Following Strong growth in the Beauty and Fashion Sectors Nykaa Share is Becoming a hot Topic Among investors. In this Post well Analyze Nykaa Share Price Target for 2025, 2026, and 2030, Based on Reliable Market data from Trendlyne, Moneycontrol, INDmoney, and TradingView.

Well also Explore Nykaa Business Fundamentals Future Growth outlook & Market Expert Predictions to help you Make informed investment Decisions. Whether your a Short-term Trader or a Long-term investor this Detail Analysis will Provide insight into Nykaa Share Performance and future Prospects.

At Nykaa, we are not just a retailer we are the creators and builders of India beauty and fashion market. Nykaa has cumulatively served over 49 million customers across its beauty and fashion platforms.

Also Read: Groww Share Price TargetLong Term Growth Profit

we have established a robust omnichannel presence, combining our online beauty platform along with the largest network of 237 beauty physical stores Nationwide.

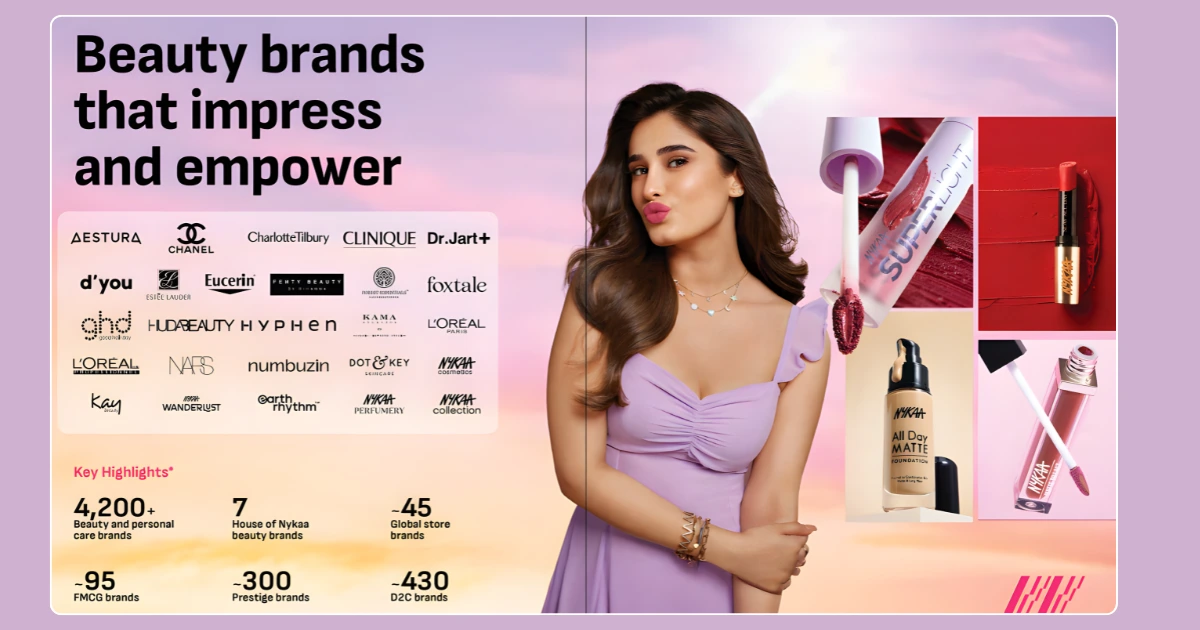

This allows us to serve over 34 million beauty customers by providing access to more than 4,200 global and domestic beauty brands. Additionally, Nykaa empowers 2.76 lakh retailers in the unorganised BPC market by utilising technology and customer demand data across 1,100 Indian cities.

Nykaa fashion offers a curated selection of the Latest trends from over 4,400 global and domestic brands. Our fashion platform has been able to emerge as the 01 platform of choice for all the latest trends/styles in Fashion.

Through the House of Nykaa offerings in both beauty and fashion, Nykaa addresses gaps in the Indian market by providing curated assortments tailored to local preferences. As of March 31, 2025.

the House of Nykaa portfolio includes seven beauty brands and five fashion brands. Many of our House of Nykaa brands have been able to achieve a significant scale.

Nykaa Share Price Target Tomorrow

Nykaa Share Price Target 2025

The share price of Nykaa may go up & Down. According to our analysis levels, the minimum price of Nykaa Shares in 2025 can be ₹260, and the maximum price can be ₹290.

| Month Wise (Year 2025) | Target Price |

|---|---|

| November | ₹260 |

| December | ₹290 |

Shriram Finance Share Price Target

Nykaa Share Price Target 2026

The share price of Nykaa may go up & Down. According to our analysis levels, the minimum price of Nykaa Shares in 2026 can be ₹300, and the maximum price can be ₹500.

| Month Wise (Year 2026) | Target Price |

|---|---|

| January | ₹300 |

| December | ₹500 |

Lenskart IPO Listing Price Prediction 2025 | Expert Analysis & Forecast

Nykaa Share Price Target 2027

The share price of Nykaa may go up & Down. According to our analysis levels, the minimum price of Nykaa Shares in 2027 can be ₹400, and the maximum price can be ₹700.

| Month Wise (Year 2027) | Target Price |

|---|---|

| January | ₹400 |

| December | ₹700 |

Vibhor steel tubes Share Price Target

Nykaa Share Price Target 2028

The share price of Nykaa may go up & Down. According to our analysis levels, the minimum price of Nykaa Shares in 2028 can be ₹500, and the maximum price can be ₹1000.

| Month Wise (Year 2028) | Target Price |

|---|---|

| January | ₹500 |

| December | ₹1,000 |

Studds Accessories Share Price Target

Nykaa Share Price Target 2029

The share price of Nykaa may go up & Down. According to our analysis levels, the minimum price of Nykaa Shares in 2029 can be ₹700, and the maximum price can be ₹1500.

| Month Wise (Year 2029) | Target Price |

|---|---|

| January | ₹700 |

| December | ₹1,500 |

Nykaa Share Price Target 2030

The share price of Nykaa may go up & Down. According to our analysis levels, the minimum price of Nykaa Shares in 2030 can be ₹1000, and the maximum price can be ₹1900.

| Month Wise (Year 2030) | Target Price |

|---|---|

| January | ₹1,000 |

| December | ₹1,900 |

Nykaa Fundamentals

| Fundamentals | Nykaa |

|---|---|

| Market Cap | ₹73,929 Cr |

| 52 Week High | 277.00 |

| 52 Week Low | 154.90 |

| NSE Symbol | NYKAA |

| ROE | 7.50% |

| P/E Ratio | 717.36 |

| EPS | 0.36 |

| P/B Ratio | 53.26 |

| Dividend Yield | 0.00% |

| Industry P/E | 123.30 |

| Book Value | 4.85 |

| Debt to Equity | 1.01 |

| Stock Face Value | 1 |

Nykaa Shareholding Pattern

| Retail & Others | 10.36% |

|---|---|

| FII | 12.20% |

| Promoters | 52.12% |

| DII | 5.84% |

| Mutual Funds | 19.51% |

The Nykaa Financial Reports

| Sector | Year (2025) |

|---|---|

| Revenue | 2,880 Cr. |

| Expense | 2,754 Cr. |

| Profit Before Tax | 109.62 Cr. |

| Net Profit | 67.74 Cr. |

People also ask F&Q

Question 1: What is the share price target of Nykaa for 2025?

Answer 1: The estimated share price target of Nykaa for 2025 can range from ₹260 to ₹290.

Question 2: What is the share price target of Nykaa for 2030?

Answer 2: The estimated share price target of Nykaa for 2030 can range from ₹1000 to ₹1900.

Question 3: What are the primary growth drivers for Nykaa stock?

Answer 3: The most prominent growth drivers include a diversified portfolio, strategic market expansion, technological innovations, and strong brand loyalty.

Question 4: Are Nykaa a good long-term investment?

Answer 4: Nykaa has strong long-term potential due to its diversification and sustainability focus. Investors should watch the company’s Q3 results for market insights.

Question 5: Is Nykaa listed in NSE?

Answer 5: Nykaa were listed at ₹406.18 on NSE.

Question 6: Who is the CEO of Nykaa?

Answer 6: Falguni Nayar is the CEO of Nykaa.

Question 7 : What is the share price of Nykaa in 2035?

Answer 7: The estimated share price target for 2035 can range from ₹2200 to ₹3500.

Question 8 :What is the target price of Nykaa in 2040?

Answer 8: The estimated share price target for 2040 can range from ₹4200 to ₹6000.

Disclaimer

This Article is for educational Purposes only and does not Constitute investment advice. Please Consult your Financial advisor Before making any investment Decisions.