dr agarwal’s health Care Share Price Target : Are you thinking of investing in dr agarwal’s health care shares? Want to know its future price target? In this guide, we will discuss dr agarwal’s health care share price target for the year 2025, 2026, 2030. Along with this, we will do a complete fundamental analysis to help you make the right decision.

OUR BUSINESS

Our Company incorporation dated April 19, 2010 We provide a comprehensive range of eye care services, including cataract, refractive and other surgeries; consultations, diagnoses and non-surgical treatments; and sell opticals, contact lenses and accessories, and eye care related pharmaceutical products.

we had a market share of approximately 25% of the total eye care service chain market in India during the Financial Year 2024.

Our offerings cover :-

• Services, which comprise the following.

▪ Surgeries.

Cataract surgeries :- We offer cataract surgical treatments at our Facilities, such as small incision cataract surgery, phacoemulsification, robotic cataract surgery and glued intraocular lens treatments.

Refractive surgeries :- Our refractive surgeries include surgical procedures to correct the refractive error of the eye to get rid of or reduce dependence on glasses and contact lens.

Primary refractive treatments include laser-assisted in-situ keratomileusis (“LASIK”) surgeries, small incision lenticule extraction (“SMILE”)

treatments, implantable collamer lens treatment and photo-refractive keratectomy.

Other surgeries :- We also offer a range of other surgical treatments for eye ailments, such as surgical retinal treatments, corneal transplantation and pinhole pupilloplasty, oculoplasty and surgeries for the treatment of glaucoma and pterygium.

Consultations, diagnoses and non-surgical treatments: We also offer doctor consultation services, diagnostic services for eye disorders along with non-surgical treatments, including retinal laser therapy and dry eye treatment.

Dr. Amar Agarwal, who has more than 35 years of clinical experience in the eye care services industry and has received several awards recognizing his contribution to ophthalmology.

OUR COMPETITIVE STRENGTHS

Largest eye care services provider in India with a trusted brand :-

we are India’s largest eye care service chain by revenue from operations for the Financial Year 2024, with approximately 1.7 times the revenue from operations of the second-largest eye care service chain in the country during such period.

we have 193 Facilities in India spanning 14 states and 4 union territories, and 16 Facilities spread across nine countries in Africa.

we have a diversified presence across Tier-I cities (where 70 of our Facilities are located) and other cities (where 123 of our Facilities are located) in India.

End-to-end, comprehensive eye care services offering :-

We are an end-to-end eye care services provider offering a comprehensive set of services, which allows us to cater to all ophthalmic needs of our patients.

We provide a comprehensive range of eye care services and products, covering cataract surgeries, refractive treatments and other surgeries; and other services, such as consultations, clinical investigations and nonsurgical treatments; along with optical and eye care related pharmaceutical products.

In addition, standard operating procedures (“SOPs”) are vital growth drivers for eye care service chains in India.

SOPs ensure consistent, high-quality patient care across all centers, building trust and reputation.

We endeavour to offer a standardized level of experience to our patients across all our Facilities by streamlining our systems and operating protocols.

Our Facilities :-

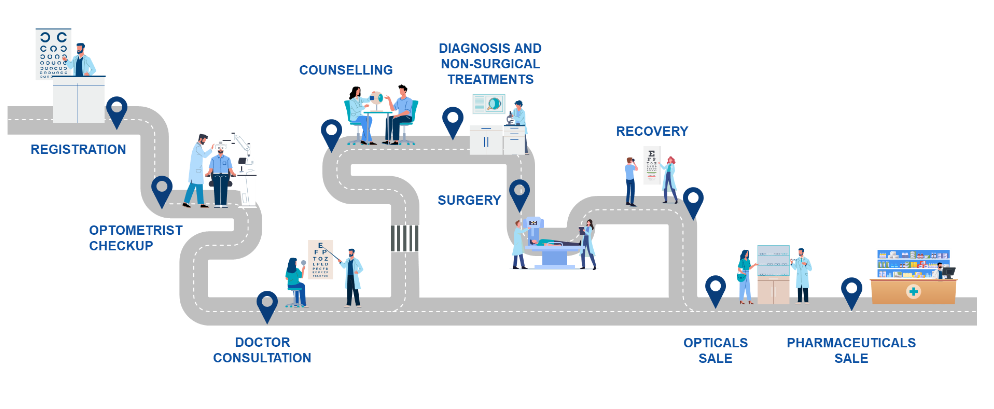

follow similar operating and medical protocols across locations to smoothen the experience of our patients throughout their journey with us, including navigating through registration, optometrist check-ups, doctor consultations, counselling, diagnosis, and non-surgical treatments, surgeries, and post-surgery care, as well as sales of optical and eye care-related pharmaceutical products.

A typical patient experience at our Facilities is depicted below :-

Proven clinical excellence driven by a strong clinical board and history of surgical innovations :-

• Quality control committee, which oversees the regular audit of clinical aspects.

This committee oversees the audit of clinical aspects of our Facilities on multiple parameters, such as the formulation of protocols and policies, ensuring transparency in reporting adverse events, analyzing adverse events, identifying and addressing areas of improvement and collaborating with other departments and stakeholders to develop and implement quality improvement initiatives.

• Education committee, for continuous and ongoing training of doctors.

This committee is responsible for ensuring continuous training of doctors, optometrists, and para-medical staff, and to conduct conferences and conventions in this regard.

• Drug and medical devices committee, to control the introduction and usage of new pharmaceutical products and intraocular lens (“IOLs”), and to streamline the process of approval / upgradation/ replacement of medical devices.

• Research and development committee, which conducts clinical trials in cataract, glaucoma, corneal and retinal specialties. During the six months ended September 30, 2024 and the Financial Years 2024, 2023 and 2022, this committee has completed 28 clinical research studies, with 17 studies ongoing.

Our clinical board has also established an international advisory board comprising doctors from the United States of America to advise on improvements in clinical practices in ophthalmology, and a specialty advisory board comprising 31 experts to focus on nine specialised services.

We provide a comprehensive range of eye care services, covering cataract, refractive and other surgeries; consultations, diagnoses and non-surgical treatments; and sell optical and eye care related pharmaceutical products through a network of Facilities across 14 states and four union territories with 117 cities in India, and nine countries in Africa.

Dr. Agarwal’s Health Care Limited Listed Peers

- Apollo Hospitals Enterprise Limited

- Max Healthcare Institute Limited

- Fortis Healthcare Limited

- Global Health Limited

- Narayana Hrudayalaya Limited

- Krishna Institute of Medical Sciences Limited

- Aster DM Healthcare Limited

- Rainbow Children’s Medicare Limited

Dr Agarwal’s Health Care Fundamentals

Fundamentals

Dr Agarwal's Health Care

Market Cap

₹13,801Cr

52 Week High

464.00

52 Week Low

365.70

NSE Symbol

AGARWALEYE

ROE

6.89%

P/E Ratio

166.12

EPS

2.63

P/B Ratio

8.31

Dividend Yield

0.00%

Industry P/E

62.41

Book Value

52.58

Debt to Equity

0.69

Stock Face Value

1

Also Read : Adani Power Share Price Target Forecasts from 2025 to 2030

Dr Agarwal’s Health Care Shareholding Pattern

Promoters

32.45%

Retail & Others

5.49%

DII

1.92%

FII

56.97%

Mutual Funds

3.18%

Dr Agarwal’s Health Care Financial Reports

Sector

Year (2024)

Revenue

1376Cr.

Expense

1235Cr.

Profit Before Tax

140Cr.

Net Profit

95Cr.

Dr Agarwal’s Health Care Share Price Target 2025

The share price of Dr Agarwal’s Health Care may Ups & Down. According to our analysis levels, the minimum price of Dr Agarwal’s Health Care share in 2025 can be ₹400 and the maximum price can be ₹550.

Month Wise (Year 2025)

Target Price

January

₹400

February

₹410

March

₹425

April

₹431

May

₹445

June

₹460

July

₹475

August

₹490

September

₹510

October

₹525

November

₹530

December

₹550

Also Read : Orient Green Share Price Target Forecasts from 2025 to 2030

Dr Agarwal’s Health Care Share Price Target 2026

The share price of Dr Agarwal’s Health Care may Ups & Down. According to our analysis levels, the minimum price of Dr Agarwal’s Health Care share in 2026 can be ₹550 and the maximum price can be ₹700.

Month Wise (Year 2026)

Target Price

January

₹550

December

₹700

Also Read : MOFS Share Price Target Forecasts from 2025 to 2030

Dr Agarwal’s Health Care Share Price Target 2027

The share price of Dr Agarwal’s Health Care may Ups & Down. According to our analysis levels, the minimum price of Dr Agarwal’s Health Care share in 2027 can be ₹715 and the maximum price can be ₹1000.

Month Wise (Year 2027)

Target Price

January

715

December

₹1000

Also Read : Hindustan Aeronautics Share Price Target Forecasts from 2025 to 2030

Dr Agarwal’s Health Care Share Price Target 2028

The share price of Dr Agarwal’s Health Care may Ups & Down. According to our analysis levels, the minimum price of Dr Agarwal’s Health Care share in 2028 can be ₹1050 and the maximum price can be ₹1500.

Month Wise (Year 2028)

Target Price

January

₹1050

December

₹1500

Also Read : Tata Motors Share Price Target Forecasts from 2025 to 2030

Dr Agarwal’s Health Care Share Price Target 2029

The share price of Dr Agarwal’s Health Care may Ups & Down. According to our analysis levels, the minimum price of Dr Agarwal’s Health Care share in 2029 can be ₹1400 and the maximum price can be ₹2000.

Month Wise (Year 2029)

Target Price

January

₹1400

December

₹2000

Dr Agarwal’s Health Care Share Price Target 2030

The share price of Dr Agarwal’s Health Care may Ups & Down. According to our analysis levels, the minimum price of Dr Agarwal’s Health Care share in 2030 can be ₹1800 and the maximum price can be ₹2700.

Month Wise (Year 2030)

Target Price

January

₹1800

December

₹2700

Frequently Asked Questions on Dr Agarwal’s Health Care Share Price Target

Question 1: What is the share price target of Dr Agarwal’s Health Care for 2025?

Answer 1: The estimated share price target for 2025 can range from ₹400 to ₹550.

Question 2: What is the share price target of Dr Agarwal’s Health Care for 2030?

Answer 2: The estimated share price target of Dr Agarwal’s Health Care for 2030 can range from ₹1800 to ₹2700.

Question 3: What are the primary growth drivers for Dr Agarwal’s Health Care stock?

Answer 3: The most prominent growth drivers include a diversified portfolio, strategic market expansion, technological innovations, strong brand loyalty, etc.

Question 4: Is Dr Agarwal’s Health Care a good long-term investment?

Answer 4: Yes, Dr Agarwal’s Health Careshows a strong long-term potential due to its diversified operations, strategic expansion along with focus on further sustainability. Investors should keep an eye on the company’s Q3 results to stay updated on market trends and company performance.

How To Buy Dr Agarwal’s Health Care Share?

To buy Dr Agarwal’s Health Care shares, you can easily buy shares of Dr Agarwal’s Health Care by using the trading platform of many stock brokers.

The names of most trading platforms for buying Dr Agarwal’s Health Care shares are given below.

- Groww App

- Phonepe. Share Market App

- Angel One App

- Dhan App

- Upstox App

- Zerodha App

Disclaimer :- The above article is for informational purposes only, and should not be construed as any investment advice. Money Mint idea suggests its readers/viewers to consult their financial advisors before making any money-related decisions.

4 thoughts on “Dr Agarwal’s Health Care Share Price Target 2025, 2026, to 2030 .”