NSE Unlisted Share Price: Are you thinking of investing in NSE Unlisted share Price? Want to know its future Price target? In this guide, we will discuss the NSE Unlisted share Price for the year 2025. Along with this, we will do a complete Fundamental Analysis to help you make the right Decision on the NSE Unlisted share Price.

About NSE LTD

Our Company was incorporated in Mumbai on 27 November 1992. We are the leading stock exchange in India and the fourth largest in the world by equity trading volume in 2015, according to WFE.

We own and manage the NIFTY 50 index, a leading benchmark for the Indian capital markets.

We offer comprehensive coverage of the Indian capital markets across asset classes, including equity, fixed income and derivative securities.

We have a fully-integrated business model comprising our exchange listings, trading services, clearing and settlement services, indices, market data feeds, technology solutions and financial education offerings.

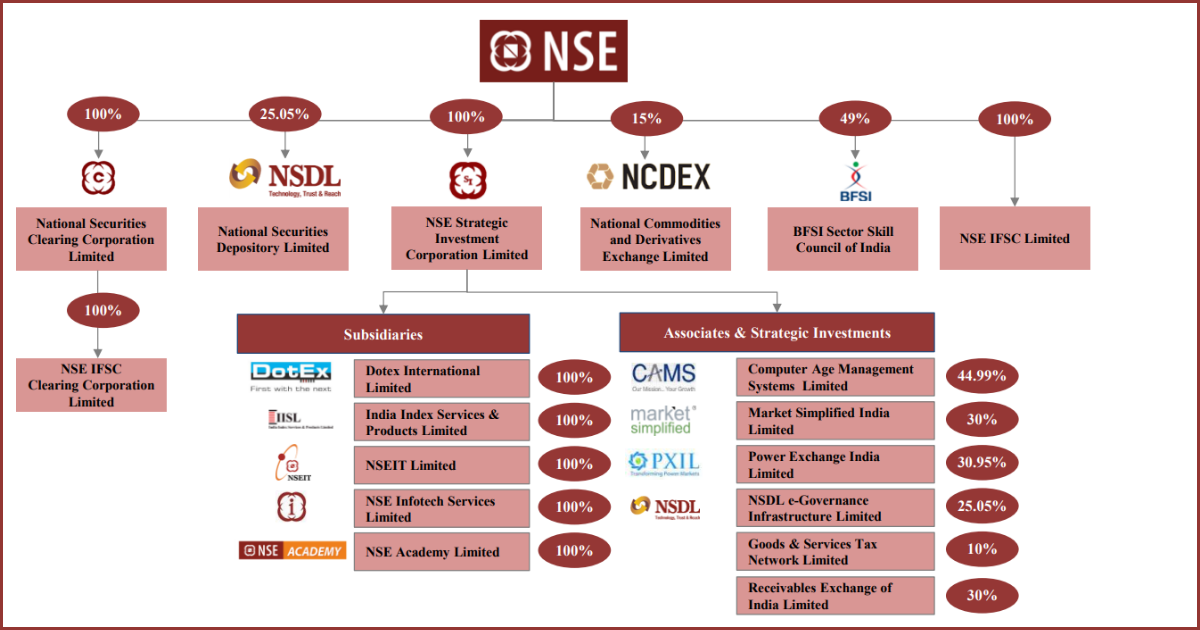

NSE Group Companies

- NSE Academy

- NSE Clearing

- NSE Data & Analytics

- NSE Foundation

- NSE Indices

- NSE International Exchange

- NSE International Clearing

- NSE Investments

- NSEIT

Products & Services

- Equity Market

- Indices

- Emerge Platform

- Mutual Funds

- Equity Derivatives

- Currency Derivatives

- Commodity Derivatives

- Interest Rate Derivatives

- Fixed Income and Debt

- Public Issues

Also Read: Oravel Stays OYO Unlisted Share

We also oversee compliance by our trading and clearing members and listed companies with the rules and regulations of our exchange.

We ranked first among exchanges globally in terms of stock index option and currency option trading volumes in 2015, according to WFE.

We also ranked second among exchanges globally in terms of single stock future contracts trading volume and currency future contracts trading volume in 2015, according to WFE.

Qualitative Factors

- It is a market leader in India and a leading stock exchange globally.

- Strong track record of growth in an Indian economy poised for further growth.

- Comprehensive and innovative product and service offerings delivered through a vertically integrated business model supported by a robust risk management system.

- Proprietary technology platform with a track record of innovation.

- Strong and diverse financial profile across established and high-growth business lines.

- Experienced and skilled management team.

Also Read: Tata Capital Unlisted Share Price

NSE Unlisted Share Price Fundamentals Detail

Fundamentals

Oravel Stays Limited

Share Price

₹1870

Market Cap

₹470250Cr

Lot Size

250 Shares

52 Week High

6500

52 Week Low

1900

ROE

35.06%

P/E Ratio

55.95

EPS

33.97

P/B Ratio

19.61

Dividend Yield

0.00%

Industry P/E

0.00

Book Value

96.87

Debt to Equity

0.00

Stock Face Value

1

Also Read: BoAt Unlisted Share Price

Financials Data NSE Unlisted Share Price

Financials Data (in Cr.)

FY20

FY21

FY22

FY23

FY24

Net Sales

3507.9

5624.8

8929.5

11856.2

14780

Total Income

3897.5

6202.3

9499.6

12765.4

16433.6

Net Profit

1884.8

3573.4

5198.3

7356

8406.5

Shareholder Funds

8622

11636

15418.3

20480.4

23973.9

Total Assets

24170.3

29205.6

35607

36564.3

65464

EPS

7.62

14.44

21

29.72

33.97

NSE unlisted share dividend

Year

Record Date

Final Dividend

Interim Dividend

2012

September 27

Rs. 40 per share

--

2013

September 26

Rs. 50 per share

--

2014

August 08

Rs. 68 per share

--

2015

September 18

Rs. 79.50 per share

--

2016

September 16

Rs. 73 per share

--

2017

July 28

Rs. 12.25 per

share

--

2018

July 27

Rs. 7.75 per

share

Rs.9.25

2019

July 26

Rs.8.00 per

share

Rs.9.80

2020

September 11

Rs.11-00 per

share

--

2021

August 18

Rs. 24.75 per

share

--

2022

July 05

Rs. 42.00 per

share

--

2023

August 16

Rs. 80.00 per

share

--

2024

August 20

Rs. 90.00 per

share

--

NSE Unlisted Share Bonus

Year

Record

Date

Bonus shares

2016

Nov 23

1:10

2024

Nov 02

4:1

We have leading market shares by total turnover of 85% in equity cash trading, 94% in equity derivatives trading, 59% in currency derivatives trading, 79% in interest rate derivatives trading, 77% in ETFs trading, and 80% in corporate bonds trading for fiscal 2016.

4 thoughts on “NSE India Limited Unlisted Share Price 2025”