Table of Contents

ToggleIntroduction to Primary Market.

- New issues market where Company/ institutions raise funds or capital from public by issuing new securities.

- Objective: To raise capital.

- Two major types of issuers of securities:

- Corporate Entities (Companies)

- Government (Central and State)

- Major types of Issues in Primary Market:-

– Public Issue

– Preferential Issue

– Rights Issue

– Bonus Issue

- Objects of the issue and intended utilization of funds

- Given by issuers in the Offer Document

Primary v/s Secondary Market : Key Differentiation

| Features | Primary Market | Secondary Market |

| Definition | Securities issued first time to the public. | Trading of already issued and listed securities. |

| Also called as | New Issue Market. | Post Issue Market. |

| Price Determination | By Issuer Company in consultation with Merchant Bankers. | Supply and Demand Forces of Market. |

| Key Intermediaries | Merchant Bankers, Bankers/ Lead Managers, RTAs. | Stock Brokers and DPs. |

| Purpose | - Raise capital for expansion,diversification, etc. - To seek listing of securities. | - Trading of securities. - Providing liquidity to investors. - Raising further capital for expansion. |

Modes of Capital Issuances

IPO ( Initial public offering )

- Initial Public Offering.

- Done by unlisted company.

- Fresh issue of securities/ offers its existing securities for sale/ Combination of both.

- Securities issued for the first time to the public.

- Paves way for listing and trading of the issuer’s securities in the Stock Exchange(s).

FPO ( Follow-On Public Offer )

- Further Public Offer / Follow-on Offer.

- Done by already listed company.

- Fresh issue of securities / Offer for sale of securities to public .

Rights Issue

- Done by already listed company.

- Issue of securities to its existing shareholders (as on a Record date).

- Record Date is fixed by the issuer.

- The rights offered in a particular ratio to the number of securities held by existing shareholders as on the record date.

Bonus Issue

- Done by already listed company.

- Issue of shares to existing shareholders (as on a record date).

- Existing shareholders need not make any payment for “Bonus” shares.

- Shares are issued out of the company’s free reserve or share premium account.

- Issued in a particular ratio to the number of securities held on record date.

Preferential Issue

- Done by already listed company.

- Issue of shares / convertible securities (like warrants) to a select group of persons.

- Subject to prescribed norms such as minimum pricing, minimum public shareholding and lock-in.

QIP ( Qualified Institutional Buyer )

- Qualified Institutional Placement.

- Done by already listed company.

- Issue of shares / convertible securities (like warrants) to Qualified Institutional Buyers (QIBs).

- Subject to prescribed norms such as minimum pricing and minimum public shareholding.

IPO – Initial Public Offering

- Process of a company to be publicly listed and traded company.

- IPO: Fresh issue of shares / Offer for Sale of shares by existing investors/ Combination of both.

- Process of IPO is as follows:

- Issuer files an Offer Document in prescribed format with Securities and Exchange Board of India (SEBI), Stock Exchanges and the Registrar of Companies (ROC) for listing on the stock exchanges

- Issuer receives observations from regulatory authorities.

- After complying with all observations, issuer can open the offer inviting general public to invest in the IPO subject to stipulated timelines.

- Post successful completion of the Offer the shares of the company are traded on the stock exchange(s) where the shares are listed.

How to apply in Public Issue?

ONLINE MODE ( ASBA )

- Application Supported by Blocked Amount.

- Facility provided by Self Certified Syndicate Banks (SCSBs)

- Full Bid Amount blocked in the bank account of the bidder.

UPI in ASBA

– For a) Retail Individual Investors.

b) Shareholders bidding in Shareholders Reservation Portion up to Rs.5,00,000/-.

– Application via UPI facility of Sponsor Bank.

3-in-1 Account

- Applying in IPO through 3-in-1 account (demat, trading and bank account).

OFFLINE MODE

Filled Form

- To open a Demat Account first.

- Investors may obtain Application Form from Stock Broker/ Sponsor Bank/ Exchange Website.

- Form submitted to Stock Broker/ Sponsor Bank.

Advantages and disadvantages of IPO

Just like every coin has two sides, IPO also has advantages and disadvantages for the company and investors.

1. Advantages of IPO for the company:

- When a company lists its IPO in the stock market, it helps the company in its development, expansion, capital expenditure, repayment of outstanding loans and raising large amounts of money.

- When a company brings its IPO, it provides an exit route for promoters and old investors.

- Company IPO is a cost-effective way of raising capital as companies do not have to pay interest on the money raised from the public, nor do they have to return the capital raised.

- Public companies get easier access to finance than private companies. This is because public companies are required to maintain transparency in their business operations, which reduces the risk for lenders by having all the information available for verification.

- IPO increases visibility and helps to build a brand image for the company.

- IPO enhances the reputation of employees and builds their trust in the company. It helps to retain employees and attract new employees.

- IPO enables correct valuation of the company.

- IPO promotes discipline in management as the company is accountable to its shareholders for all its actions.

- By going public, the company gets to know the view of outsiders. This helps them to plan their actions for better prospects.

2. Benefits of IPO to Investors

- Zero cost investment, as there are no charges to apply for IPO, unlike buying shares on the secondary market, where you have to pay brokerage and regulatory fees.

- Applying for IPO is simple, easy and hassle-free.

- By applying for IPO, investors get an opportunity to participate in profitable and high-growth companies.

- IPOs offer a chance to earn high profits quickly in case of premium listing or allow wealth creation in case of long-term investment.

- Strict IPO norms make IPO markets more professional and secure.

- The Red Herring Prospectus (RHP) issued for an IPO contains all the necessary information about the company to help investors make informed decisions.

- In case of successful allotment, investors will become shareholders of the company. Shareholders can participate in certain corporate actions and elect members of the board of directors through voting rights.

3. Disadvantages of IPO for the Company

- Preparing an IPO requires a lot of time from the company’s promoters, management and employees.

- Although IPOs are a low-cost way of raising capital, it can be expensive due to fees payable to intermediaries and fund managers.

- IPOs may result in dilution of ownership among different shareholders which was previously limited to a few promoters and investors.

- The company conducting the IPO is required to file regulatory documents on a regular basis along with the required disclosures. This increases the administrative cost for the company, as it has to hire a team to oversee and complete these tasks.

- By going public, the company becomes accountable to its investors and hence must maintain a relationship with the investors and meet their expectations.

4. Disadvantages of IPO for Investors

- Investors do not have any background information about the company conducting the IPO as it is a new company going public for the first time. The investor has to go through the entire RHP to know all the details of the company.

- The investor may suffer losses if a discount listing is done with the goal of quick returns (listing gains).

- There is no guarantee of allotment in an IPO in case of oversubscription.

Rights of a Shareholder

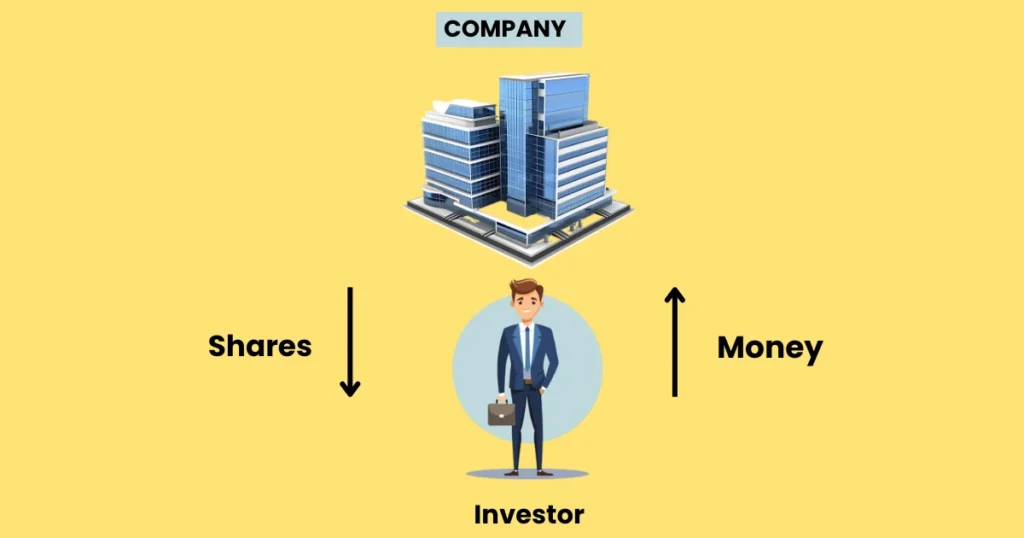

- Part-owner of the company, in proportion to their holding in the company.

- Right to receive corporate benefits like dividend, whenever declared.

Right to receive:

– Annual Reports

– Audited Financial Statements

– Notices of General Meetings and other notices

– Other information disseminated by company.

- Right to attend company meetings.

- Right to contribute in key corporate governance decisions through postal ballot/ e-voting.

Right to:

– Ask questions to the board of directors.

– Place items on the agenda of general meetings.

– Propose resolutions, etc.

Right to participate in matters needing shareholder approval like:

– To vote in company proceedings.

– To approve mergers & acquisitions, appointment of directors on company board, changing auditors, etc.

- Right to Inspect company’s statutory books and records.

- Right to Transfer shares by applicable laws.

- To raise grievances, if any, against the company (using SCORES, etc.).

Rights & Responsibilities of A Shareholder

ANNUAL REPORT :

- Circulated to all Shareholders (via Post / Email).

- Available on website of Company and Stock Exchanges.

- NOTICE : for shareholder meetings with details of the agenda.

- MD’s NOTE : the managing director’s note in the annual report to understand how the business is doing.

- AUDITOR’s NOTE : check if there are any red-flags / adverse findings flagged.

INFORMATION ON STOCK EXCHANGE WEBSITE :

Company’s structural changes, updates, press release, investor presentations etc. under corporate announcements, which any investor should refer to.

Pre-Application Analysis : Broad Contours

Investors should take a well- informed decision of investing / applying in an IPO / FPO / Rights issue.

- Don’t go by mere rumours / euphoria over expected returns as what the others feel.

- Invest based on one own risk appetite and investment parameters.

Points to be considered as a part of pre- application analysis (before investing / applying in an IPO/ FPO / Rights application).

- Product, Plant and Pricing

- Sustainability & Growth

- Scalability and Addressable Market

- Business Beyond Numbers

- Management Quality

- Sustainable Margins: Absolute & Relative

- Stakeholders Behavioral Pattern.

- Corporate Governance

- Corporate Structure

- Business Succession