Chetana Education IPO GMP Today in the Grey Market is Not Available at The Moment. Investors are Advised to Closely Monitor Market Trends and consult Reliable Sources for the Most up-to-date Information. It is important to Exercise Caution and Conduct Thorough Research Before Making Any Investment Decisions.

About Chetana Education IPO-

How Much GMP Price Chetana Education IPO today?, live Grey Market Premium Kostak Rates today live Chetana Education IPO Now. Subject to sauda Rate today, Chetana Education IPO as of today Subject to sauda rates kostak. Chetana Education IPO is to open on 24 July, 2024. Chetana Education is a SME IPO to Raise 5,400,000 shares (Approx ₹45.90 Cr) Via IPO. The Chetana Education IPO Price Band is Fixed At ₹85 Per Every Share With a IPO Lot Size of 1600 Shares.

About Chetana Education Data Like –

- Mr. Anil Jayantilal Rambhia is the CEO of Chetana Education and Chetana Education was founded in the year 2017 and has just completed 6 years in operation.

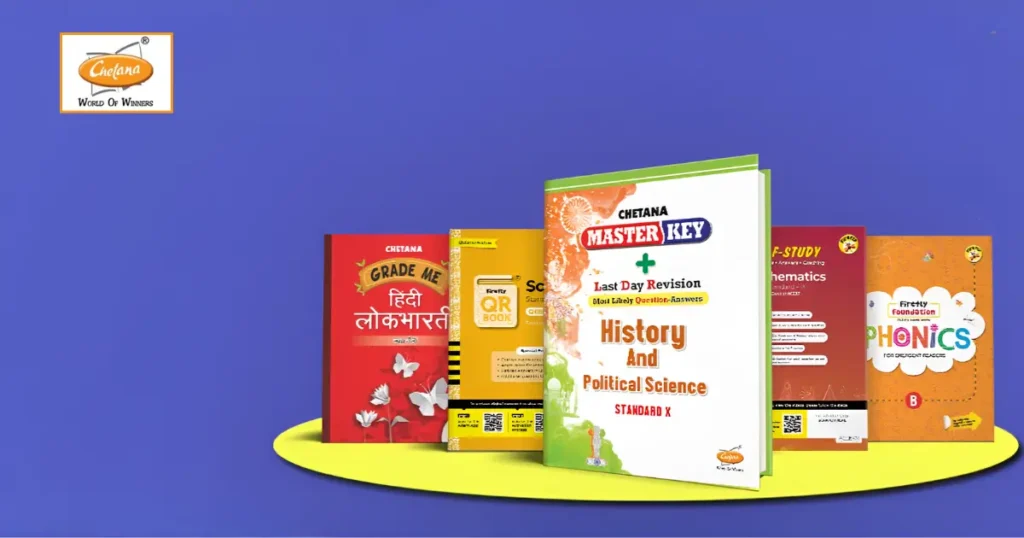

- Chetana Education are a content-based Company, specializing in educational book publishing for the CBSE/State Board curriculum catering to the K-12 segment. Additionally, we provide access to educational software for learning videos (for teachers and Students) accessible through QR (Quick Response) codes, backed by a comprehensive sales and distribution network.

- We currently focus on serving the Maharashtra State Board and Central Board of Secondary Education (CBSE), covering the spectrum of education books from early pre-primary learning to K-12 course. We have established a portfolio of over 700 titles as of 2023 with 15 distinct brands. Some of the names in our lineup include Master Key, Self-Study, Firefly, Bright Buddies, My Skill Book, Grade Me, QR series etc.

Chetana Education IPO GMP With Per Lot Profit

| DATE | IPO GMP PRICE | EST LISTING PRICE |

|---|---|---|

| 31 July | ₹21 | ₹106 |

| 30 July | ₹21 | ₹106 |

| 29 July | ₹30 | ₹115 |

| 28 July | ₹45 | ₹130 |

| 27 July | ₹45 | ₹130 |

| 26 July | ₹45 | ₹130 |

| 25 July | ₹42 | ₹127 |

| 24 July | ₹46 | ₹131 |

| 23 July | ₹12 | ₹97 |

| 22 July | ₹14 | ₹99 |

| 21 July | ₹14 | ₹99 |

| 20 July | ₹14 | ₹99 |

| 19 July | ₹14 | ₹99 |

| 18 July | ₹0 | ₹85 |

Also Read : Chetana Education IPO details, Date, Price, GMP, Review

Latest IPO GMP

We Update live GMP status of all upcoming IPOs every day until the IPO gets listed on the stock exchange. You can easily see the GMP price of all IPOs on our IPO GMP dashboard. We update IPO GMP performance regularly on Moneymintidea.com. You can easily get a rough idea of the GMP of all IPOs and what the listing price of the IPO is going to be.

IPO Grey Market Premium (GMP)

Before investing money in any IPO, one should pay more attention to the fact that the IPO GMP price is very volatile, if you are thinking of investing in Chetana Education IPO by looking at the GMP price, then your decision may prove to be quite risky. Before investing in a new IPO, you should have good knowledge about the business of the company. It should be your decision whether to invest in Chetana Education IPO or not and not by looking at the GMP price of the IPO.

Grey Market Premium (GMP) is the price at which an IPO is traded in an informal/unregulated manner before getting listed on the stock exchange. GMP price in the gray market reflects the price at which a company’s IPO is listed. Going to do. A good GMP premium/price gives you an indication of how much profit the IPO will make upon listing. Rather, if the GMP premium of an IPO is negative, then one should avoid investing money in that IPO.

Disclaimer:- The article here should not be construed as an offer to you to buy or sell based on any IPO / Gray Market Premium (GMP) or as advice in any way. The article here is written for informational and educational informational purposes only. This article should not be relied upon for investing in IPOs. Readers should consult a qualified financial advisor before making investment decisions.

Any reader making any investment decision based on the information published here does so entirely at his own risk. Investors should be aware that any investment in the equity market is subject to unpredictable market-related risks. The author does not intend to invest in this offering.