Unicommerce E- Solutions IPO details Today : Unicommerce E- Solutions IPO details Today is Open on 6 AuTgust 2024 and Close on 8 August 2024. Unicommerce E- Solutions IPO to Raise 25,608,512 shares (Approx ₹276.57 Cr) via IPO. The Offer For Sale is 25,608,512 shares (Approx ₹276.57 Cr).

Company Incorporated in February 2012 We are India’s largest e-commerce enablement Software-as-a-Service (“SaaS”) platform in the transaction processing or nerve centre layer 23, in terms of revenue for the financial year ended March 31, 2022 that enables end-to-end management of e-commerce operations for brands, sellers and logistics service provider firms.

We are also the only profitable company among the top five players in this industry in India.

We enable our enterprise clients and small and medium business (“SMB”) clients to efficiently manage their entire journey of post-purchase e-commerce operations through a comprehensive suite of SaaS products that include

(i) the warehouse and inventory management system (“WMS”).

(ii) the multi-channel order management system (“OMS”).

(iii) the omni-channel retail management system (“Omni-RMS”).

(iv) seller management panel for marketplaces, housed in our platform, Uniware.

(v) recently introduced post-order services related to logistics tracking and courier allocation (“UniShip”).

(vi) payment reconciliation (“UniReco”).

We offer several sub-modules that our customers may use as a part of their routine operations. Our products act as the nerve centre for e-commerce fulfilment operations of our clients, ensuring that the orders received from our clients’ end customers are processed correctly, efficiently and within timelines as per client needs. Our products aid in streamlining e-commerce operations for our clients and enables us to become a critical part of the supply chain stack of our clients.

The chart below depicts a snapshot of our scale and financial health as of September 30, 2023:23Transaction processing and nerve centre layer refers to a stage of the order journey where key business activities happen to enable the fulfilment of the order placed by a customer. These include, among other things, acknowledging the order, packaging the order at a warehouse facility or a store and handing it over to a logistics partner for fulfillment.

E-commerce businesses and retailers face significant challenges to scale their operations efficiently. Some of the major challenges faced by e-commerce businesses, D2C brands and retailers include management of inventory across multiple locations, minimising fulfilment costs, order processing from multiple onlineand offline channels, management of returns, generation of correct invoices, reconciliation of order payments, enabling shipment tracking for their customers, taxation and other regulatory compliances.

Brands and retailers are reachingout to the customers through multiple offline channels and online channels to compete in the market. As the number of these marketplaces and omni-channel practicescontinues to increase, the demand for e-commerce enablement SaaS products is directly affected.

As businesses scale to process higher numbers of orders fortheir ecommerce operations, the scale of such challenges also increases exponentially, including keeping inventory updated across all sale channels, processing orders through the correct warehouse, management of distributed inventory across multiple warehouses and adhering to service-level agreements (“SLAs”) and procedures for respective sales channels.

Given the range of issues, regularly changing business needs and market practices, and the need for sanctity of data across the various stages, customers prefer comprehensive end-to-end transaction processing layer SaaS products. Our products are designed and regularly updated to meet these challenges and the business needs of various types and sizes ofretail enterprises, both online and offline.

We provide a modular suite of products with features developed over years for a variety of uses across industries, including inter alia, inventory management and visibility, management of orders across channels, timely order fulfilment and minimised cancellations, procurement and vendor management and returns management. Our products are sector and size-agnostic and are designed to meet the business needs of various types and sizes of retail and e-commerce enterprises, both online and offline.

Our products are configurable as per client needs, and our clients can use oneor more products at a time depending on their needs and configure them to suit their specific workflows. We also have several additional sub-modules, which form part of our SaaS products, that clients can utilize for their business operations including procurement management, invoice management and logistics management.

Clients prefer to use a SaaS solution like ours which can continue to develop the technology as per changing market needs and add emerging integrations relevant to their business while they can focus on their business.

Table of Contents

ToggleOur key products are as follows:

- Warehouse and Inventory Management System (“WMS”)

- Multi-Channel Order Management System (“OMS”)

- Omni-Channel Retail Management System(“Omni-RMS”)

- Seller Management Panel for Marketplaces

- UniShip

- UniReco

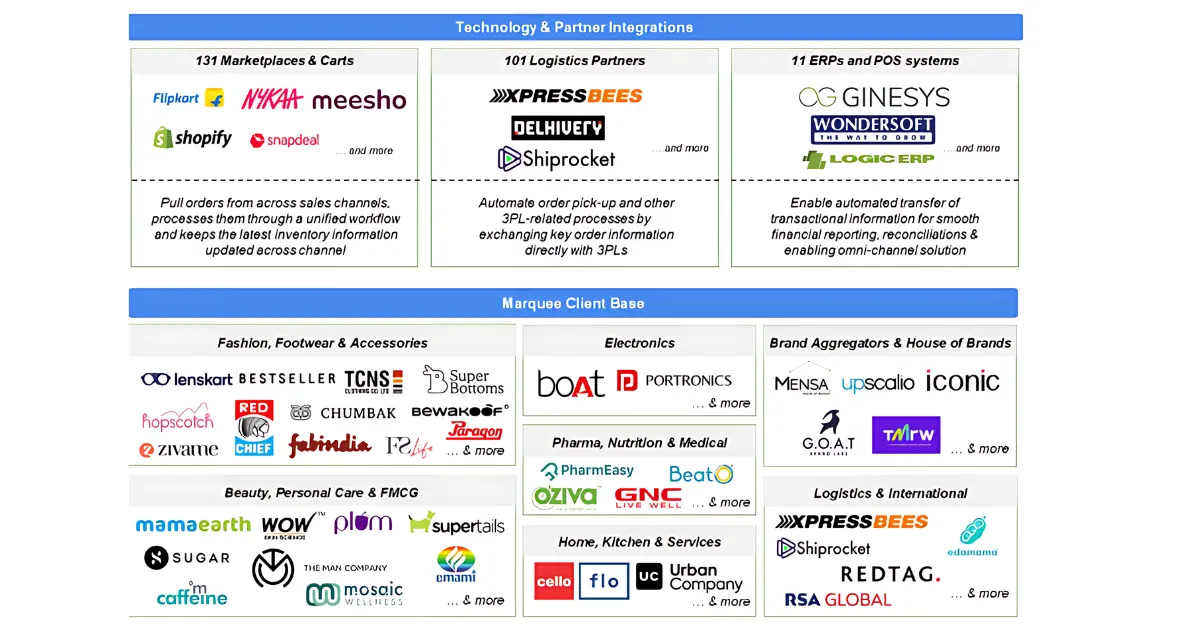

Our products also enable plug-and-play integrations that seamlessly connect other critical components of a client’s supply chain stack, such as their own apps/websites, marketplaces, logistics service providers, point of sales systems and financial/ERP systems for automated data exchange and for exchanging critical operating instructions with sales systems and financial/ERP systems of our clients to enable end-to-end automation.

We have an extensive suite of technology and partner integrations, which, tillSeptember 30, 2023, comprises 124 Marketplaces and WebStore integrations, 94 Logistics Partner integrations and11ERPs, POS and other systems integrations.

We have been able to create a large, growing base of marquee clients across the retail and e-commerce landscape in India as well as consistently onboard new clients in international geographies. Our clients, inter alia, include D2C brands, brand aggregator firms, traditionally offline brands, e-commerce retailers, marketplaces, third-party logistics and fulfilment players and SMBs. Our clients belong to various sectors including fashion (apparel, footwear, accessories), electronics, home and kitchen, FMCG, beauty and personal care, sports and fitness, nutrition, health and pharma as well as third-party logistics and warehousing.

Our client base has grown over the years. The following tables provides data of the number of items processed by our client through our platform, our existing enterprise and SMB clients during the mentioned time periods indicated.

Unicommerce E- Solutions IPO Date & Price Band Details

| IPO Open Date | 6 Aug 2024 |

|---|---|

| IPO Close Date | 8 Aug 2024 |

| IPO Size | 25,608,512 shares (Approx ₹276.57 Cr) |

| Offer For Sale | 25,608,512 shares (Approx ₹276.57 Cr) |

| Lot Size | 138 Shares |

| IPO Face Value | ₹1 Per Equity Share" |

| IPO Price Band | ₹102 to ₹108 Per Every Share |

| IPO Listing On | NSE & BSE |

| IPO Retail Quota | 10% |

| IPO QIB Quota | 75% |

| IPO NII Quota | 15% |

| DRHP Draft | Click Here |

| Anchor Investor | Click Here |

Unicommerce E- Solutions IPO Market Lot Details

| Application | Lot Size | Shares | Amount |

|---|---|---|---|

| Retail Minimum | 1 | 138 | ₹14,904 |

| Retail Maximum | 13 | 1,794 | ₹1,93,752 |

| S-HNI Minimum | 14 | 1,932 | ₹2,08,656 |

| B-HNI Minimum | 68 | 9,384 | ₹10,13,472 |

Object of the Issue

- Carry out the Offer for Sale of up to 2,98,40,486*Equity Shares by the Selling Shareholders aggregating to ₹ [●]thousand.

- Achieve the benefits of listing the Equity Shares on the Stock Exchanges.

- The Equity Shares being offered by SB Investment Holdings (UK) Limited as part of the Offer for Sale include a portion of Equity Shares which will result upon conversion of 9,858 Series A Preference Shares and 2,775 Series B Preference Shares held by SB Investment Holdings (UK) Limited.

Unicommerce E- Solutions IPO Allotment & Listings (Details)

| IPO Open Date | 6 Aug 2024 |

|---|---|

| IPO Close Date | 8 Aug 2024 |

| Basis of Allotment | 9 Aug 2024 |

| Refunds | 12 Aug 2024 |

| Credit to Demat Account | 12 Aug 2024 |

| IPO Listing Date | 13 Aug 2024 |

Unicommerce E- Solutions Financial Reports

| ₹ in Crores | |||

|---|---|---|---|

| Year | Revenue | Expense | PAT |

| 2024 | ₹109.43 | ₹91.96 | ₹13.08 |

| 2023 | ₹92.97 | ₹84.11 | ₹6.48 |

| 2022 | ₹61.36 | ₹54.45 | ₹6.01 |

Our Company Promoters

- Ace Vector Limited (formerly known as Snapdeal Limited).

- Starfish I Pte. Ltd

- Kunal Bahl

- Rohit Kumar Bansal

Qualitative Factors

- Largest e-commerce enablement SaaS products platform in the transaction processing or nerve centre layer, in terms of revenue for the financial year ended March 31, 2022.

- Comprehensive and modular suite of products with a wide range of plug-and-play integrations makes us an integral part of our client’s tech stack.

- Large, growing and diversified base of marquee Indian and global clients with long-term relationships and the capability to upsell or cross-sell new and additional products.

- Proprietary technology platform built for scalability and high adaptability to accommodate various uses across different industries.

- Consistent track record of fast, profitable growth with strong cash flows over the past three financial years.

- Strong governance practices, experienced management, and marquee investors.

Unicommerce E- Solutions Company Contact Details

Unicommerce eSolutions Limited

Mezzanine Floor, A-83O

khla Industrial Area, Ph-II,

New Delhi, South Delhi 110 020,

NCT of Delhi, India

Tel: +91 931174924065

E-mail:complianceofficer@unicommerce.com

Website: www.unicommerce.com

Unicommerce E- Solutions Lead Manager

IIFL Securities Limited

24th Floor, One Lodha Place,

Senapati Bapat Marg, Lower Parel (West)

Mumbai 400 013

Maharashtra, India

Tel:+91 22 4646 4728

E-mail:unicommerce.ipo@iiflcap.com

Investor Grievance E-mail:ig.ib@iiflcap.com

Website: www.iiflcap.com

Contact Person:Mukesh Garg/ Pawan Jain

CLSA India Private Limited

8/F Dalamal House

Nariman Point Mumbai 400 021

aharashtra, India

Tel:+91 22 6650 5050

E-mail:unicommerce.ipo@clsa.com

Investor Grievance E-mail:investor.helpdesk@clsa.com

Website: www.india.clsa.com

Contact Person: Prachi Chandgothia/Siddhant Thakur

Unicommerce E- Solutions IPO Registrar

Name: Link Intime India Private Limited

C-101, 247 Park, L.B.S Marg,

Vikhroli West, Mumbai-400083

Telephone: +91 8108114949

E-mail: shreetirupatibalajee.ipo@linkintime.co.in

Investor Grievance E-mail:shreetirupatibalajee.ipo@linkintime.co.in

Contact Person: Ms. Shanti Gopalkrishnan

Website: www.linkintime.co.in

4 thoughts on “Unicommerce E- Solutions IPO Details, Date, Review, Price”