSE By 25, June 2025. Investor Quota like 75% QIB, 10% Retail, and 15% HNI Category.

Financial Year 2025 Company Posted a Revenue of ₹557.76 Cr. and A Net Profit of ₹6.53 Cr. Showing Strong Growth From The Previous Year. Based On Financial, The IPO Looks Promising For Long-term Investors.

About Arisinfra Solutions Limited

Our Company was originally incorporated on February 10, 2021 as “Arisinfra Solutions Private Limited” We are a business-to-business (“B2B”) technology-enabled company operating in a growing construction materials market, focusing on simplifying and digitizing the entire procurement process for construction materials, delivering an efficient end-to-end procurement experience.

We leverage our network of vendors to source construction materials and provide them to real estate and infrastructure developers and contractors, striving to be a one-stop solution for all their construction material requirements.

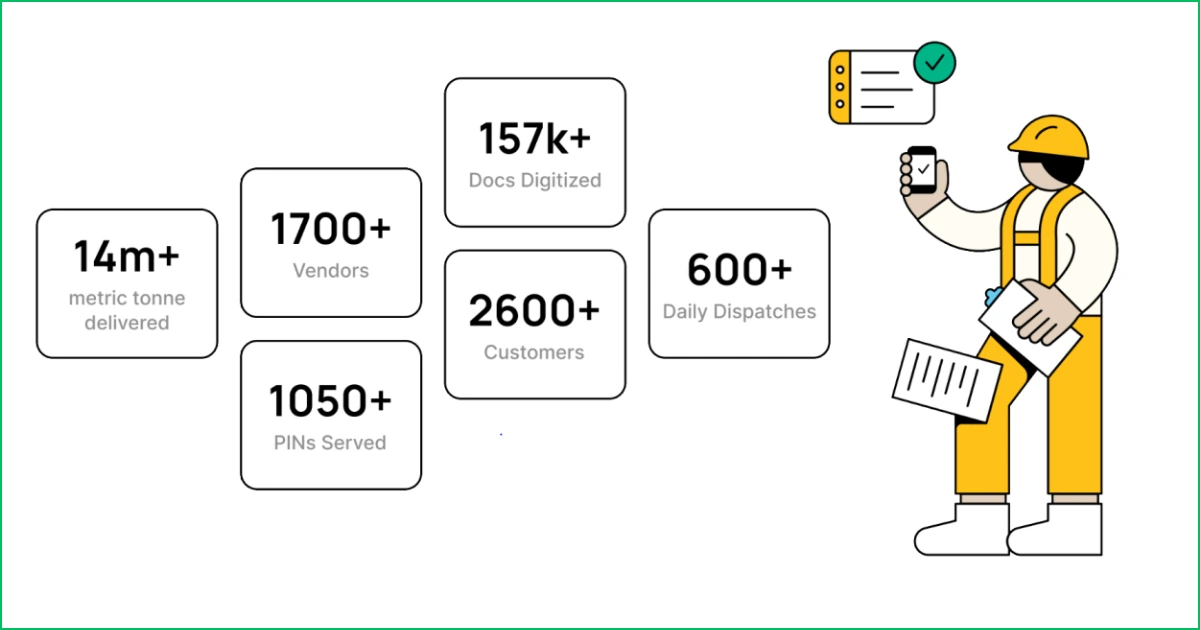

we have delivered 14.10 million metric tonnes (“MT”) of construction materials, including aggregates, ready-mix concrete (“RMC”), steel, cement, construction chemicals and walling solutions, utilizing 1,729 vendors and serving 2,659 customers across 1,075 pin codes in various cities, including Mumbai (Maharashtra), Bengaluru (Karnataka) and Chennai (Tamil Nadu).

Our customer base includes large real estate and infrastructure developers and contractors, including Capacit’e Infraprojects Limited, J Kumar Infraprojects Limited, Afcons Infrastructure Limited, EMS Limited, S P Singla Constructions Private Limited, Real Gem Buildtech Private Limited, Wadhwa Group Holdings Private Limited,

Casa Grande Civil Engineering Private Limited, Sheth Creators Private Limited, Puranik Builders Limited, and Transcon Iconica Private Limited.

Arisinfra Solutions IPO Dates & Price Band Details

| IPO Open Date | June 18, 2025 |

|---|---|

| IPO Close Date | June 20, 2025 |

| IPO Price Band | ₹210 to ₹222 per share |

| Face Value | ₹2 per equity share |

| Lot Size | 67 Shares |

| Minimum Investment | ₹14,874 Thousand (for 1 lot at ₹222) |

| IPO Issue Type | Book Built Issue |

| IPO Issue Size | 2,25,04,324 shares (Approx ₹499.60 Cr) |

| Fresh Issue | 2,25,04,324 shares (Approx ₹499.60 Cr) |

| Offer For Sale | - |

| Retail Investor Quota | 10% |

| QIB Quota | 75% |

| NII (HNI) Quota | 15% |

| Listing Exchange | NSE BSE |

| Anchor Investor List | Click Here |

| DRHP (Draft Prospectus) | Click Here |

| RHP (Final Prospectus) | Click Here |

Arisinfra Solutions IPO Market Lot Size

The Minimum Lot Size For The Arisinfra Solutions IPO is 67 Shares, Requiring An Application Amount of ₹14,874 For Retail Investors. Investors Must Apply in Multiples of The Lot Size.

| Application | Lot Size | Shares | Amount |

|---|---|---|---|

| Retail Minimum | 1 | 67 | ₹14,874 |

| Retail Maximum | 13 | 871 | ₹1,93,362 |

| S-HNI Minimum | 14 | 938 | ₹2,08,236 |

| B-HNI Minimum | 68 | 4,556 | ₹10,11,432 |

Objects Of The Issue

- ₹ 2,046.00 million towards repayment or prepayment of all or part of certain outstanding borrowings

- ₹ 1,770.00 million towards funding the working capital requirements of the Company

- ₹ 480.00 million towards investment in its Subsidiary, Buildmex-Infra Private Limited, for funding its working capital requirements

- ₹ 699.96 million towards general corporate purposes and unidentified inorganic acquisitions, of which the amount to be utilized towards unidentified inorganic acquisitions will not exceed ₹ 600.00 million, and the cumulative amount to be utilized towards general corporate purposes and unidentified inorganic acquisitions shall not exceed 25% of the Gross Proceeds.

Arisinfra Solutions IPO Allotment & Listing Dates

Arisinfra Solutions IPO Will Open on June 18 and Close on June 20, 2025. The allotment is Expected on June 23, With the Listing Scheduled on NSE BSE For June 25, 2025 (More information below table).

| Anchor Investor Bidding | June 17, 2025 |

|---|---|

| IPO Opens | June 18, 2025 |

| IPO Closes | June 20, 2025 |

| Allotment Finalisation | June 23, 2025 |

| Refunds / Unblocking | June 24,2025 |

| Shares Credited to Demat | June 24, 2025 |

| Listing Date | June 25, 2025 |

Arisinfra Solutions IPO Financial Report (FY 2025)

Arisinfra Solutions Reported a total Revenue of ₹557.76 Cr. in FY 2025, Slightly up From ₹702.36 Cr. in FY 2024. The Company Net Profit Also Rose to ₹6.53 Cr. From ( ₹17.30 ) Cr. in the Previous Year Showing Consistent Financial Growth Ahead of its IPO. (More information below table).

| Period Ended | 31 Dec 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

|---|---|---|---|---|

| Assets | 586.56 | 492.83 | 394.95 | 334.22 |

| Revenue | 557.76 | 702.36 | 754.44 | 453.77 |

| Profit After Tax | 6.53 | -17.30 | -15.39 | -6.49 |

| Net Worth | 152.09 | 141.60 | 104.94 | 140.30 |

| Reserves and Surplus | 141.10 | 139.77 | -41.36 | -6.01 |

| Total Borrowing | 322.82 | 273.98 | 220.35 | 154.25 |

| Amount in ₹ Crore |

Arisinfra Solutions IPO Valuation Report – FY 2025 (KPI)

Check Detailed Arisinfra Solutions IPO Valuation Metrics for FY 2025, including EPS, P/E Ratio, RoNW, NAV, ROCE, and other key financial indicators. These Ratios help Investors Assess the Company financial Health & Valuation Before applying for The IPO. (More information below table).

| KPI | Value |

|---|---|

| Return on Equity (ROE) | - |

| Return on Capital Employed (ROCE) | - |

| EBITDA Margin | - |

| PAT Margin | - |

| Debt-to-Equity Ratio | 1.45 |

| Earnings Per Share (EPS) | - 5.30 |

| Price to Earnings Ratio (P/E) | - 41.89 |

| Return on Net Worth (RoNW) | - 13.14% |

| Net Asset Value (NAV) | ₹27.29 |

Qualitative Factors

1. Leveraging technology to transform the supply chain for construction materials.

2. Well-positioned to capitalize on market opportunities.

3. Our growing third-party manufactured construction materials.

4. Network effects ensuring long-term strategic benefits.

5. Tech enabled comprehensive credit risk analysis framework for operational efficiency.

6. Led by Promoters and supported by an experienced professional team.

Our Company Promoters

- Ronak Kishor Morbia,

- Bhavik Jayesh Khara,

- Siddharth Bhaskar Shah,

- Jasmine Bhaskar Shah,

- Priyanka Bhaskar Shah,

- Bhaskar Shah,

- Aspire Family Trust and Priyanka Shah Family Trust are the Promoters of our Company.

Comparison With Industry Peers

Our Company operates a B2B technology driven platform to streamline construction material procurement for real estate and infrastructure developers, a model distinct from traditional supply chain or manufacturing businesses in the sector.

No suitable industry peers are available for KPI comparison, as confirmed by our analysis of regulatory filings and industry data.

Also Read – Mayasheel Ventures IPO Date, GMP, Price, Review, Allotment Details

Arisinfra Solutions Company Contact Details

Corporate Office: Unit No. G-A-04 to 07,

Ground Floor – A Wing, Art Guild House,

Phoenix Marketcity, LBS Marg, Kurla

(West) Mumbai 400 070, Maharashtra, India

Telephone: 022 – 6911 2000

Email: cs@arisinfra.one

Website: https://arisinfra.com

Arisinfra Solutions Lead Manager

JM Financial Limited

7th Floor, Cnergy, Appasaheb Marathe Marg

Prabhadevi, Mumbai – 400 025 Maharashtra, India

Telephone: +91 22 6630 3030

E-mail: aris.ipo@jmfl.com

Website: www.jmfl.com

IIFL Capital Services Limited

24th Floor, One Lodha Place, Senapati Bapat Marg

Lower Parel (West) Mumbai 400 013 Maharashtra, India

Tel: (+ 91 22) 4646 4728

E-mail: arisinfra.ipo@iiflcap.com

Website: www.iiflcap.com

Nuvama Wealth Management Limited

801-804, Wing A Building No 3 Inspire BKC,

G Block Bandra Kurla Complex, Bandra

East Mumbai – 400 051 Maharashtra, India

Telephone: +91 22 4009 4400

E-mail: aris.ipo@nuvama.com

Website: www.nuvama.com

Arisinfra Solutions IPO Registrar

MUFG Intime India Private Limited (formerly

known as Link Intime India Private Limited)

C-101, 1st Floor, 247 Park L.B.S. Marg, Vikhroli (West)

Mumbai 400 083 Maharashtra, India

Telephone: +91 810 811 4949

E-mail: arisinfra.ipo@linkintime.co.in

Website: www.linkintime.co.in

Arisinfra Solutions IPO FAQs

Question 1: What is the Arisinfra Solutions IPO?

Answer 1: Arisinfra Solutions IPO is a Mainboard IPO of 2,25,04,324 equity shares of the face value of ₹2 approximately up to ₹499.60 Cr. The issue is priced at 210 to 222 per share.

The Arisinfra Solutions IPO opens on 18 June 2025 and closes on 20 June 2025.

MUFG Intime India Private Limited is the registrar for the IPO. The shares to be listed on NSE BSE.

Question 2: How to apply in Arisinfra Solutions IPO through Groww?

Answer 2: Groww customers can apply online in Arisinfra Solutions IPO using UPI as a payment gateway. Groww customers can apply in Arisinfra Solutions IPO by login into Groww (back office) and submitting an IPO application form.

Steps to apply in Arisinfra Solutions IPO through Groww –

- Visit the Groww website and login to Groww.

- Go to Main Page and click the Products & tools and click IPO tab.

- New page Open and Show ‘Mayasheel Ventures IPO’ click the ‘Apply’ button.

- Show IPO detail Shares lot Size and Bid Price & click here to Cutoff Price check Box and Continue.

- Inter Your UPI id like . 95****299@kotak accept terms and condition click Box and Apply For IPO

- groww share payment link Your UPI Mobile Number Pay Payment for IPO Bid to approve the e-mandate successfully submit application .

Question 3: When Arisinfra Solutions IPO will open?

Answer 3: The Arisinfra Solutions IPO opens on June 18, 2025 and closes on June 20, 2025.

Question 4: What is the lot size of Arisinfra Solutions IPO?

Answer 4: Arisinfra Solutionss IPO lot size and the minimum order quantity is 67 Shares.

Question 5: How to apply for Arisinfra Solutions IPO?

Answer 5: You can apply in Arisinfra Solutions IPO online using either UPI or ASBA as a payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don’t offer banking services. Read more detail about applying IPO online through Groww, Zerodha, Upstox, 5Paisa, Phonepe Share Market, HDFC Bank, and Angel one.

Question 6: When is Arisinfra Solutions IPO allotment date?

Answer 6: The Basis of Allotment for Arisinfra Solutions IPO will be on Mon, 23 June 2025, and the allotted shares will be credited to your demat account by Thursday, 24 June 2025. For Check the Arisinfra Solutions IPO allotment status.

Question 7: When is Arisinfra Solutions IPO listing date?

Answer 7: The Arisinfra Solutions IPO listing date is 25 June 2025. The date of Arisinfra Solutions IPO listing on wed, 25 June, 2025.

2 thoughts on “Arisinfra Solutions IPO 2025, Date, GMP, Price, Allotment, Review & Listing”