Arisinfra Solutions IPO GMP Today ₹ : Get the Latest Updates on arisinfra solutions ipo Grey market premium (GMP), Kostak rate, and Subject to Sauda Price along with Expected Listing Gains. Track daily GMP trends and IPO details before investing.

Latest Arisinfra Solutions IPO GMP (Grey Market Premium)

- Arisinfra Solutions IPO GMP Today is – ₹ Per Share

- Kostak Rate – Not Available

- Subject to Sauda – ₹-

- Expected Listing Gain – %

arisinfra solutions IPO GMP Price to Down a high to low of ₹25 Rupay on June 13 and a low of ₹11 on June 20, 2025 Showing Strong Market demand.

Arisinfra Solutions IPO GMP Live – Day-wise Trend ( Table)

| GMP Date | GMP Price | Estimated Listing Price | Estimated Profit |

|---|---|---|---|

| 25-06-2025 | ₹- | ₹- | ₹- |

| 24-06-2025 | ₹- | ₹- | ₹- |

| 23-06-2025 | ₹- | ₹- | ₹- |

| 22-06-2025 | ₹- | ₹- | ₹- |

| 21-06-2025 | ₹- | ₹- | ₹- |

| 20-06-2025 | ₹11 | ₹233 (1.92%) | ₹737 |

| 19-06-2025 | ₹11 | ₹233 (1.92%) | ₹737 |

| 18-06-2025 | ₹11 | ₹233 (1.92%) | ₹737 |

| 17-06-2025 | ₹25 | ₹247 (11.26%) | ₹1675 |

| 16-06-2025 | ₹25 | ₹247 (11.26%) | ₹1675 |

| 15-06-2025 | ₹25 | ₹247 (11.26%) | ₹1675 |

| 14-06-2025 | ₹25 | ₹247 (11.26%) | ₹1675 |

| 13-06-2025 | ₹25 | ₹247 (11.26%) | ₹1675 |

Arisinfra Solutions IPO Details

| IPO Open Date | June 18, 2025 |

|---|---|

| IPO Close Date | June 20, 2025 |

| IPO Price Band | ₹210 to ₹222 per share |

| Face Value | ₹2 per equity share |

| Lot Size | 67 Shares |

| Minimum Investment | ₹14,874 Thousand (for 1 lot at ₹222) |

| IPO Issue Type | Book Built Issue |

| IPO Issue Size | 2,25,04,324 shares (Approx ₹499.60 Cr) |

| Fresh Issue | 2,25,04,324 shares (Approx ₹499.60 Cr) |

| Offer For Sale | - |

| Retail Investor Quota | 10% |

| QIB Quota | 75% |

| NII (HNI) Quota | 15% |

| Listing Exchange | NSE BSE |

| Anchor Investor List | Click Here |

| DRHP (Draft Prospectus) | Click Here |

| RHP (Final Prospectus) | Click Here |

About Arisinfra Solutions Limited

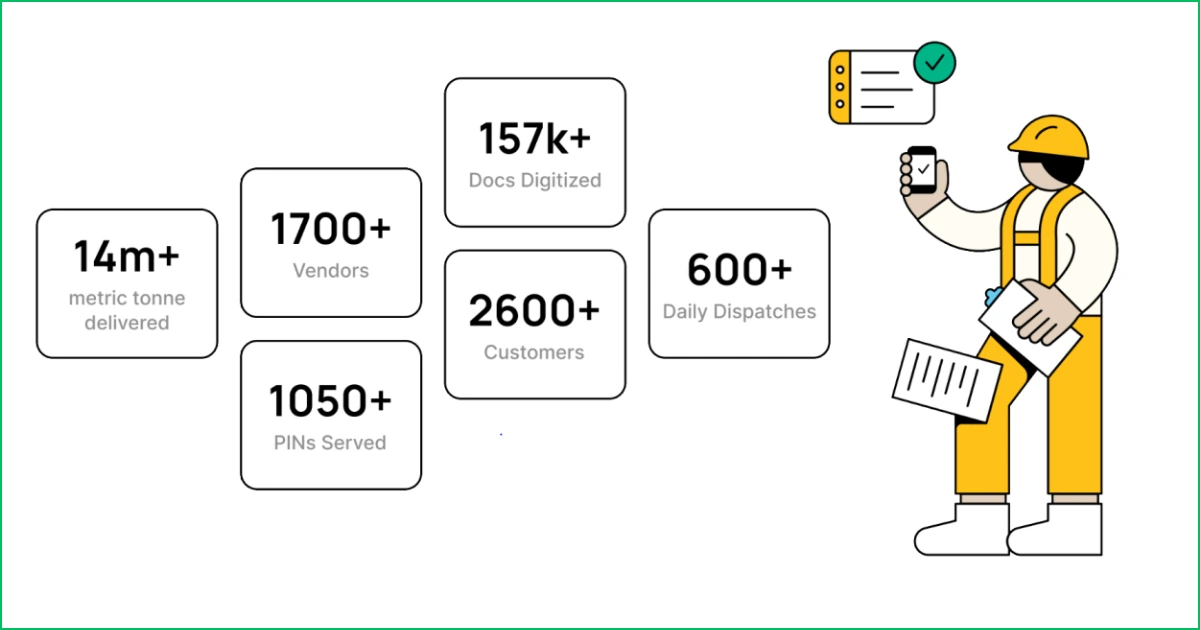

Our Company was originally incorporated on February 10, 2021 as “Arisinfra Solutions Private Limited” We are a business-to-business (“B2B”) technology-enabled company operating in a growing construction materials market, focusing on simplifying and digitizing the entire procurement process for construction materials, delivering an efficient end-to-end procurement experience.

We leverage our network of vendors to source construction materials and provide them to real estate and infrastructure developers and contractors, striving to be a one-stop solution for all their construction material requirements.

we have delivered 14.10 million metric tonnes (“MT”) of construction materials, including aggregates, ready-mix concrete (“RMC”), steel, cement, construction chemicals and walling solutions, utilizing 1,729 vendors and serving 2,659 customers across 1,075 pin codes in various cities, including Mumbai (Maharashtra), Bengaluru (Karnataka) and Chennai (Tamil Nadu).

Our customer base includes large real estate and infrastructure developers and contractors, including Capacit’e Infraprojects Limited, J Kumar Infraprojects Limited, Afcons Infrastructure Limited, EMS Limited, S P Singla Constructions Private Limited, Real Gem Buildtech Private Limited, Wadhwa Group Holdings Private Limited,

Casa Grande Civil Engineering Private Limited, Sheth Creators Private Limited, Puranik Builders Limited, and Transcon Iconica Private Limited.

also Read : Oswal Pumps IPO GMP, Review, Price, Date, Latest IPO Details

FAQs on arisinfra solutions IPO GMP Today

Q1: What is arisinfra solutions IPO GMP today?

Oswal Pumps IPO GMP Price is ₹– Per Share

Q2: What is the Kostak Rate today?

arisinfra solutions IPO Kostak Rate is ₹- as of today Not available.

Q3: arisinfra solutions ipo gmp investorgain?

arisinfra solutions ipo gmp ipowatch Price is ₹– rupay Righ Now

Q4: arisinfra solutions ipo gmp ipowatch?

arisinfra solutions ipo gmp ipowatch Price is ₹– rupay Righ Now

Q5: What is the Subject to Sauda rate?

arisinfra solutions IPO Subject to Sauda is ₹– as of today.

Q6: What are the expected listing gains?

arisinfra solutions IPO Estimated % returns based on current GMP

Disclaimer:

- IPO GMP (Grey Market Premium), Kostak and Subject to Sauda Rates are Unofficial and Can Change Quickly.

- We do Not BUY or SELL IPO Forms.

- Do Not apply For IPOs Based only on GMP Price.

- Always Review the company’s fundamentals before investing.

1 thought on “Arisinfra Solutions IPO GMP Today ₹ Grey Market Premium Live ”