jio financial Share Price Target : Are you thinking of investing in jio financial shares? Want to know its future Price target? In this guide, we will discuss jio financial share price target for the year 2025, 2026, 2030. Along with this, we will do a complete fundamental analysis to help you make the right decision.

Our Business

Jio Financial Services Limited (JFSL) post demerging of the financial services business from Reliance Industries Limited into the Company and subsequent listing on the Indian bourses, NSE and BSE.

JFSL is a Core Investment Company – Non-Deposit taking – Systemically important Company (CIC), registered with the Reserve Bank of India, and operates its financial services businesses through its consumer-facing.

Subsidiaries : Jio Finance Limited (JFL), Jio Insurance Broking Limited (JIBL), Jio Payment Solutions Limited (JPSL), Jio Leasing Services Limited (JLSL), and a Joint Venture (JV) with SBI, Jio Payments Bank Limited (JPBL).

JFSL announced a JV with BlackRock Inc. to establish, pending regulatory approvals, an Asset Management Company, and further expanded the scope of the partnership on April 15, 2024 by entering into another JV for the Wealth Management and Broking businesses.

Further, JLSL has set up a 50:50 JV Reliance International Leasing IFSC Limited (RILIL), with Reliance Strategic Business Ventures Limited (RSBVL), for undertaking

a ship leasing business.

RILIL is based out of Gujarat International Finance Tec-City (GIFT City) the international financial services centre (IFSC) in Gujarat.

Key Highlights FY24 Jio Financial Services

- ₹1,855cr. Total Income (Consolidated)

- ₹1,605cr. Profit after Tax (Consolidated)

- ₹2.53 Earnings per Share (Consolidated)

- ₹1,39,148cr. Networth (Consolidated)

- 584 Total Employees.

- 4.27mn Total Retail Shareholders

Jio Finance Limited (JFL) :

Consumer Lending : JFL’s initial focus is on offering secured loans aimed at both salaried and self Employed individuals, taking into account their risk profiles and business dynamics.

Its product suite includes loan against mutual funds, home loan (beta launch), with plans to offer loan against securities, loan against property and other secured lending products.

MSME and Corporate Lending : JFL provides a spectrum of financing options designed to support the operations of MSMEs and corporates.

The offerings include working capital loans and supply chain finance.

Jio Payments Bank Limited (JPBL)

As a digital-first bank, JPBL offers a powerful neighbourhood banking experience, in the phygital world, which is driven by simple, smart and secure solutions.

JPBL offers a fully capable mobile banking app. Customers can also walk into any of JPBL touchpoints for assisted account opening and transaction services, all done digitally.

The app powers 2,300 BC network partners spread across various Reliance Smart points, Reliance Trendz stores, Jio Points etc.

Jio Payment Solutions Limited (JPSL)

JPSL offers an extensive array of online and offline payment solutions tailored for diverse merchant categories, from large enterprises to government entities and SMEs/MSMEs.

Jio Insurance Broking Limited (JIBL)

JIBL offers a diverse range of products including fire, marine, property, group health, group term life, extended warranty, and motor insurance, along with bespoke sachet products integrated into the consumer journey.

JIBL has launched an online direct-to-consumer (D2C) platform that will allow customers to purchase general, health, and life insurance products from various insurers.

Jio BlackRock – Joint Venture

joint venture with BlackRock Inc. Group, the world’s largest asset manager.

The strategic partnership, a 50:50 JV, is aimed to Leverage JFSL’s extensive market reach and BlackRock’s investment acumen to democratise consumer access to

top-tier investment solutions across India.

The agreement outlines the structure for share subscriptions, governance, management roles, and mutual obligations, ensuring a clear operational roadmap.

JFSL has entered into another JV with BlackRock Inc. for wealth management and broking services, signifying a comprehensive approach to offer investment management solutions.

The commencement of these additional JVs are contingent upon receiving the necessary regulatory and statutory approvals.

Jio Leasing Services Limited (JLSL)

Jio Information Aggregator Services Limited (JIASL), later renamed as Jio Leasing Services Limited (JLSL), offers operating lease solutions to consumers and businesses

through a Device-as-a-Service (DaaS) model.

DaaS is a new-age service model where businesses or individuals lease certain goods along with associated services , instead of purchasing the devices outright.

DaaS typically includes installation, maintenance, support, and sometimes additional services like updates, offering an operating lease structure to customers.

Jio Financial Share Price Target 2024, 2025, 2027, 2030, 2040, 2050

When Jio Financial was separated from Reliance, at that time a large number of investors started selling this stock. On 21 August 2023, the stock of Jio Financial was listed in the stock market at a price of ₹ 260. Similarly, lower circuits kept appearing continuously in this stock for 1 week.

If you invest in Jio Financial Service shares for the long term, then there is a strong possibility of getting good returns. The company is expanding its services very rapidly, as was being reported in the news some time back, very soon the company will work together with the world’s most renowned company BlackRock in a mutual fund. BlackRock is the world’s largest asset manager. Jio Financial Service share price from 2024 to 2050, if stock market experts are to be believed, then Jio Financial share price target can reach the highest position in the financial sector. Let’s take a look at the Jio Financial share price target 2024 to 2050.

Also Read Now – bajaj Auto Share Price Target

Jio Financial Share Fundamentals

Fundamentals

Jio Financial Services Ltd

Market Cap

₹1,51,52,682 Cr.

52 Week High

394.70

52 Week Low

217.01

NSE Symbol

JIOFIN

ROE

1.17%

P/E Ratio

93.00

EPS

2.53

P/B Ratio

1.09

Dividend Yield

0.00%

Industry P/E

17.60

Book Value

215.86

Debt to Equity

0.00

Stock Face Value

10

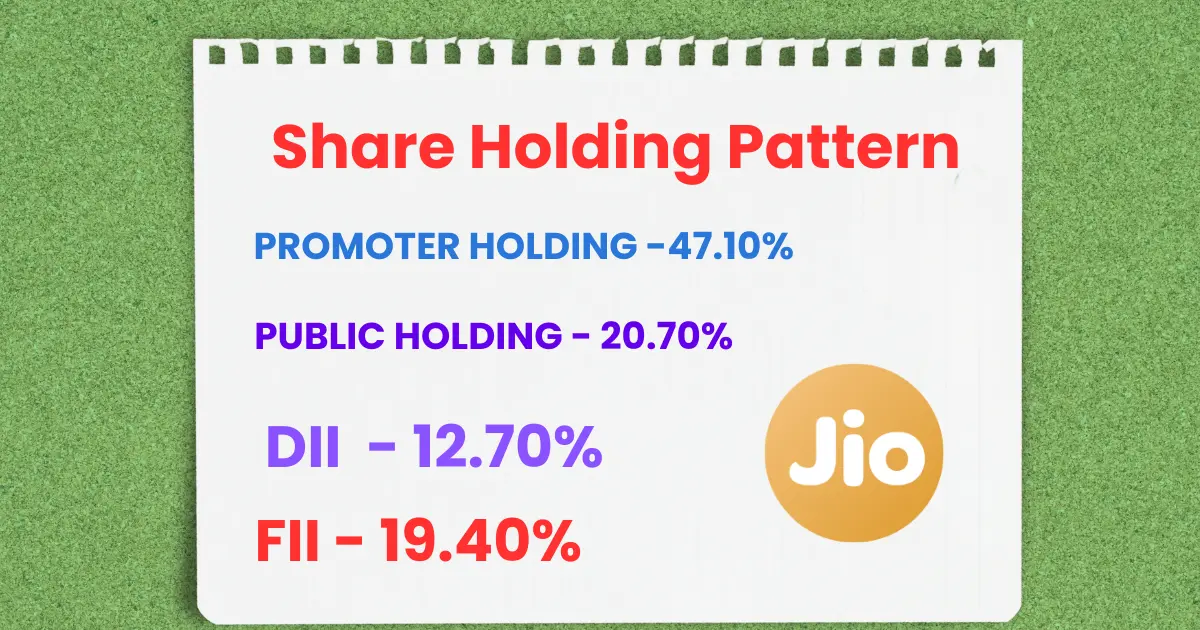

Jio Financial Share Shareholding Pattern

| Promoters | 47.12% |

|---|---|

| Retail & Others | 24.70% |

| DII | 7.43% |

| FII | 15.62% |

| Mutual Funds | 5.13% |

Jio Financial Share Financial Reports

| Sector | Year (2024) |

|---|---|

| Revenue | 1854 Cr. |

| Expense | 327 Cr. |

| Profit Before Tax | 1955 Cr. |

| Net Profit | 1604 Cr. |

Jio Financial Share Share Price Target 2025

The share price of Jio Financial Share may Ups & Down. According to our analysis levels, the minimum price of Jio Financial Share share in 2025 can be ₹220 and the maximum price can be ₹380.

Month Wise (Year 2025)

Target Price

January

₹220

December

₹380

Jio Financial Share Share Price Target 2026

The share price of Jio Financial Share may Ups & Down. According to our analysis levels, the minimum price of Jio Financial Share share in 2026 can be ₹300 and the maximum price can be ₹450.

Month Wise (Year 2026)

Target Price

January

₹300

December

₹450

Jio Financial Share Share Price Target 2027

The share price of Jio Financial Share may Ups & Down. According to our analysis levels, the minimum price of Jio Financial Share share in 2027 can be ₹400 and the maximum price can be ₹700.

Month Wise (Year 2027)

Target Price

January

₹400

December

₹700

Jio Financial Share Share Price Target 2028

The share price of Jio Financial Share may Ups & Down. According to our analysis levels, the minimum price of Jio Financial Share share in 2028 can be ₹600 and the maximum price can be ₹950.

Month Wise (Year 2028)

Target Price

January

₹600

December

₹950

Jio Financial Share Share Price Target 2029

The share price of Jio Financial Share may Ups & Down. According to our analysis levels, the minimum price of Jio Financial Share share in 2029 can be ₹900 and the maximum price can be ₹1350.

Month Wise (Year 2029)

Target Price

January

₹900

December

₹1350

Jio Financial Share Share Price Target 2030

The share price of Jio Financial Share may Ups & Down. According to our analysis levels, the minimum price of Jio Financial Share share in 2030 can be ₹1200 and the maximum price can be ₹1800.

| Month Wise (Year 2030) | Target Price |

| January | ₹1200 |

| December | ₹1800 |

How To Buy Jio Financial Share?

To buy Jio Financial shares, you can easily buy shares of Jio Financial Services by using the trading platform of many stock brokers.

The names of most trading platforms for buying Jio Financial shares are given below.

- Groww App

- Phonepe. Share Market App

- Angel One App

- Dhan App

- Upstox App

- Zerodha App

Types of Investors and Ratio of Jio Financial Services Shares

There are mainly four types of investors present in Jio Financial Services Shares.

Promoter Holding (47.10%)

The Promoter Holding means how much capital is invested by the promoter (owner of the company) of the company through total capital. Promoter Holding Capacity for Jio Financial Shares is (47.10%).

Public Holding (20.70%)

The Public investor is a person who invests in public market (big and small companies) to get profit in future. Public Holding Capacity for Jio Financial Shares is (20.70%).

FII (Foreign Institutional Investors) 19.40%

Foreign Institutional Investors are large companies that invest in different countries. FII for Jio Financial stock is 19.10%.

DII (Domestic Institutional Investors) 12.70%

Domestic Institutional Investors (such as insurance, companies and mutual funds) that invest in their own country. DII for Jio Financial stock is 14.52%.

Advantages and Disadvantages of Jio Financial Services Share

Every share has some advantages and some disadvantages. Jio Financial Services Share also has some advantages and disadvantages, which are detailed below.

- Advantages

The book value of the company has increased in the last 2 years, which is a good thing for the growth of the company. Jio Financial share price target has also increased over time. No shares of the company have been pledged which is a very positive sign for the growth of the company. The company does not have any debt, which will help the company in its growth.

- Disadvantages

Jio company has a share return on equity (4.50%) which is very poor, it has a negative impact on the growth of the company. PAT margin rate is also poor, which has a very negative impact on the growth of the company.

Conclusion

Hopefully, www.Moneymintidea.com will help you to get some basic information idea about Jio Financial services Share Price Target. Since Jio Financial Services Ltd is related to the financial sector. So the demand of this sector also increases which helps the stock to gain profit in future.

Frequently Asked Questions on Adani Power Share Price Target

Question 1: What is the share price target of Adani Power for 2025?

Answer 1: The estimated share price target for 2025 can range from ₹220 to ₹380.

Question 2: What is the share price target of Adani Power for 2030?

Answer 2: The estimated share price target of Adani Power for 2030 can range from ₹1200 to ₹1800.

Question 3: What are the primary growth drivers for Adani Power stock?

Answer 3: The most prominent growth drivers include a diversified portfolio, strategic market expansion, technological innovations, strong brand loyalty, etc.

Question 4: Is Adani Power a good long-term investment?

Answer 4: Yes, Adani Power shows a strong long-term potential due to its diversified operations, strategic expansion along with focus on further sustainability. Investors should keep an eye on the company’s Q3 results to stay updated on market trends and company performance.

Disclaimer :- The above article is for informational purposes only, and should not be construed as any investment advice. Money Mint idea suggests its readers/viewers to consult their financial advisors before making any money-related decisions.

9 thoughts on “Jio Financial Share Price Target 2025, to 2030 – Expert Analysis & Prediction.”