Inox India Share Price Target: Are you considering investing in Inox India Shares? Want to know its future Price target? This guide will discuss the Inox India share price target for The Years 2025, 2026 and 2030. Along with this, we will do a complete Fundamental analysis to help you make the right decision.

Inox India Share Price Today | Live NSE/BSE Updates Get real-time stock Price of Inox India Ltd., the latest market trends, and live updates. Stay ahead in the market.

About Inox India LTD –

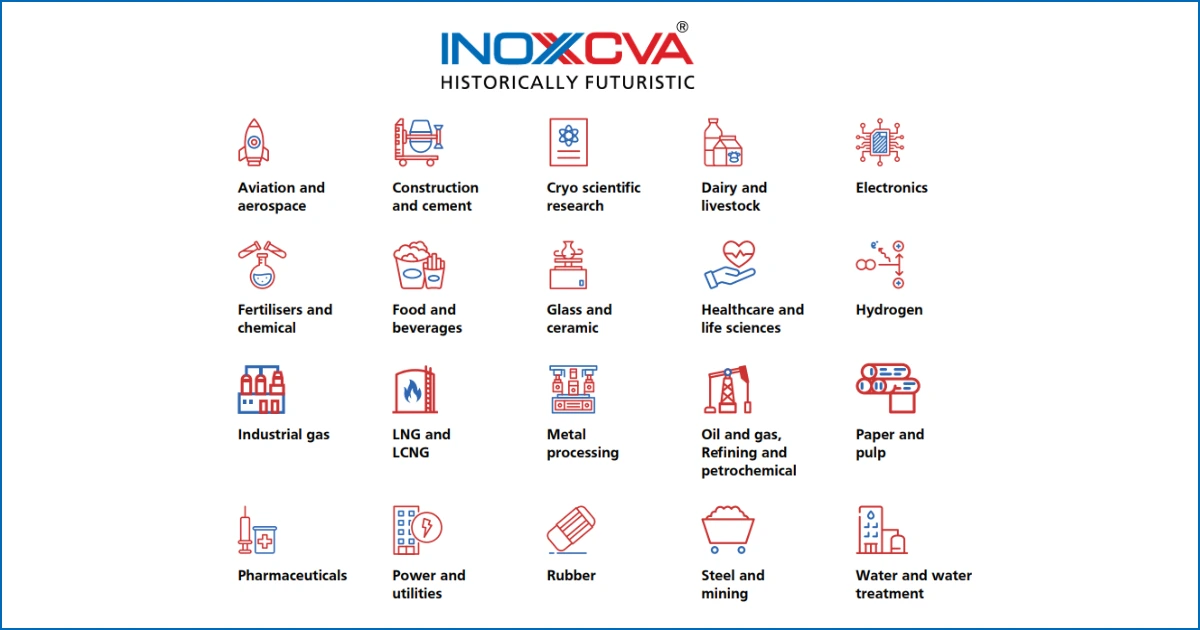

INOXCVA has positioned itself as a dominant force globally in the specialised domain of vacuum-insulated cryogenic equipment.

Our expertise spans across activities ranging from conceptualisation to execution, including design, engineering, manufacturing, delivery and the seamless integration of turnkey solutions. We offer a portfolio comprising both standardised and bespoke cryogenic equipment crafted with care to meet the varying demands of Equipment for storage, transportation and handling cryogens across a wide temperature scale.

We have an extensive variety of cryogens, including Helium, Hydrogen, Nitrogen, Oxygen, Argon, CO2, N2O, LNG, and Ethylene, among others. Our expertise in design innovation, advanced modelling techniques, rigorous analysis and efficient procurement processes facilitate the widespread adoption of sustainable energy alternatives.

Inox India Fundamentals

| Fundamentals | Inox India |

| Market Cap | ₹8,706 Cr |

| 52 Week High | 1,506.90 |

| 52 Week Low | 884.20 |

| NSE Symbol | INOXINDIA |

| ROE | 25.95% |

| P/E Ratio | 42.56 |

| EPS | 22.54 |

| P/B Ratio | 11.60 |

| Dividend Yield | 1.15% |

| Industry P/E | 22.10 |

| Book Value | 82.71 |

| Debt to Equity | 0.13 |

| Stock Face Value | 2 |

Inox India Shareholding Pattern

| Promoters | 75.00% |

| Retail & Others | 11.48% |

| DII | 1.61% |

| FII | 6.52% |

| Mutual Funds | 5.38% |

Inox India Financial Reports

| Sector | Year (2024) |

| Revenue | 1162Cr. |

| Expense | 904Cr. |

| Profit Before Tax | 257Cr. |

| Net Profit | 196Cr. |

Inox India Share Price Target 2025

The share price of Inox India may Ups & Down. According to our analysis levels, the minimum price of Inox India shares in 2025 can be ₹900 and the maximum price can be ₹1100.

| Month Wise (Year 2025) | Target Price |

| January | ₹900 |

| February | ₹920 |

| March | ₹935 |

| April | ₹950 |

| May | ₹970 |

| June | ₹995 |

| July | ₹1020 |

| August | ₹1045 |

| September | ₹1060 |

| October | ₹1070 |

| November | ₹1085 |

| December | ₹1100 |

Inox India Share Price Target 2026

The share price of Inox India may Ups & Down. According to our analysis levels, the minimum price of Inox India shares in 2026 can be ₹1000 and the maximum price can be ₹1400.

| Month Wise (Year 2026) | Target Price |

| January | ₹1000 |

| December | ₹1400 |

Inox India Share Price Target 2027

The share price of Inox India may Ups & Down. According to our analysis levels, the minimum price of Inox India shares in 2027 can be ₹1200 and the maximum price can be ₹1700.

| Month Wise (Year 2027) | Target Price |

| January | ₹1200 |

| December | ₹1700 |

Inox India Share Price Target 2028

The share price of Inox India may Ups & Down. According to our analysis levels, the minimum price of Inox India shares in 2028 can be ₹1500 and the maximum price can be ₹2000.

| Month Wise (Year 2028) | Target Price |

| January | ₹1500 |

| December | ₹2000 |

Inox India Share Price Target 2029

The share price of Inox India may Ups & Down. According to our analysis levels, the minimum price of Inox India shares in 2029 can be ₹1650 and the maximum price can be ₹2200.

| Month Wise (Year 2029) | Target Price |

| January | ₹1650 |

| December | ₹2200 |

Inox India Share Price Target 2030

The share price of Inox India may Ups & Down. According to our analysis levels, the minimum price of Inox India shares in 2030 can be ₹1800 and the maximum price can be ₹2400.

| Month Wise (Year 2030) | Target Price |

| January | ₹1800 |

| December | ₹2400 |

Frequently Asked Questions on Inox India Share Price Target

Question 1: What is the share price target of Inox India for 2025?

Answer 1: The estimated share price target of Inox India for 2025 can range from ₹900 to ₹1100.

Question 2: What is the share price target of Inox India for 2030?

Answer 2: The estimated share price target of Inox India for 2030 can range from ₹1800 to ₹2400.

Question 3: What are the primary growth drivers for Inox India stock?

Answer 3: The most prominent growth drivers include a diversified portfolio, strategic market expansion, technological innovations, and strong brand loyalty.

Question 4: Is Inox India a good long-term investment?

Answer 4: Yes, Inox India has strong long-term potential due to its diversification and sustainability focus. Investors should watch the company’s Q3 results for market insights.

Disclaimer: The above article is for informational purposes only and should not be construed as investment advice.

9 thoughts on “Inox India (INOXINDIA) Forecast & Share Price 2025”