Motilal oswal financial Services Share Price Target : Are you thinking of investing in Motilal oswal financial Services shares? Want to know its future price target? In this guide, we will discuss Motilal oswal financial Services share price target for the year 2025, 2026, 2030. Along with this, we will do a complete fundamental analysis to help you make the right decision.

Our Business

Our Company was incorporated as a public limited of ‘Motilal Oswal Financial Services Limited ’May 18, 2005. Our Company is one of the largest full-service brokers in India with highest gross brokerage revenue as of March 31, 2023 amongst players in the broking industry

Motilal Oswal Group offers a diversified range of financial products and services such as retail broking and distribution, institutional broking, investment banking, asset management, private equity, wealth management and housing finance.

Our Company acts as a stock-broker and commodities broker for clients comprising of retail customers (including high net worth individuals), mutual funds, foreign institutional investors, financial institutions and corporate clients.

Our broking and allied services are offered through our (i) network of over 2,500 Business Locations spread across over 550 cities in India as of December 31, 2023; (ii) online and digital platforms including mobile applications (iii) network of over 9,300 Business Associates spread over various locations in India as of December 31, 2023.

Our Company have had more than one crore download of our mobile applications as of December 31, 2023, which enabled our clients to avail services digitally.

Our Company started operations in 1987 as a provider of sub-broking and prudential portfolio services and has over 37 years of experience in broking and distribution industry.

The Equity Shares of our Company were listed on BSE and National Stock Exchange of India Limited in September 2007.

Our Company is registered with SEBI under the Stock Brokers and Sub Brokers Regulations, 1992 and is a member of BSE, NSE, MCX and NCDEX.

We provide a wide range of financial services to our clients which can be principally divided into four segments including capital markets, asset and wealth management, affordable housing finance and treasury investments, the details of which are as follows:

Qualitative Factors

- Large and diverse distribution network

- Strong research and sales teams

- Skilled and experienced top management

- Well-established brand

- Wide range of financial products and services

Comparison of accounting ratios with listed industry peers

- Indiabulls Financial Services

- India Infoline

- IL&FS Investsmart

Motilal Oswal Financial Services Fundamentals

Fundamentals

Motilal Oswal Financial Services

Market Cap

₹40,382Cr

52 Week High

1,064.00

52 Week Low

345.36

NSE Symbol

MOTILALOFS

ROE

30.58%

P/E Ratio

12.28

EPS

54.89

P/B Ratio

3.65

Dividend Yield

0.52

Industry P/E

14.95

Book Value

184.72

Debt to Equity

1.41

Stock Face Value

1

Also Read : CDSL Share Price Target Forecasts from 2025 to 2030

Motilal Oswal Financial Services Shareholding Pattern

Promoters

68.71%

Retail & Others

19.01%

DII

0.55%

FII

5.89%

Mutual Funds

5.84%

Motilal Oswal Financial Services Financial Reports

Sector

Year (2024)

Revenue

7130Cr.

Expense

4098Cr.

Profit Before Tax

3031Cr.

Net Profit

2445Cr.

Motilal Oswal Financial Services Share Price Target 2025

The share price of Motilal Oswal Financial Services may Ups & Down. According to our analysis levels, the minimum price of Motilal Oswal Financial Services share in 2025 can be ₹650 and the maximum price can be ₹800.

Month Wise (Year 2025)

Target Price

January

₹650

February

₹666

March

₹680

April

₹695

May

₹700

June

₹715

July

₹730

August

₹740

September

₹755

October

₹770

November

₹785

December

₹800

Also Read : Eicher Motors Share Price Target Forecasts from 2025 to 2030

Motilal Oswal Financial Services Share Price Target 2026

The share price of Motilal Oswal Financial Services may Ups & Down. According to our analysis levels, the minimum price of Motilal Oswal Financial Services share in 2026 can be ₹800 and the maximum price can be ₹1000.

Month Wise (Year 2026)

Target Price

January

₹800

December

₹1000

Also Read : Orient Green Share Price Target Forecasts from 2025 to 2030

Motilal Oswal Financial Services Share Price Target 2030

The share price of Motilal Oswal Financial Services may Ups & Down. According to our analysis levels, the minimum price of Motilal Oswal Financial Services share in 2030 can be ₹1500 and the maximum price can be ₹2100.

Month Wise (Year 2030)

Target Price

January

₹1500

December

₹2100

Also Read : MOFS Share Price Target Forecasts from 2025 to 2030

Motilal Oswal Financial Services Share Price Target 2040

The share price of Motilal Oswal Financial Services may Ups & Down. According to our analysis levels, the minimum price of Motilal Oswal Financial Services share in 2040 can be ₹3000 and the maximum price can be ₹4500.

Month Wise (Year 2040)

Target Price

January

₹3000

December

₹4500

Also Read : Hindustan Aeronautics Share Price Target Forecasts from 2025 to 2030

Motilal Oswal Financial Services Share Price Target 2050

The share price of Motilal Oswal Financial Services may Ups & Down. According to our analysis levels, the minimum price of Motilal Oswal Financial Services share in 2050 can be ₹6000 and the maximum price can be ₹8000.

Month Wise (Year 2050)

Target Price

January

₹6000

December

₹8000

Also Read : Tata Motors Share Price Target Forecasts from 2025 to 2030

Our Company is registered with CDSL and NSDL in the capacity of depository participant.

Our Company is also registered with SEBI in capacity of a research analyst and with other regulatory agencies inter alia including IRDAI, Association of Mutual Funds in India, RERA, CERSAI, KYC Registration Agencies and NSDL Database Management Limited.

Our Company has a pan-India presence with domestic offices in 22 states including two union territories and one international representative office and employed 7,601 employees as of December 31, 2023.

Our Company provides broking services across the states through our online and digital platforms, along with our vast network of Business Locations and Business Associates, which are integrated with each other enabling our clients to have a seamless trading and investment experience, positioning us to benefit from the development of Indian financial market, increased emphasis on digitisation and growth in returns from such financial investments.

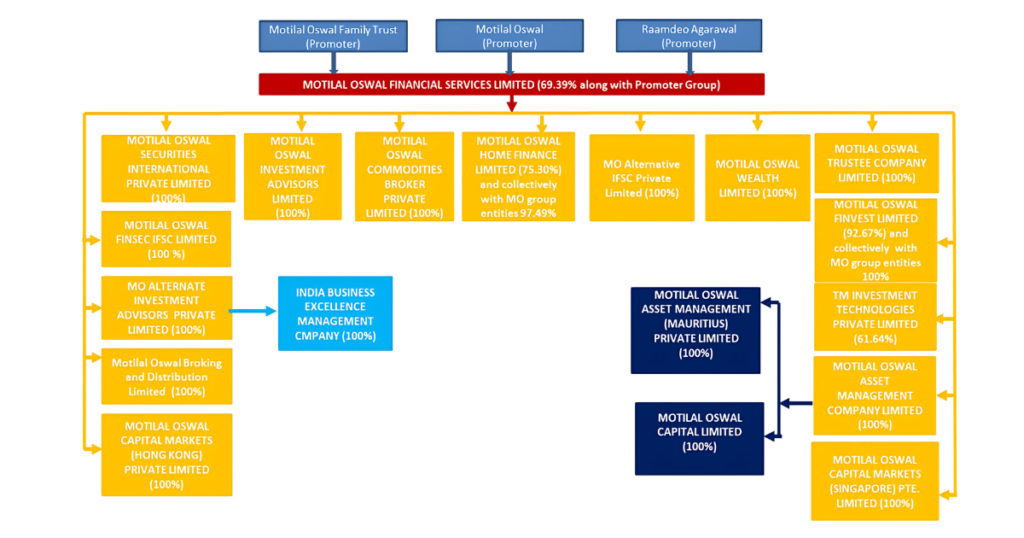

Structure of the Group

A. Capital markets

Broking and distribution : – Our Company along with certain of our Subsidiaries, namely, MO Commodities Broker, MOFL, MOSIPL, MO Singapore, MO Hongkong and MO Finsec IFSC provide broking services across equity (cash-delivery, intra-day, futures and options) commodity and currency derivatives to our clients comprising of retail customers (including high net worth individuals), mutual funds, institutional investors, foreign institutional investors, financial institutions and corporate clients.

As a part of the broking and advisory services offered by our Company, it also facilitates opening of demat accounts for our clients.

The broking and distribution business is based on the following key premises :-

(i) Investment advisory :- As of December 31, 2023, our Company has a dedicated team of over 2,500 advisors.

Our Company provide investment advisory services to our clients with customised investment ideas and strategies based on our market and technical analysis, which our Company believe assists our clients in achieving their investment goals across various investment avenues

such as equities, derivatives and commodities.

(ii) Investor education:- Our website, www.motilaloswal.com, is also a knowledge centre which aims to empower investors, including our clients, with an understanding in respect of trading and investments products. As part of our investor awareness, our Company undertake initiatives

including organizing conferences, management meetings and webinars to disseminate investment ideas and to enhance our retail clients’ knowledge regarding our products, research and market trends.

(iii) Distribution:- Our Company undertake distribution of third-party financial products such as portfolio management services, insurance products and mutual funds according to our clients’ requirements.

Our Company believes that distribution business helps our clients to achieve their financial and risk mitigation objectives by providing them with personal wealth management services.

(iv) Funding facility:- We also provide margin trade financing facility, working capital loans, loans against securities, unsecured loans, including initial public offering funding and other loan products to our clients.

Institutional equities :- As of December 31, 2023, our Company has a dedicated research team of 41 members who carter to quantitative and qualitative research requirements relating to the stock market such as equities, derivatives and commodities.

Our Company’s research product portfolio covers more than 250 companies in 21 sectors as of December 31, 2023.

Investment banking:- Through our Subsidiary, MO Investment Advisors, we undertake investment banking business and advise companies inter alia in its initial public offerings and private placements (including qualified institutional placements).

We believe that sectoral focus on BFSI, auto, consumer, healthcare and industrials is expected to yield benefits in the medium to long term. We constantly engage in a wide crosssection of transactions across capital markets and advisory to achieve inter-segment synergies.

B. Asset and wealth management

Asset management :- Through our Subsidiaries, namely, MOAMC, MO Trustee, MO Mauritius and MOCL, which operates mutual funds, portfolio management services and alternative investment funds in the public equities space.

We have a diverse product basket with categories including Indian-equities, international equities, factors, sectors, commodities, multi asset and debt.

Wealth management :- Through our Subsidiary, MOWL, which offers customised investment management services including planning, advisory, execution and monitoring of a range of investment products to our retail customers.

Private equity and real estate :- Through our Subsidiaries, namely, MO Alternate, IBEMC and MO Alternative IFSC, which manages three equity growth capital funds and four real estate funds. The equity growth funds are focused on themes that may benefit from structural changes like domestic consumption, domestic savings and infrastructure.

C. Housing finance

Affordable housing finance services are provided through our Subsidiary, MOHFL, which focuses on providing home loans to individuals and families inter alia for purchase, construction (including renovation) and extension of houses.

MOHFL also provide home loans to families in the new to credit, self-employed, cash salaried category where formal income proof and credit bureau reports are not easily available, thereby promoting financial inclusion.

D. Treasury investments

Our Company along with certain of our Subsidiaries, inter alia including, MOAMC, MOFL, MO B&D, TMITPL, MO Investment Advisors and MOWL manages treasury investments out of the operating profit generated by the respective entities with investments across mutual funds, portfolio management services, alternative investment funds, publicly traded stocks, bonds and other securities which involves buying undervalued assets with the intention of holding them for long term.

How To Buy Motilal oswal financial Services Share?

To buy Motilal oswal financial Services shares, you can easily buy shares of Motilal oswal financial Services by using the trading platform of many stock brokers.

The names of most trading platforms for buying Motilal oswal financial Services shares are given below.

- Groww App

- Phonepe. Share Market App

- Angel One App

- Dhan App

- Upstox App

- Zerodha App

Disclaimer :- The above article is for informational purposes only, and should not be construed as any investment advice. Money Mint idea suggests its readers/viewers to consult their financial advisors before making any money-related decisions.

4 thoughts on “Motilal Oswal Financial Services Share Price Target 2025, 2026, 2030 to 2040”