In this article, we are going to tell you in detail about Bajaj Auto share price target 2024, 2025, 2030, 2040, 2050. Today we will know in detail about the overall development and performance of Bajaj Auto company.

Talking about Bajaj Auto share price target, this stock is often in the news in the stock market regarding trading and long term investment. If you are also thinking of investing in the stock market, then this stock is the best for investment at the present time, if you have made up your mind then you should know well about Bajaj Auto share price target.

In today’s article, we will discuss the company’s financial growth, the company’s business policy, the company’s share holding pattern and a forecasted share price year after year. We will analyze all the data of the company to understand the Bajaj Auto share price target properly so that we can get an estimated information about the correct price. Let us take a look at what could be the price of this stock from Bajaj Auto share price target 2024 to 2050.

Table of Contents

ToggleWhat is Bajaj Auto Limited Company?

Bajaj Auto Limited is an Indian multinational automobile company that manufactures vehicles (two-wheelers and three-wheelers). This company has been working for 75 years. Bajaj Auto Limited Company started with scooters, then motorcycles and now manufactures many types of vehicles like auto rickshaws.

Company Overview

Bajaj Auto is the third largest motorcycle manufacturer in the world and the second largest in India. The company started its operations in 1945 by manufacturing scooters but today the company manufactures many vehicles like motorcycles, auto rickshaws, sports bikes, etc. We are exports its motorcycles to more than 70 countries of the world.

Fundamentals

Bajaj Auto Limited

Market Cap

₹2,56,456.75 Cr.

52 Week High

9,525

52 Week Low

4,544

NSE Symbol

BAJAJ-AUTO

ROE

26.61%

P/E Ratio

32.90

EPS

276.10

P/B Ratio

8.75

Dividend Yield

0.88%

Industry P/E

22.62

Book Value

1037.41

Debt to Equity

0.07

Stock Face Value

10

Bajaj Auto Share Price Target From 2024 to 2050

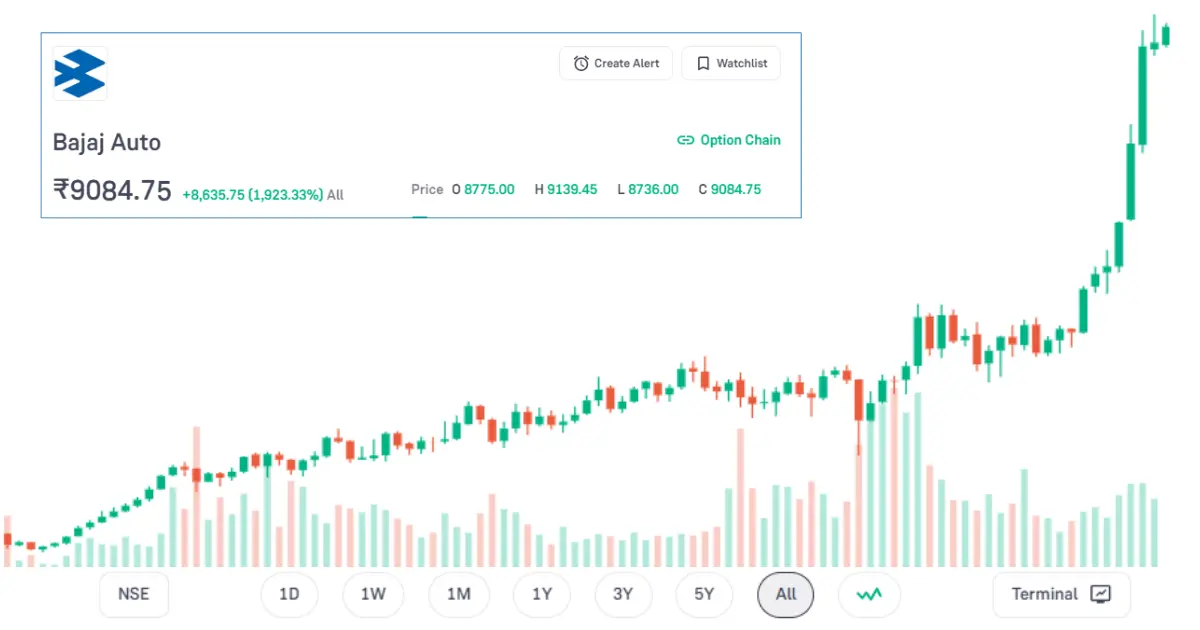

The Bajaj Auto shares are listed on both the stock exchanges NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). Bajaj Auto has given return of 10.94% in 3 months, +49.67% return in 6 months, 97.84% return in 1 year, +208.48% return in 5 years and (3,290.71%) return in its lifetime to its shareholders. From this, you can guess how much money this stock can make you.

Also Read Now – jio financial services Share Price Target

Bajaj Auto Share Price Target 2024

Year

Bajaj Auto target price 2024

1st Target

8,500

2nd Target

9,600

3rd Target

11,000

The Bajaj Auto Share Price Target 2027

Year

Bajaj Auto target price 2027

1st Target

17,610

2nd Target

18,355

3rd Target

19,120

Bajaj Auto Share Price Target 2030

Year

Bajaj Auto target price 2030

1st Target

24,570

2nd Target

25,960

3rd Target

26,800

The Bajaj Auto Share Price Target 2040

Year

Bajaj Auto target price 2040

1st Target

50,100

2nd Target

53,400

3rd Target

55,700

Bajaj Auto Share Price Target 2050

Year

Bajaj Auto target price 2050

1st Target

58,700

2nd Target

61,200

3rd Target

63,270

Bajaj Auto Shareholding Pattern

Promoters

55.06%

Retail & Others

21.93%

DII

3.45%

FII

14.20%

Mutual Funds

5.37%

Company Financial Reports

| Sector | Year (2023) |

|---|---|

| Revenue | 12,460 Cr. |

| Expense | 9,784 Cr. |

| Profit Before Tax | 2,676 Cr. |

| Net Profit | 2,042 Cr. |

How To Buy Bajaj Auto Share?

To buy Bajaj Auto shares, you can easily buy shares of Bajaj Auto by using the trading platform of many stock brokers.

The names of most trading platforms for buying Bajaj Auto shares are given below.

- Groww App

- Phonepe. Share Market App

- Angel One App

- Dhan App

- Upstox App

- Zerodha App

(Disclaimer :- The above article is for informational purposes only, and should not be construed as any investment advice. Money Mint idea suggests its readers/viewers to consult their financial advisors before making any money-related decisions.)

10 thoughts on “Bajaj Auto Share Price Target 2024, 2025, 2030, 2040, 2050”