Piccadily Agro Industries Share Price Target: Are you considering investing in Piccadily Agro Industries Shares? Want to know its future Price target? This guide will discuss the Piccadily Agro Industries share price target for The Years 2025, 2026 and 2030. Along with this, we will do a complete Fundamental analysis to help you make the right decision.

About Piccadily Agro Industries Ltd

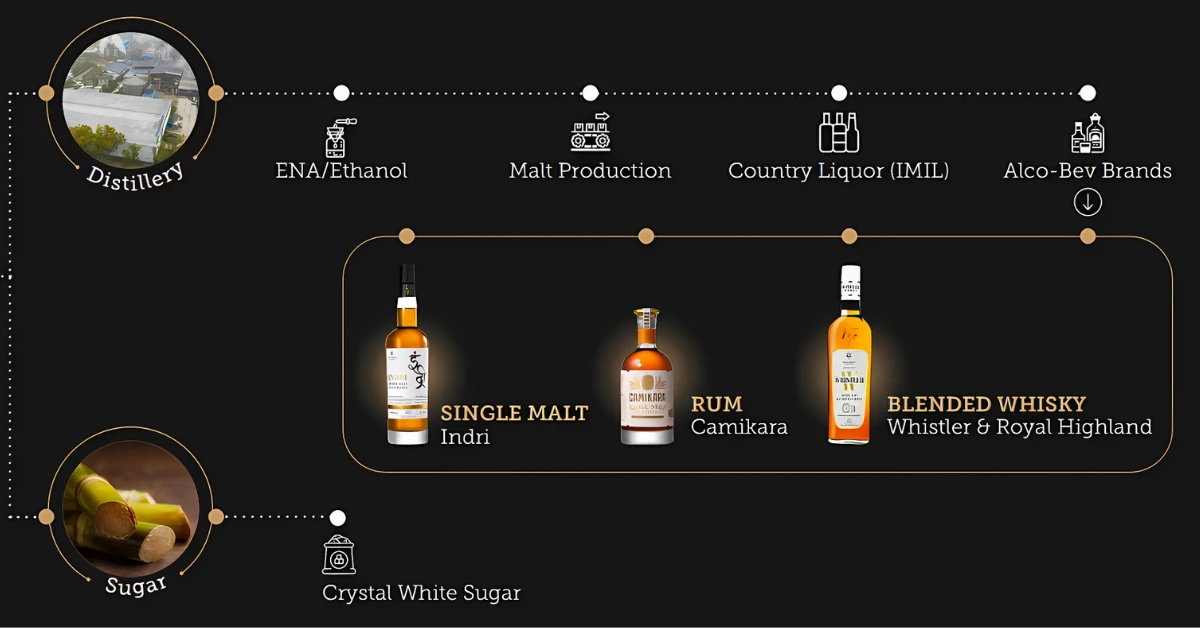

Our Company Piccadily Agro Industries (PAIL) is a Name Synonymous With heritage Crafts-manship & Innovation Our Company Incorporation in 1994 it has grown to Become India Largest Independent Producer of Malt Spirits.

Piccadily Agro Industries Our Product Portfolio Includes single malt whiskies, Cane juice rum & a Range of IMFL brands, setting new benchmarks in quality and innovation.

Our Company Manufacture Ethanol Extra Neutral Alcohol (ENA), DDGS and white crystal sugar With a diverse portfolio of premium alco-bev Brands & More Products in The offing ,We Endeavour to define the Future of niche & Premium Indian Alco-bev Spirits in India and Overseas.

At the heart of our Operations Lies a state-of-the-art Manufacturing Facility in Indri, Haryana, Spanning 168 Acres Areas. This World-class Facility Seamlessly Integrates Cutting-Edge Technology to Produce.

Malt :

- Capacity of 12 KLPD.

- Setting new standards in quality and refinement

Extra Neutral Alcohol (ENA) and Ethanol :

- Capacity of 78 KLPD.

- Contributing to sustainable energy solutions and a greener future.

White Crystal Sugar :

- Capacity of 5,000 TCD.

- Collaborating with 5,000+ Farmers for Sustainable Sugarcane Sourcing.

Architects of Premium Spirits:

Piccadily Agro LTD is at The forefront of India evolving spirits Landscape, by driving Premiumization & Setting New Benchmarks in Craftsmanship and Innovation. With An insightful grasp of market Dynamics and a steadfast Dedication to Fine Craftsmanship, we Cater to a Select clientele who Value not only Quality but the Artistry of Innovation.

Through our flagship brands, we deliver more than just spirits we offer an experience that transcends the ordinary where timeless tradition meets contemporary mastery.

Each creation is a testament to our relentless pursuit of excellence, refining the very essence of premium and redefining the art of indulgence

- 12 KLPD Malt Plant.

- 78 KLPD Ethanol / ENA Plant.

- 28 Country presence.

- 11,000+ PAN India Retail Outlets.

Piccadily Agro Industries Share Price Target Tomorrow

Piccadily Agro Industries Share Price Target 2025

The share price of Piccadily Agro Industries may go up & Down. According to our analysis levels, the minimum cost of Piccadily Agro Industries shares in 2025 can be ₹500, and the maximum price can be ₹700.

| Month Wise (Year 2025) | Target Price |

|---|---|

| January | ₹500 |

| February | ₹515 |

| March | ₹535 |

| April | ₹560 |

| May | ₹580 |

| June | ₹595 |

| July | ₹615 |

| August | ₹635 |

| September | ₹650 |

| October | ₹660 |

| November | ₹680 |

| December | ₹700 |

Piccadily Agro Industries Share Price Target 2026

The share price of Piccadily Agro Industries may go up & Down. According to our analysis levels, the minimum cost of Piccadily Agro Industries shares in 2026 can be ₹600, and the maximum price can be ₹850.

| Month Wise (Year 2026) | Target Price |

|---|---|

| January | ₹600 |

| December | ₹850 |

Cochin Shipyard Share Price Target

Piccadily Agro Industries Share Price Target 2027

The share price of Piccadily Agro Industries may go up & Down. According to our analysis levels, the minimum cost of Piccadily Agro Industries shares in 2027 can be ₹700, and the maximum price can be ₹1,000.

| Month Wise (Year 2027) | Target Price |

|---|---|

| January | ₹800 |

| December | ₹1,250 |

Vibhor steel tubes Share Price Target

Piccadily Agro Industries Share Price Target 2028

The share price of Piccadily Agro Industries may go up & Down. According to our analysis levels, the minimum cost of Piccadily Agro Industries shares in 2028 can be ₹800, and the maximum price can be ₹1,250.

| Month Wise (Year 2028) | Target Price |

|---|---|

| January | ₹800 |

| December | ₹1,250 |

Bharat Dynamics Share Price Target

Piccadily Agro Industries Share Price Target 2029

The share price of Piccadily Agro Industries may go up & Down. According to our analysis levels, the minimum cost of Piccadily Agro Industries shares in 2029 can be ₹950, and the maximum price can be ₹1,500.

| Month Wise (Year 2029) | Target Price |

|---|---|

| January | ₹950 |

| December | ₹1,500 |

Piccadily Agro Industries Share Price Target 2030

The share price of Piccadily Agro Industries may go up & Down. According to our analysis levels, the minimum cost of Piccadily Agro Industries shares in 2030 can be ₹1,100, and the maximum price can be ₹1,800.

| Month Wise (Year 2030) | Target Price |

|---|---|

| January | ₹1,100 |

| December | ₹1,800 |

Piccadily Agro Industries Fundamentals

| Fundamentals | Piccadily Agro Industries |

|---|---|

| Market Cap | ₹5,346 Cr |

| 52 Week High | 1,019.90 |

| 52 Week Low | 352.60 |

| BSE Symbol | 530305 |

| ROE | 16.96% |

| P/E Ratio | 50.51 |

| EPS | 11.22 |

| P/B Ratio | 8.87 |

| Dividend Yield | 0.00% |

| Industry P/E | 70.19 |

| Book Value | 63.91 |

| Debt to Equity | 0.35 |

| Stock Face Value | 10 |

Piccadily Agro Industries Shareholding Pattern

| Retail & Others | 28.24% |

|---|---|

| FII | 0.78% |

| DII | 0.01% |

| Promoters | 70.97% |

The Piccadily Agro Industries Financial Reports

| Sector | Year (2024) |

|---|---|

| Revenue | 208.33 Cr. |

| Expense | 148.18 Cr. |

| Profit Before Tax | 36.72 Cr. |

| Net Profit | 25.05 Cr. |

People also ask F&Q

Question 1: What is Piccadily Agro Industries’ share price target for 2025?

Answer 1: The Piccadily Agro Industries‘ estimated share price target for 2025 can range from ₹500 to ₹700.

Question 2: What is Piccadily Agro Industries’ share price target for 2030?

Answer 2: Piccadily Agro Industries‘ estimated share price target for 2030 can range from ₹1,100 to ₹1,800.

Question 3: What are the primary growth drivers for Piccadily Agro Industries stock?

Answer 3: The most prominent growth drivers include a diversified portfolio, strategic market expansion, technological innovations, and strong brand loyalty.

Question 4: Is Piccadily Agro Industries a good long-term investment?

Answer 4: Piccadily Agro Industries has strong long-term potential due to its diversification and sustainability focus. Investors should watch the company’s Q3 results for market insights.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your research before making investment decisions.