Devyani International Share Price Target: Are you considering investing in Devyani International Shares? Want to know its future Price target? This guide will discuss the Devyani International share price target for The Years 2025, 2026 and 2030. Along with this, we will do a complete Fundamental analysis to help you make the right decision.

About Devyani International Ltd

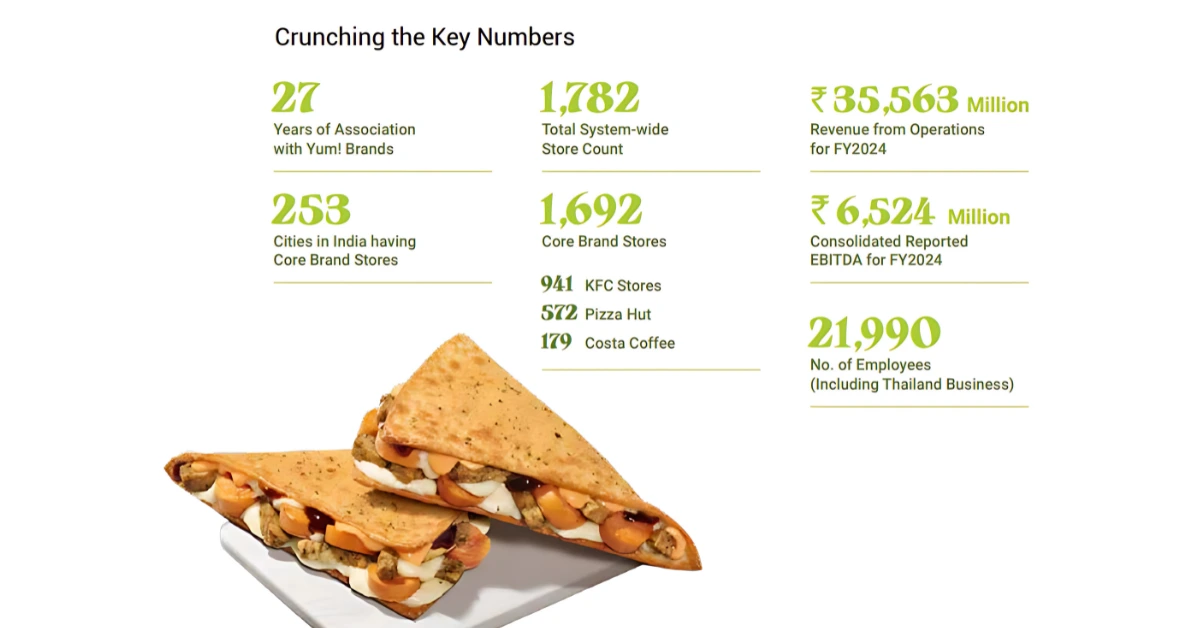

Company Established in 1991 (DIL) is one of India’s largest Chains of Quick Service Restaurant (QSR) operators in India.

The Company’s portfolio is a compelling blend of iconic global brands and successful homegrown creations.

We hold the pride of being the largest franchisee of Yum! Brands1 in India, managing their renowned brands KFC and Pizza Hut across India, and expanding to Nigeria (KFC only) and Nepal.

Devyani International also operates KFC stores in Thailand, following the strategic acquisition of Restaurant Development Company Limited, a leading franchisee of KFC in Thailand.

Additionally, the Company is the exclusive franchisee for Costa Coffee in India. Complementing our global offerings are our homegrown brands: Vaango known for its South-Indian vegetarian cuisine, and Food Street a food court concept that consolidates our brands under one roof, enhancing the experience for consumers.

DIL is an integral growth engine for RJ Corp, a conglomerate that today is a powerhouse multinational with thriving businesses in beverages, fast-food restaurants, retail, ice cream, dairy products, healthcare and education. As an extension of RJ Corp, we share a common heritage of resilience and innovation, striving to set new benchmarks in every sector we undertake.

Our Business Verticals

- Core Brands India Business: Operations of KFC, Pizza Hut and Costa Coffee stores in India.

- International Business: Operations in Thailand, Nigeria for KFC and Nepal for KFC and Pizza Hut stores.

- Other Business: Operations of Vaango, the food street and certain other Operations in the F&B industry in India

Devyani International Share Price Target Tomorrow

Devyani International Share Price Target 2025

The share price of Devyani International may go up & Down. According to our analysis levels, the minimum cost of Devyani International shares in 2025 can be ₹120, and the maximum price can be ₹350.

| Month Wise (Year 2025) | Target Price |

|---|---|

| January | ₹120 |

| February | ₹130 |

| March | ₹145 |

| April | ₹160 |

| May | ₹170 |

| June | ₹190 |

| July | ₹205 |

| August | ₹225 |

| September | ₹260 |

| October | ₹290 |

| November | ₹320 |

| December | ₹350 |

Devyani International Share Price Target 2026

The share price of Devyani International may go up & Down. According to our analysis levels, the minimum cost of Devyani International shares in 2026 can be ₹200, and the maximum price can be ₹500.

| Month Wise (Year 2026) | Target Price |

|---|---|

| January | ₹140 |

| December | ₹300 |

Cochin Shipyard Share Price Target

Devyani International Share Price Target 2027

The share price of Devyani International may go up & Down. According to our analysis levels, the minimum cost of Devyani International shares in 2027 can be ₹300, and the maximum price can be ₹650.

| Month Wise (Year 2027) | Target Price |

|---|---|

| January | ₹300 |

| December | ₹650 |

Vibhor steel tubes Share Price Target

Devyani International Share Price Target 2028

The share price of Devyani International may go up & Down. According to our analysis levels, the minimum cost of Devyani International shares in 2028 can be ₹400, and the maximum price can be ₹800.

| Month Wise (Year 2028) | Target Price |

|---|---|

| January | ₹400 |

| December | ₹800 |

Bharat Dynamics Share Price Target

Devyani International Share Price Target 2029

The share price of Devyani International may go up & Down. According to our analysis levels, the minimum cost of Devyani International shares in 2029 can be ₹550, and the maximum price can be ₹1,100.

| Month Wise (Year 2029) | Target Price |

|---|---|

| January | ₹550 |

| December | ₹1,100 |

Devyani International Share Price Target 2030

The share price of Devyani International may go up & Down. According to our analysis levels, the minimum cost of Devyani International shares in 2030 can be ₹700, and the maximum price can be ₹1,250.

| Month Wise (Year 2030) | Target Price |

|---|---|

| January | ₹700 |

| December | ₹1,250 |

Devyani International Fundamentals

| Fundamentals | Devyani International |

|---|---|

| Market Cap | ₹15,201 Cr |

| 52 Week High | 191.00 |

| 52 Week Low | 109.65 |

| NSE Symbol | DEVYANI |

| ROE | -2.15% |

| P/E Ratio | -308.25 |

| EPS | -0.40 |

| P/B Ratio | 9.79 |

| Dividend Yield | 0.00% |

| Industry P/E | 77.38 |

| Book Value | 12.60 |

| Debt to Equity | 2.15 |

| Stock Face Value | 1 |

Devyani International Shareholding Pattern

| Promoters | 61.37% |

|---|---|

| Retail & Others | 9.47% |

| FII | 9.71% |

| DII | 3.55% |

| Mutual Funds | 15.90% |

The Devyani International Financial Reports

| Sector | Year (2025) |

|---|---|

| Revenue | 1,453 Cr. |

| Expense | 1,447 Cr. |

| Profit Before Tax | -15.90 Cr. |

| Net Profit | -10.98 Cr. |

People also ask F&Q

Question 1: What is Devyani International’s share price target for 2025?

Answer 1: The Devyani International estimated share price target for 2025 can range from ₹120 to ₹350.

Question 2: What is Devyani International’s share price target for 2030?

Answer 2: The Devyani International estimated share price target for 2030 can range from ₹700 to ₹1,250.

Question 3: What are the primary growth drivers for Devyani International stock?

Answer 3: The most prominent growth drivers include a diversified portfolio, strategic market expansion, technological innovations, and strong brand loyalty.

Question 4: Is Devyani International a good long-term investment?

Answer 4: Devyani International has strong long-term potential due to its diversification and sustainability focus. Investors should watch the company’s Q3 results for market insights.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your research before making investment decisions.